Zimmer Biomet Spin-off (Spine and Dental) Notes

March 18, 2022 Update

Good interview with Vafa Jamali CEO of ZimVie

- ZimVie is projecting approximately $1b in revenue for 2022

- The company is burdened with $561m in debt at the time of spin

February 15, 2022 Update

Good write up on the ZimVie spinoff

- RemainCo will have a full divestment of ZimVie with 80.3% going to shareholders and 19.7% being IPOed

February 3, 2022 Update

Good overview on the ZimVie spin

- The Dental and Spine (SpinCo) branches of Zimmer Biomet does not have as strong margin and growth profile as the RemainCo

- ZimVie’s EBITDA fell from $153m in 2018 to $89m in 2020

- During the same period, ZimVie’s margins fell from ~15% to 10%

- There has been some rebound TTM EBITDA of $144m with 14% margin

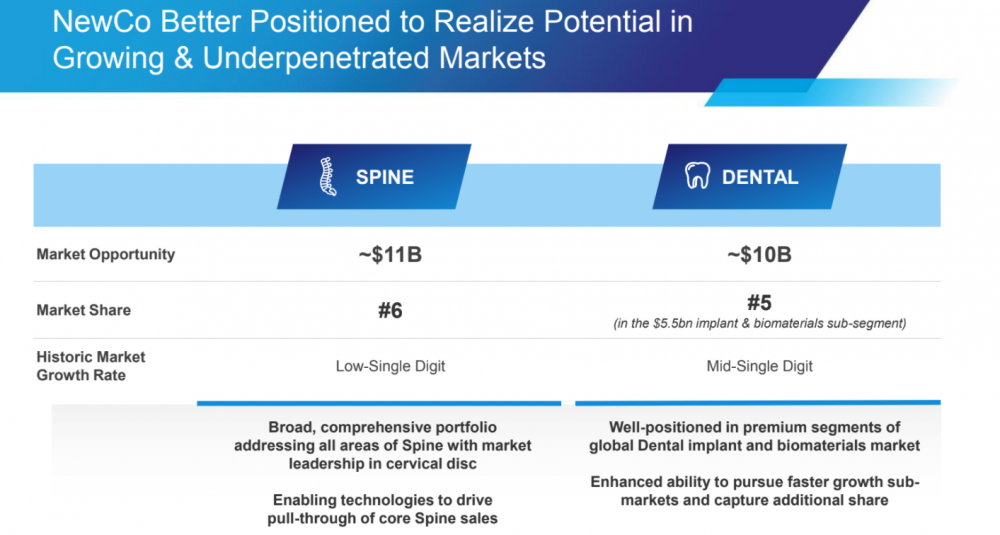

- The Dental and Spine market TAM combined are worth $21b which ZimVie will account for <5%

- The SpinCo will be burdened with ~$555m in gross debt for almost 3.5x net leverage

- This seems like a possible opportunity for indiscriminate selling depending on whether investors identify the SpinCo as a different industry and many investors may sell simply because of the smaller size

January 27, 2022 Update

Good key points on understanding the Zimmer Biomet spin, ZimVie

- Recently Zimmer Biomet filed its initial Form 10 with the SEC

February 19, 2021 Update

- Zimmer announced that it will spin off, ZimVie, its Spine and Dental businesses into an independent public company.

- The tax free spin-off is supposed to be completed by mid 2022.

- Spin-off Presentation.

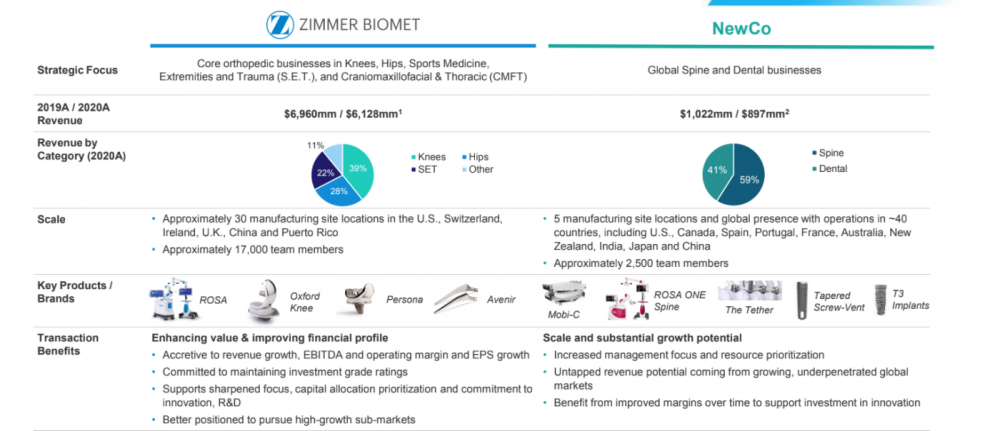

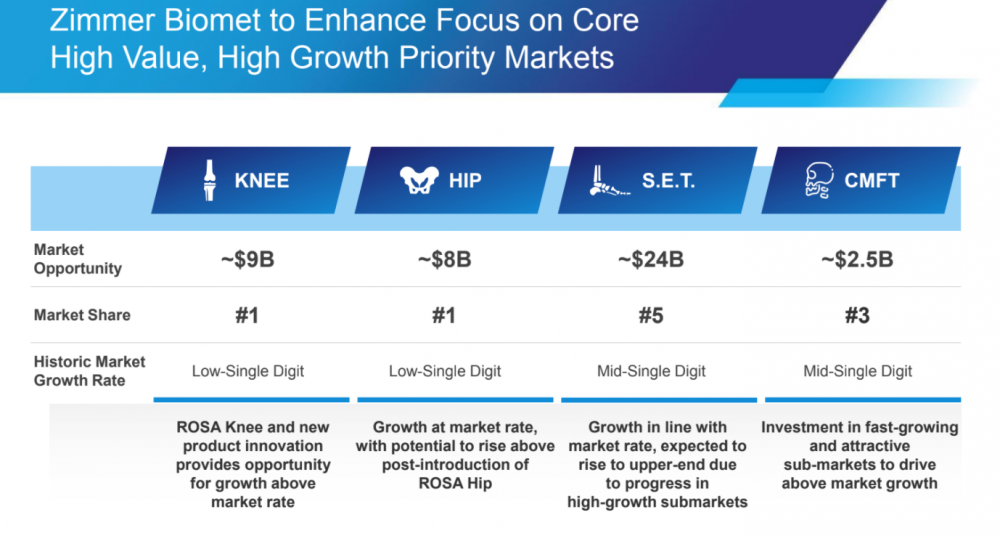

- Remainco:

- Will have ~$6.1BN in revenue.

- Market leader in knees and hips.

- Spin-off

- $900MM in 2020 revenue.

- Focused on Spine (#6 in the market) and Dental (#5 in the market)

- Spine and Dental were paired together because they use similar materials.

- Could be an interesting situation given size differential of spin-off vs. parent (could see indiscriminate selling).

Leave A Comment