Spin-offs with Insider Buying (May 2021)

This month, we have three (two new names and one name we’ve highlighted before) spin-offs with notable insider buying.

Let’s go in alphabetical order.

Apartment Investment & Management (AIV)

Late last year, Apartment Investment & Management (AIV), known as Aimco, spun off Apartment Income REIT (AIRC).

At the time, the RemainCo, AIV, looked more interesting given it was the smaller of the companies and experienced some indiscriminate selling (it got kicked out of the S&P 500).

AIV is a real estate development company with a hodgepodge of assets.

At the time of the spin-off, NAV was $8 per share. I imagine NAV has appreciated since then, but it’s difficult to get a precise number.

One concern that I had at the time of the separation was that management owns very little stock yet collects very generous annual compensation (CEO gets ~$6MM per year).

I wrote, “If I see significant insider buying or a big share buyback, that might give me enough comfort to buy the AIV.”

Well significant insider buying has started (see below).

This is a name that’s on my watch list, but I still have reservations given excess CEO compensation and lack of insider buying by the CEO.

Here are some more notes about the transaction.

Cyclerion Therapeutics (CYCN)

Cyclerion is a 2019 spin-off of Ironwood Pharmaceuticals (IRWD).

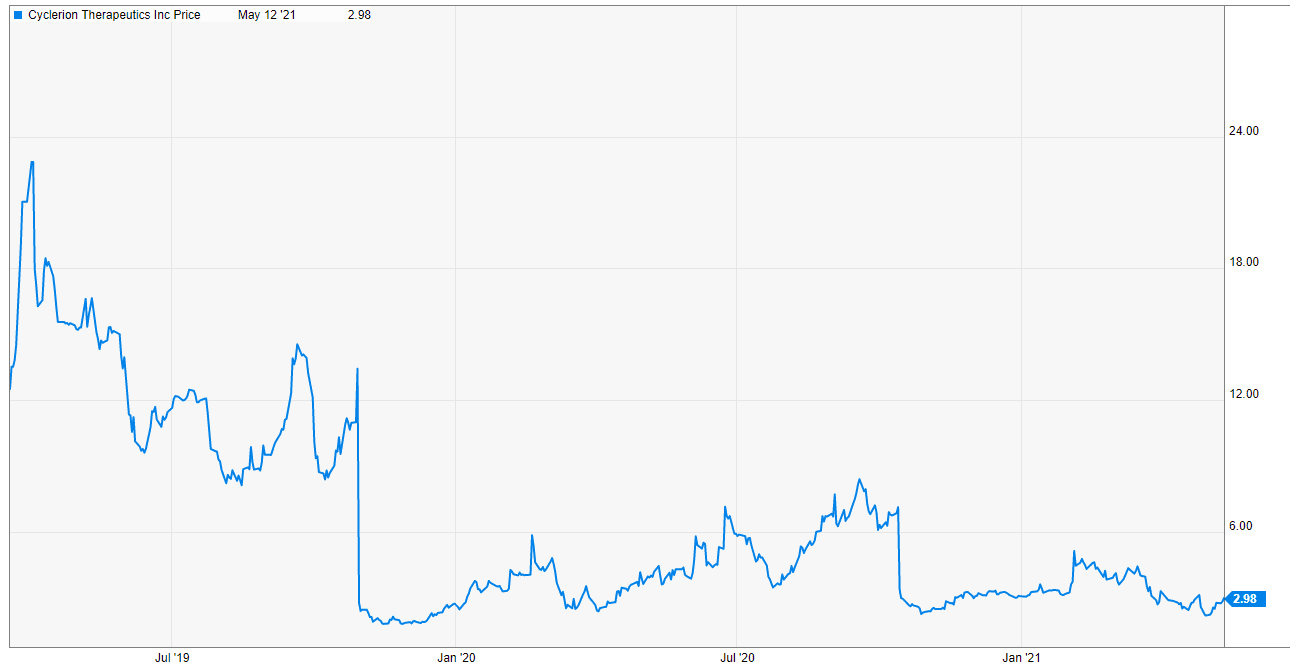

Since the spin-off, the company has had a number of pipeline setbacks and the stock chart doesn’t look pretty….

But it’s starting to look interesting.

It has a market cap of $101MM but with $41MM of cash on its balance sheet an enterprise value of only $58MM.

And the CEO has recently made sizable purchases in the open market. It might be worth a flyer.

Vistra Corp (VST)

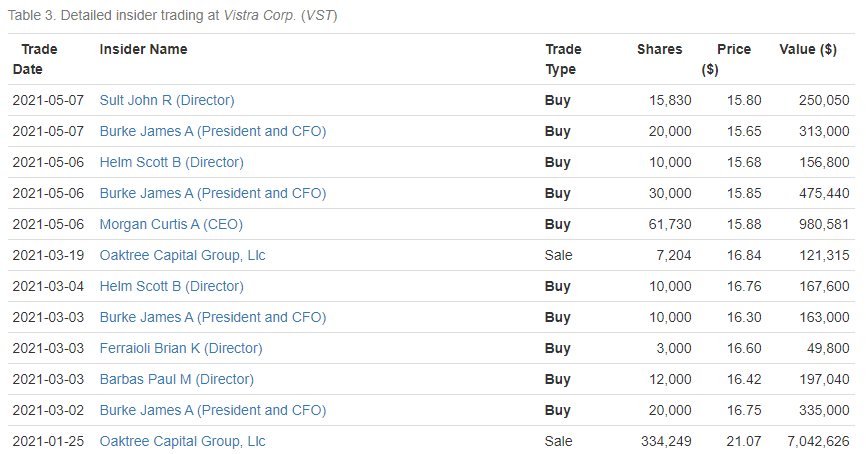

Vistra is a name that we featured in March, but insiders continue to gobble up shares.

In 2007, in the largest LBO in history, TPG, KKR, and Goldman Sachs teamed up to buy TXU for $45bn ($8.3bn in equity and $36.7bn in debt).

By 2014, TXU had to file chapter 11 due to its crushing debt load. Vistra Energy (VST) is the post-reorg equity of TXU Corporation.

Vistra is one of the largest power producers (nuclear, coal, and nat gas) and retail energy providers in the U.S.

Vistra took a big hit when it announced a $1.6BN adverse impact due to Texas’ recent winter storm.

Since the announcement, Vistra has lost $3.7BN in market cap which seems like an overreaction given the company has plenty of liquidity.

Insiders across the board are buying stock in the open market.

I previously owned VST and made money in it. Oaktree Capital is not a dummy. I really like the CEO. It is a non-regulated utility and so it does not trade as high as others. I bought Jan 2023 LEAPS last month.

.