Spin-offs with Insider Buying (October 2021)

This week, we have a couple new names popping up on our list.

Let’s dig right into them….

Apartment Investment & Management (AIV)

I know I promised some new names, but we are going to start with AIV which has seen even more insider buying.

Apartment Investment & Management (AIV), known as Aimco, spun off Apartment Income REIT (AIRC), in December 2020.

At the time, the RemainCo, AIV, looked more interesting given it was the smaller of the companies and experienced some indiscriminate selling (it got kicked out of the S&P 500).

AIV is a real estate development company with a hodgepodge of assets.

This VIC article lays out the bull case nicely (must create a free account to read). In summary, NAV is likely above $10 and could be as high as $16. Meanwhile, incentives are aligned for a good outcome.

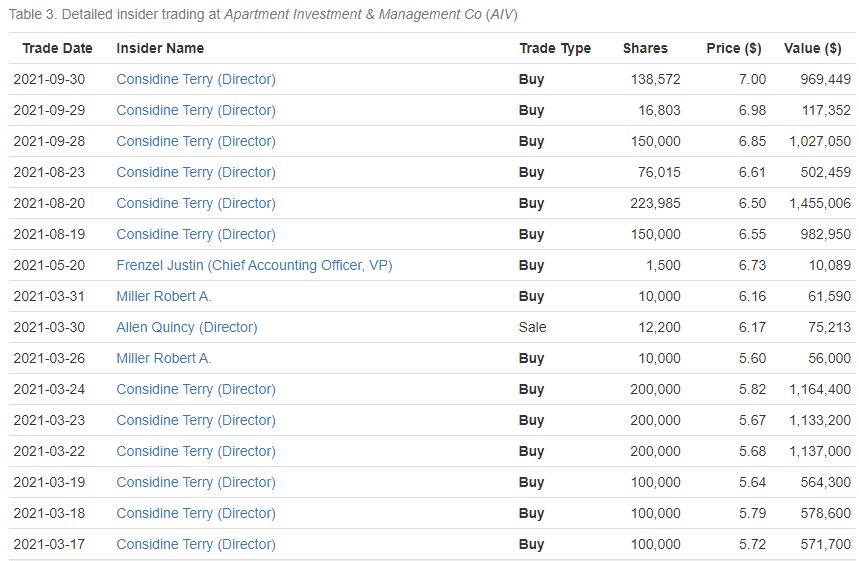

The stock currently trades at $7.50 and CEO, Terry Considine, continues his relentless open market purchases (see below)

I noticed one more interesting thing about AIV.

The company has LEAPs available.

What are LEAPs?

They are “Long-Term Equity Anticipation Securities”.

In a nutshell, if you believe the bull case on a stock, you want to own LEAPs because it magnifies your upside.

Want to know more about LEAPs? Check out this Twitter thread which covers everything you would want to know about them.

NexPoint Strategic Opportunities Fund (NHF)

Alright now for the new names…

I give all the credit to Clark Street Value for flagging Nexpoint..

NHF is a closed end real estate fund that is in the process of converting to a REIT.

Check out Clark Street’s write up.

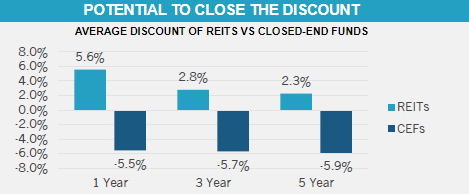

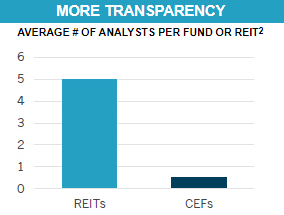

Why convert to a REIT? Because they attract more investors and sell side coverage. Check out these slides from the company’s proxy statement:

According to Clark Street Value, NAV is currently ~$22.50, implying significant upside for the stock.

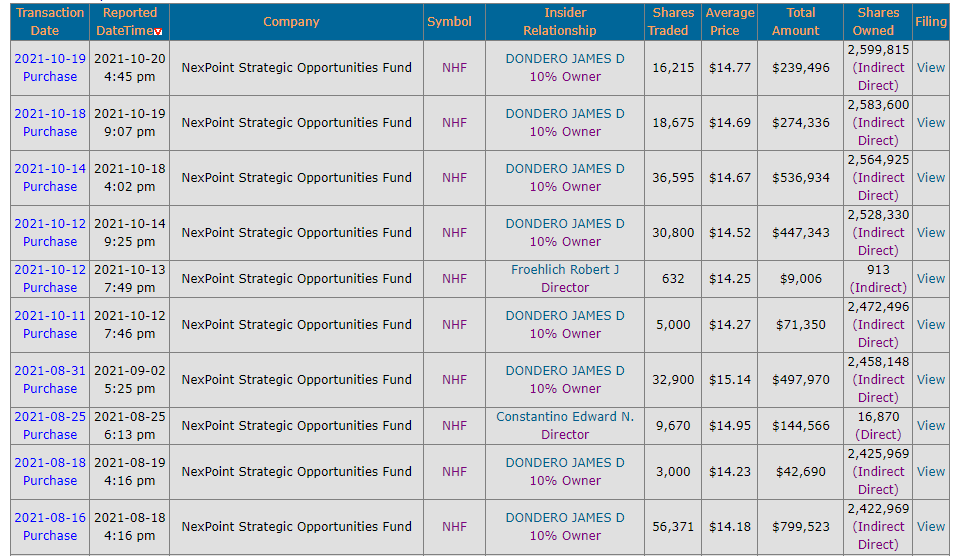

On top of that, insiders have been buying (see below).

I don’t own NHF, but it’s high on my watch list.

Vitesco Technologies (VTSC:GR)

This is another name that I recently added to my watch list.

It’s a recent spin-off from Continental.

It produces powertrains for internal combustion engines (ICE) and also hybrids and electric vehicles (EVs).

While it’s ICE business will be fading over the next decade, it should be able to offset it with growth in hybrids and EVs.

The stock looks cheap on an absolute and relative basis at 1.9x 2022 EBITDA vs. peers at ~5.0x.

Further, it expects to generate > EUR400MM in free cash flow in the medium term and has a great balance sheet (net cash position).

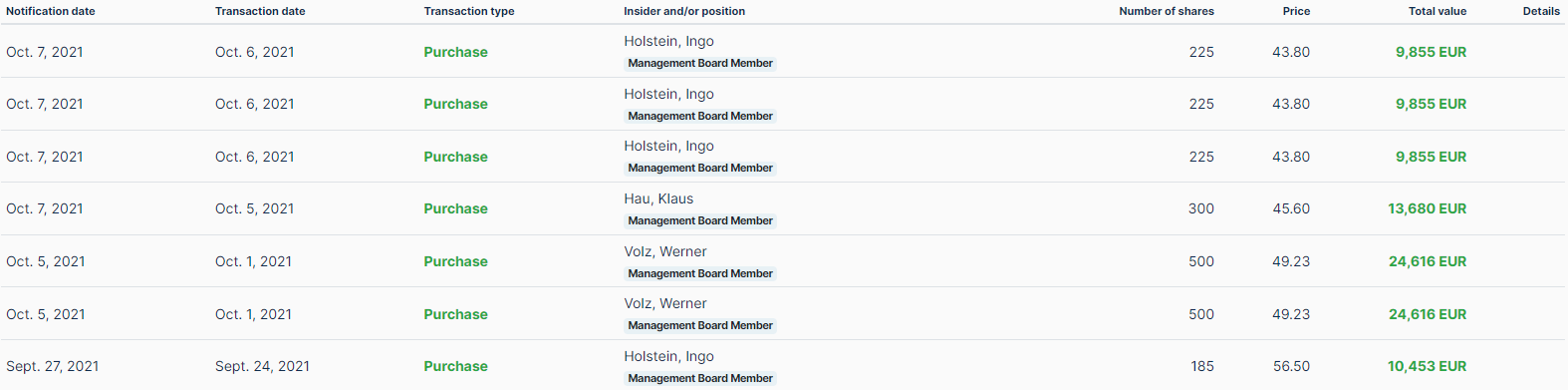

Insiders agree and have been buying in the open market.

Leave A Comment