A reader of blog recently asked me the following question:

“Is there a way to tell when the initial selling pressure has ceased by looking at volume or something? How long does it typically take?”

This is a great question, and I apologize that it took me so long to answer. At the heart of the question is the premise that oftentimes, there is indiscriminate selling pressure during the first couple days and sometimes weeks after a spinoff begins regular-way trading. Therein lies the opportunity.

Seth Klarman of the Baupost Group explains why this dynamic exists in Margin of Safety:

“Many parent-company shareholdings receiving shares in a spinoff choose to sell quickly, often for the same reasons that the parent company divested itself of the subsidiary in the first place. Shareholders receiving the spinoff shares will find still other reasons to sell: they may know little or nothing about the business that was spun off and find it easier to sell than to learn; large institutional investors may deem the newly created entity too small to bother with; and index funds will sell regardless of price if the spinoff is not a member of their assigned index.

For reasons such as these, not to mention the fact that spinoffs frequently go unnoticed by most investors, spinoff shares are likely to initially trade at depressed prices, making them of special interest to value investors. Moreover, unlike most other securities, when shares of a spinoff are being dumped on the market, it is not because the sellers know more than the buyers. In fact, it is fairly clear that they know a lot less.”

What Do Spinoff Studies Say About Initial Selling Pressure

To answer the question, I looked back at a number of studies that were conducted by investment banks and academic institutions and highlighted below the ones that discuss initial selling pressure.

Study #1: S&P Research, Capital Market Implications of Spinoffs

Date of Report: March 2017

Time period that was covered: 1989 and 2015

Geography: United States

Selling Pressure Finding:

- First five days of trading, spinoffs saw -1.37% underperformance versus their industry

Study #2: HEC Paris (Paris Business School), Investing in Spinoffs: An Academic and Empirical Analysis of Long Term Returns

Date of Report: December 2013

Time Period Covered: 1992 to 2008

Geography: North America

Selling Pressure Finding:

- Spinoffs underperformed their industry by 0.94% on average in first five days of trading.

Study #3: Credit Suisse, Do Spin-offs Create or Destroy Value?

Date of Report: September 2012

Time Period Covered: 1995 through 2012, top 1000 firms by market cap

Geography: United States

Selling Pressure Finding:

- Spinoffs bottomed on the 5th day of trading on average, underperforming the S&P 500 by 3.7% over that period.

Study #4: Citigroup, What Works in Equity Markets – Are Spin-Offs Money Spinners?

Date of Report: May 2016

Link to report is not available.

Time Period Covered: 2000 to 2016

Geography: Global

Selling Pressure Finding:

- In the first 5 days after the effective date, spinoffs in the US, Europe, and World, underperform by -2.3%, -1.4% and -1.2%, respectively (benchmark is MSCI country in which the spinoff is domiciled).

In summary, the findings of the studies generally suggest waiting for at least five days of trading before establishing a position.

My Own Research

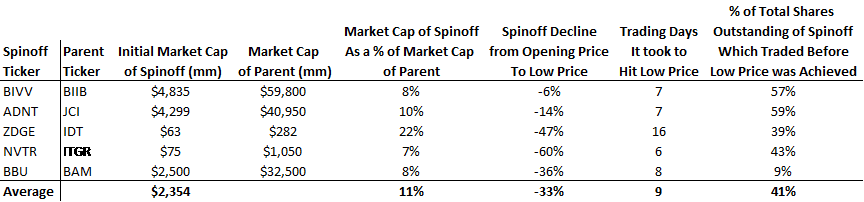

I also decided to look at some recent spinoffs over the past two years which experienced initial selling pressure. I wanted to focus on small and microcap spinoffs where there is normally a large difference in market value of the parent and spinoff. These spinoffs tend to be more prone to initial selling pressure. The list of spinoffs analyzed is not exhaustive by any means, but I believe its representative of initial trading of most small spinoffs.

As you can see from the data above, the spinoffs declined an average of 33% from their initial opening price. On average, it took roughly 9 days for the spinoffs to bottom and ~41% of the spinoffs’ shares outstanding traded before the shares bottomed.

How do you tell how many shares have traded? Go to finance.yahoo.com, and type in the ticker of the spinoff under consideration. Click on the “historical data” button and the site will display shares traded by day.

So the key takeaway from my analysis is its good to wait for at least 6 trading days to buy a spinoff that you suspect will be indiscriminately sold. You should also track how many of the spinoff’s shares outstanding have traded. Avoid establishing a position until at least 30% to 40% of the spinoff’s shares outstanding have traded. There will always be exceptions to the rule, but following this advice will generally serve you well.

Do you have any other stock spinoff questions? Let me know in the comments below, and I will try to answer them in future blog posts.

Thanks so much for answering my question, I’ll be honest I didn’t expect an answer so this is really great. I had also come to the conclusion that waiting about 6 days is the appropriate time so your affirmation is very helpful (plus your research was far more thorough than mine).

How did you find LSYN as a spinoff? I look at all 10-12B’s filed but obviously this didn’t apply to LSYN. I recently made a great return on SAUC (it spun off OTC:BAGR) but I would have done better if I had spotted it earlier, they didn’t file a 10-12B but a 10-12G instead hence why I missed it. The best free way I can currently think to identify spinoffs I might miss is to simply google “spinoff” in googles news section. Any thoughts?

Thanks again.

I actually found LSYN on a website called gemfinder.com. The site tracks spinoff SEC filings. I actually don’t subscribe the the service but you can see the filings that are months old. The LSYN filing was actually an S-1. I find that often times OTC spinoffs file S-1s not Form 10s. Don’t know why.

I have a couple google search alerts set up such as “otc spinoff” “micro cap spun off” and this usually flags otc spinoffs.

Thanks for the comment!

Thanks for the research.

It might be better to look at % of shared float instead of shares outstanding as sometimes you might have big owners that are not part of the float.

Thanks for the comment. Good point. I will factor that in when I refresh my analysis.

Thank you for posting the analysis – it really got me thinking! I have started adding when issued trading if applicable. Sometimes there is no when issued trading, sometimes it is minimal and sometimes substantial as in the case of Bioverative (BIVV) where it traded for two weeks prior to regular way trading. I did a quick calculation but it looks to add 10% +/- to the % total of shares traded.

Thanks for the comment Mike. Great thought. Next time I do the analysis, I will factor in when issued trading. Do you ever buy in the when issued market? I generally wait until regular wat trading, but perhaps there are good opportunities ahead of that. Would be curious to know your thoughts.

I have not bought in WI market yet but it looks like the ultimate trading lows sometimes occur on the first day of trading. BIVV would be a good example with its ultimate low of $40 on 1/12/17 where $54 was an easy valuation to arrive at, ASIX @ 12 on 9/15/17 when I was looking at a $30 minimum value, or possibly even CARS.COM at $19.90 on 5/18/17 when I can easily make the case for $35. If I have a clear valuation and the stock is dirt cheap I will consider it. Some dirt cheap bids on Venator would be a good start when that comes out. Thank you for your response.

Venator (VTNR) is also on my radar. Back in February 2017, the parent, Huntsman (HUN), obtained an IRS ruling allowing it to retain a 40% economic interest in Venator.

At what Enterprise Value do you think VNTR will become a compelling buy?

I’m thinking anywhere under 1.8 bn.

Great analysis – To the point and pragmatic conclusion!

Thanks Seb! If you have any questions related to spinoffs, let me know. Would be happy to answer your questions in a future blog post.

Have you ever thought about writing an e-book or guest authoring on other sites? I have a blog based on the same ideas you discuss and would really like to have you share some stories/information. I know my readers would appreciate your work. If you’re even remotely interested, feel free to shoot me an e mail.

Hi thanks for the message. I would definitely be interested in guest posting. I will shoot you an email.

Could any one share how to participate in the WI market?

Thanks for the question Tommy. You can buy on the when issued market just like buying a regular stock.

For instance CARS was trading in the when issued market for the last week or so. You could log into your brokerage account and buy it just like any other stock. If you have to trouble finding the ticker, you can just call your brokerage and they can help you out.

Sorry to post here but what about Seacor Marine Holdings – SMHI coming out on 6/1/17 from Seacor Holdings? – was not even on my radar. Any ideas?

Thanks for the comment Mike. I haven’t spent much time on it but I will take a look.

Out of my (very small) circle of competence. Seeking Alpha bearish analysis,

but this was March 2016:

https://seekingalpha.com/article/3961416-spin-seacor-marine-holdings-will-destroy-shareholder-value

Yeah I haven’t spent much time on it. I need to take a look.

Hi there,

Great blog and thank you for sharing your thoughts. I was wondering if you might have any thoughts on the Idorsia spin-off anomaly (at least from my understanding). The SpinCo was removed from a major European stock index (ParentCo remained), yet on the very first day of regular trading, the stock went up 30%, and it went up over 50% in just the first 3 days of regular trading. Granted, it was priced much more reasonably in the OTC markets prior to regular trading (I guess that is equivalent to “when-issued” trading). So then would it be reasonable to assume that the forced selling by index funds was already “priced in” before regular way trading? Or am I missing something here? I just don’t see how an obscure name like Idorsia could go up 50% in the first week of regular way trading if there were large chunks of forced sellers, unless that forced selling literally occurred in the first hour of the first day of regular trading, or was somehow already “priced in” in the OTC market before regular way.

As a parallel example, BIVV was removed from the S&P500, and it seemed like forced selling was occurring in the WI market and the price remained depressed throughout the first week of regular way trading. That is what I was expected from Idorsia but I got this curveball instead.

I would greatly appreciate your thoughts, SS Guy.

Interesting question and thanks for flagging this situation. I unfortunately do not have great insight. I would have expected Idorsia to sell off as well. However, it appears that investors were bullish and buy orders more than offset any forced selling. Reason the stock looked attractive at the initial spinoff date: 1) it was trading at a valuation equal to cash on its balance sheet (CHF 1Bn) 2) the founder of Actelion (Jean-Paul Clozel) stayed on as CEO 3) the company’s pipeline appears robust. But I agree, I Would have expected some forced selling.

Hi,

10 days ago I shorted sell a stock after 2 days it dropped around 30$ so I bought back making 100k profit, started to trade the same stock as day trader, paying commission as well. On Friday (yesterday), my account became negative 50k from over 150k positive, so I chatted with Thinkorswim.. They said the company had a spin off the day I shorted the stock, I shouldn’t make 30$ per stock, well nothing prevented me from buying the stock , they cannot adjust after a week as they allowed me to trade all the week same stock paying commission, now I have to run and find a lawyer to get me money back.

Anyone had this experience before?

Can you share what stock is was? I can look into it for you. If you should a stock prior to a spin-off, you are effectively short the spin-off too. So to close our your position, you would have to buy back the parent (after the spin-off) and also buy back the spin-off.