Bausch Health Spin-off Notes

March 8, 2023 Update

- Good Article Sharing the latest update on Bausch Health and the potential spin-off of Bausch and Lomb

January 13, 2022 Update

- Bausch Health is splitting into three publicly traded companies Bausch Pharma, Bausch + Lomb, and Solta Medical

- Bausch Health has filed an S-1 for Bausch + Lomb (BLCO)

- During a recent presentation, Bausch shared more information on the taxed spin-off of its Eye Care business (Bausch + Lomb) and the spin-off of its Medical Aesthetics Business (Solta Medical)

- Bausch Pharma (RemainCo) is split into Salix (47%), International (27%), Ortho Dermatologics (6%), Generics (4%), Dentistry (2%), and Neuro and Other (14%)

- Bausch Pharma has tracked ~$4.2b in revenue over the last 12 months

- Bausch Pharma has a presence in about 70 countries

- Bausch Pharma is also planning on investing ~$1b into R&D which will help strengthen their pipeline

- Bausch Pharma is burdened with a ~6.5-6.7x leverage ratio

- There are three main branches of Bausch + Lomb (SpinCo 1): Vision Care (62%), Surgical (19%), and Ophthalmic Pharmaceuticals (19%)

- Bausch + Lomb has tracked ~$3.7b in revenue over the last 12 months

- Bausch + Lomb has an estimated ~$50b total addressable market

- ~100 countries are served by Bausch + Lomb and over 80% of the world’s population has access to Bausch + Lomb’s products

- Bausch + Lomb is being saddled with a 2.5x leverage ratio

- Three third branch of the spin is Solta Medical (SpinCo 2) which houses Medical Aesthetics Businesses

- Solta made ~$306m in revenue over the last 12 months

- Solta will be a full IPO and is not classified as a spin-off because shares will not be distributed to current Bausch Health shareholders

Christopher Schott

Okay, great. And the last couple of minutes here, just a few other ones. One question I’ve been getting — I know some of the folks have been submitting questions, is just an update on the time line between, I guess, the actual, like spin of B + L versus the IPO. And I think you’ve commented in the past, but I guess just what’s the latest thinking there of whenever you do an IPO, what’s the path to — how long do we think about to the business actually separated out and then distributed to shareholders? Is there any update on that time line or plan?

Joseph Papa

Yes, sure. So first, the B + L IPO, we’re contemplating it for up to 20% of the Bausch + Lomb business would be IPO-ed. So let’s say that happens. Once that — as soon as that happens, we expect that there will be a customary lockup period from 3 to 6 months, depending on the performance. But that’s just the normal customary lockup period.

Beyond that, the only issue for us is, as we use the debt of, we raised for the B + L debt raise, as we used the B + L IPO proceeds, as we’ve raised Solta IPO proceeds, all of that we focused on using to paydown the debt of Bausch Pharma. We need to get the debt of Bausch Pharma at 6.5 to 6.7x. We have a plan to do that. And we’ll do that, but that will be able to allow us to unlock the remaining Bausch + Lomb IPO shares that we can send a spinoff to our shareholders at Bausch Health.

So that’s a really exciting point. And we clearly believe as we separate these 3 businesses, we’ve got an opportunity to create real value for the Bausch Health shareholders.

February 23, 2021 – Update

Seeking Alpha: Bausch Health Trades Below SOTP

- Good article but I think 15-20x is a fair multiple for Bauch and Lomb not 30x.

November 5, 2020 – Update

- From Q3 2020 conference call:

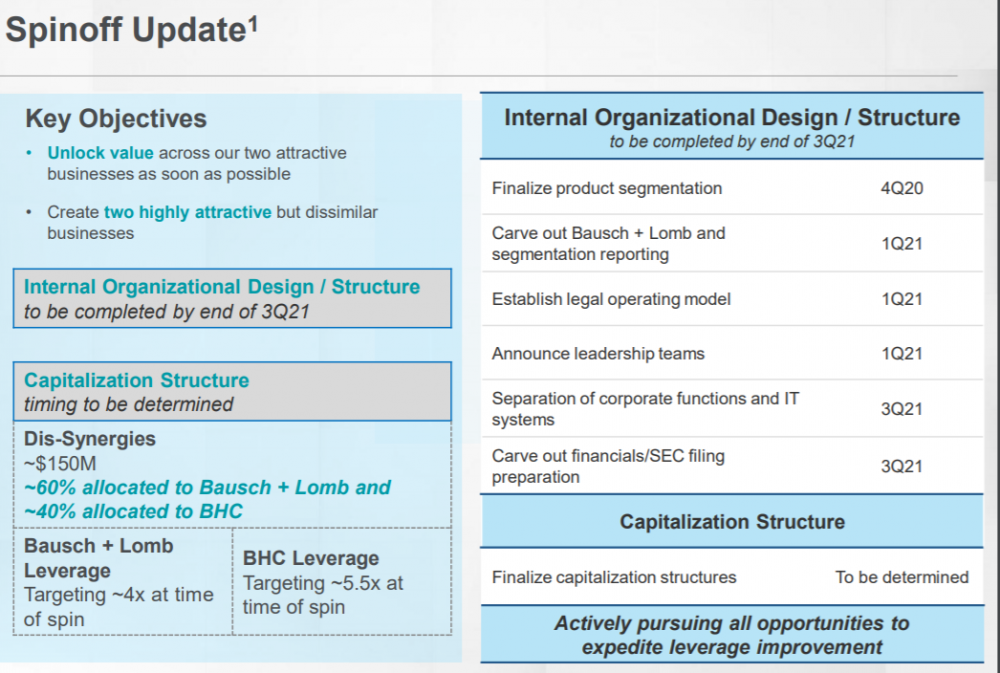

Before I wrap up, I want to give you a quick update on the planned spin-off of Bausch + Lomb on Page 27. Since announcing our intention to separate Bausch + Lomb into an independent company, our goal has been to unlock value across our 2 attractive businesses as soon as possible.

Our team has been working diligently to complete all the necessary actions, which include the items listed on the right of Slide 27. We are making great progress and expect the internal organization design to be completed by the end of the third quarter of 2021.

Finalizing the capitalization structure is more complicated and we are actively pursuing all available options to expedite leverage improvement. Our focus is on positioning these two strong with dissembler businesses so that the financial market see attractive growth opportunity for both entities.

- Spin-off Slide from Q3 Presentation:

August 27, 2020 – Update

- On August 6, 2020, Bausch Health Companies Inc. announced that it intends to spin off its leading eye health business into an independent publicly traded entity (“Bausch + Lomb – NewCo”) from the remainder of Bausch Health.

- Basic notes from Barron’s article.

- Chris Schott thinks Bausch spin-off would do $870MM in 2021 EBITDA. He thinks a fair value is 15x because peers like Alcon trade at 20x next years EBITDA. Equals value of $13.05BN.

- Remaining specialty pharma company will trade for 7.5x $2.7BN = $20.25BN.

- So total value of $33.3BN. Minus $22BN of debt. Leaves $11.3BN of equity value versus $6.0BN currently. 88% upside.

- If Bausch spin-off trades at parity with Alcon, even more upside.

- Questions:

- What multiple was Bausch originally acquired for?

- What was acquisition price?

- How many drugs will come off patent (for both spin-off and remaining specialty pharma co)?

So, this maybe a stupid question, but let’s say I own 1,000 of BHC.

What happens to my shares when this break up happens? Do I get

some Solta, Bausch and B+L shares for my BHC shares? Can’t seem

to find out any answers to that other than there will be a couple of

IPO’s when the time is right.

Thanks to anyone who can give me an answer to this.

I have the exact same question which I just sent to Jim Cramer since he’s been pumping this for months.

I hope we all get an answer from someone. From what I’ve read, BHC intends to keep all the proceeds from the spinoffs so I’d like to know what they plan on doing for shareholders. They can’t just sell off 2/3rds of the company & give shareholders nothing, I would think.

I agree with the previous comment. I have owned BHC for years and planned to sell after the spinoff. I find the spinoff took place, I think May 6, 2022 and my stock reports say I own BHC not BLCO, Which seems like fraud to me. Any helpful advice would be appreciated on this matter.

I own 1,000 of BHC from long time. When will I get my share of BLCO.

No date has been set yet for the spin-off. Bausch Health lost a patent challenge on one of its major drugs (Xifaxan). So that threw a wrench in the plan to proceed with the spin-off. It still could happen, but it’s indefinitely delayed.

Is there any update on when the shares of BLCO will be distributed to Valeant (BHC) share owners. It seems like another fraud by Papa. Can we file class action lawsuit against te company.

BHC stocks has reached $31, then they split away the most successful part (Bausch Lomb), leaving the stock holders with half value company assets.

Of course resulting the stock to go down to its lowest level of about $6. Was this manipulation even legal?

So, since the IPO did not succeed, they bought back most of the BLCO share, but they still are not distributing any BLCO shares to original owners of BHC shares

– Is this legal?