Bausch Health Companies Inc. Spin-Off Quick Summary

Resources from Bausch Health Companies Inc.

Spin-off Press Release – August 6, 2020

2Q2020 Earnings Release – August 6, 2020

Investor Relations Contact Information:

- Arthur Shannon

- Email: arthur.shannon@bauschhealth.com

- Phone: (514) 856-3855

Other Resources

Overview

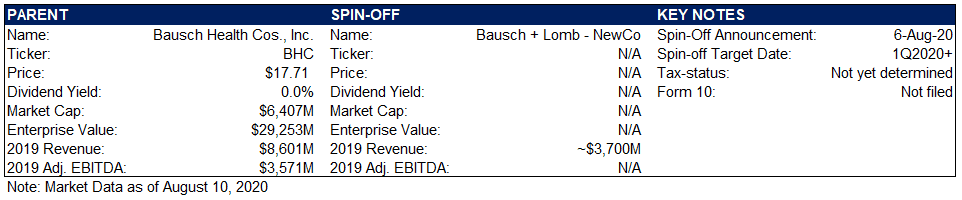

On August 6, 2020, Bausch Health Companies Inc. announced that it intends to spin off its leading eye health business into an independent publicly traded entity (“Bausch + Lomb – NewCo”) from the remainder of Bausch Health. The timing of the spinoff will be tied to certain conditions and approval, and the company’s completion fo several important actions, including the reorganization of the reporting segments, which are expected to begin in 1Q2020. As of the date of the spinoff announcement, management has not commented on the tax status/implication of the transaction.

Why the Spin-off?

The spinoff will create two separate companies that include:

- A fully integrated, pure-play eye-health company built on the iconic Bausch + Lomb brand and long history of innovation; and

- A diversified pharmaceutical company with leading positions in gastroenterology, aesthetics/dermatology, neurology, and international pharmaceuticals.

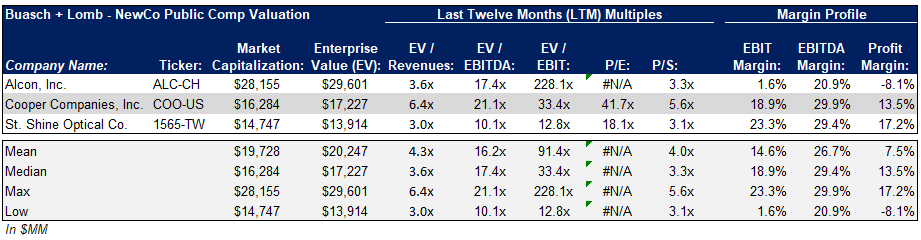

Benefits of separating these attractive, but disparate businesses include improved strategic focus by Bausch on expanding Gastroenterology, Aesthetics/Dermatology, Neurology, and International pharmaceuticals and to enhance the financial transparency to better enable stakeholders to value each business independently. However, the real reason for this proposed spinoff boils down to the eye care business being heavily undervalued when compared to peers in the space e.g. Alcon (ALC) or Cooper Companies (COO).

“Now that there’s some information out on Alcon, and trying to compare that to our B + L international segment […] it does appear to be somewhat of a valuation disconnect between the way people think about our business versus the way they think about Alcon.” – Paul Herendeen, EVP & CFO of Bausch Health Cos., Inc. (Q1 2019 Earnings Call)

“We’ve looked at the values of our peer eye health companies like Alcon and Cooper and believe that Bausch + Lomb would compare very favorably when investors have an opportunity to make a judgment about the relative value of the standalone business.” – Joseph Papa, Chairman & CEO, Bausch Health Cos., Inc. – (Q2 2020 Earnings Call)

Spin-off Overview

Company

Bausch + Lomb – NewCo will be built on the iconic Bausch + Lomb brand, a fully integrated eye-health business with an established line of contact lenses, intraocular lenses and other medical devices, surgical systems and devices, vitamin and mineral supplements, lens care products, prescription eye medications and other consumer products that allows the brand to compete in all areas of the eye health market. Additionally, the newly formed company will be accompanied by Bausch Health’s global vision care, surgical, consumer, and ophthalmology Rx eye-health brands. Moving on, through a company guided revenue segment reclassification, Bausch + Lomb – NewCo would have had a 2019 Pro Forma Revenue of $3.7 Billion with a CAGR of 4.1% (2017-2019). Finally, in order to adapt to the ever changing business environment caused by Covid-19, Bausch has taken the steps to adapt its eye-health business to meet customer needs such as accelerating e-commerce efforts, e-learning programs for eye care professionals, launch of new products, virtual salesforce engagements, etc.

Industry

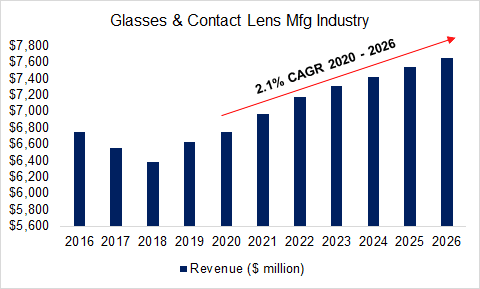

The general industry bucket that Bausch + Lomb – NewCo will fall into and be analyzed by the market is in the Glasses & Contact Lens Manufacturing Industry. Primary activities conducted in this industry include contact lens manufacturing, lens manufacturing, lens coating , etc. Some external drivers that drive this industry include the number of people with private health insurance, number of adults aged 50 and older, federal funding for Medicare and Medicaid, and per capita disposable income. In terms of industry structure and nature, glasses & contact manufacturing is a relatively low capital requirement industry, has low customer class concentration, and generally has a high profit margin vs its economic sector averages. Playing devils advocate, the industry suffers from high competition due to constant product innovation and large amounts of industry players. Finally, in terms of outlook, the glasses and contact lens manufacturing is projected to grow at 2.2% CAGR from 2020 – 2026. Underlying demand that is driving the growth of the industry include the aging population and growing incidence of diseases that deteriorate eyesight. According to estimates from the U.S. Census, 115.8 million Americans and currently aged 50 and older, and 52.5 million Americans are aged 65 and older. Additionally, diagnosis for eye conditions are increasing in the United States including myopia and presbyopia in young adults and cataracts and glaucoma in the older population. Therefore, the growing incidence of age-related eye conditions has driven demand for high-margin surgical products.

Competition

The market for Bausch + Lomb – NewCo products is very competitive both across individual product categories and geographies. Competition faced in the eye-health market include large established brands and mid-size and smaller, regional and entrepreneurial companies with fewer products in niche areas or regions.

Customers

Parent company, Bausch Health, promotes and sells its pharmaceutical products to physicians, hospitals, pharmacies, and worldwide wholesalers. Bausch + Lomb – NewCo customers encompass a wide range of end consumers in need of products for eye-health. A growing trend of customers include the baby boomer generation reaching the age of 65 with deteriorating eye health.

Quality of Business

The eye-health business as a whole is a relatively high quality business with growing end demand opening up opportunities for long-term growth. Capital intensity is low, low overall business volatility, and high profit margins compared to its sector average are some strengths of an eye-health business. However, there is not enough detailed financial information to build out a full Greenblatt ROIC analysis yet, so we will revisit this topic when the Form 10 is released.

Capital Structure

Capital structure and overall financial impact has yet to be determined.

Management

The management team has yet to be determined as the process is still in early stages..

Potential for Indiscriminate Selling

There is unlikely to be completely indiscriminate selling in the stock after the spin-off transaction occurs. Bausch + Lomb – NewCo is a high quality eye-health business that operates within the same economic sector as the parent company, albeit in different sub-industries (eye-health vs pharmaceuticals). Given management’s comments on the undervaluation of the company pre spin-off, we do not view this opportunity as one where shareholders may sell the spin shares without a fundamental position.

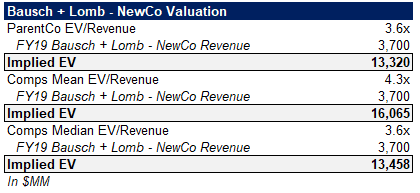

Valuation

For a valuation analysis, we worked off a blend of the Parent Co Ev/Revenue and a comparable set of mean/median Ev/Revenue multiples. Valuation analysis is limited due to the financials of the new spin-off having yet to be fully segmented from the parent companies operations. Moving on, comp set includes two competitors as identified by Bausch (Alcon and Cooper) along with players directly operating in the eye-health space. As a result of the preliminary valuation analysis, est EV range is $13,320M – $16,065M.

Leave A Comment