Embecta (Becton, Dickinson) Spin-off Notes

July 7, 2022 Update

- I don’t think it looks very cheap on normalized earnings

March 10, 2022 Update

Here are some comments about the Embecta spinoff:

February 3, 2022 Update

- Becton, Dickinson and Company announced during their earnings call that the board has approved the spinoff of their Diabetes division, Embecta, which is set to spin on April 1st

- Embecta (SpinCo) will also be comparatively smaller at ~$1b sales to RemainCo’s ~$20b sales

Embecta will be one of the largest pure-play diabetes companies in existence today with an ability to focus on its strategic goals, drive strong cash flow and allocate its capital more efficiently and effectively to drive higher revenue growth.

May 6, 2021 Notes

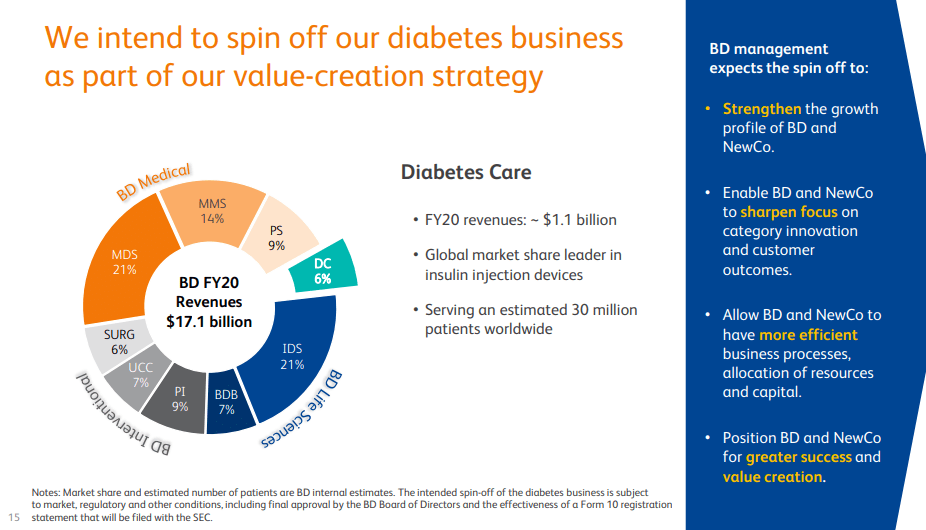

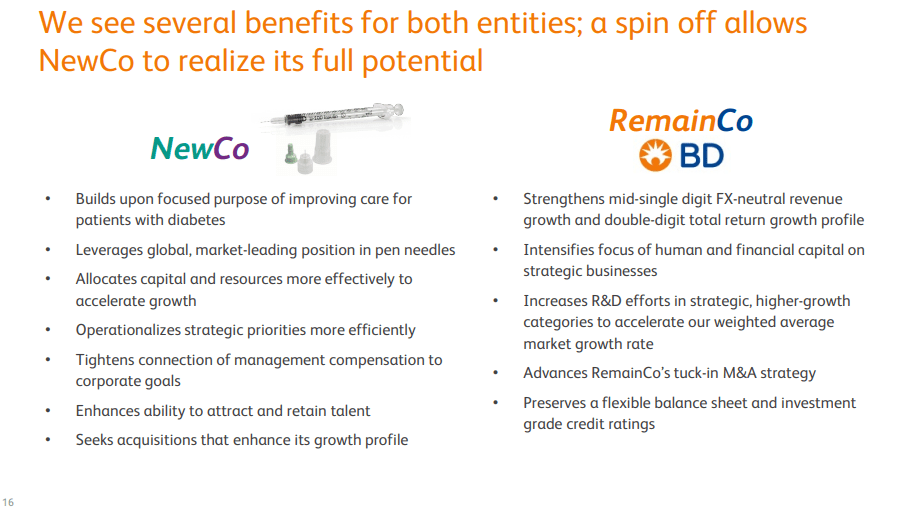

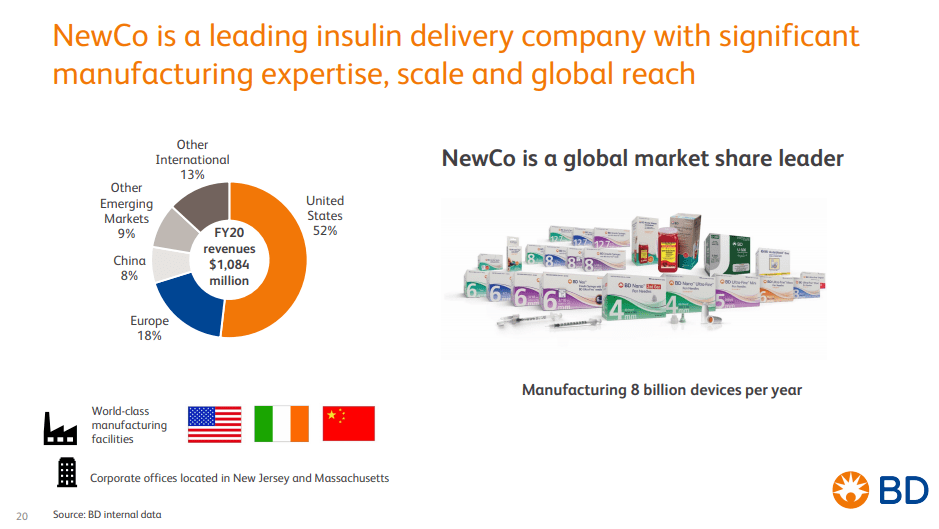

- U.S. device maker Becton, Dickinson and Company plans to spin off its diabetes care business to focus on other businesses while the company continues to grow its diagnostic testing, medication delivery and other businesses. BD believes the spinoff of the Diabetes Care business will create long-term value for BD shareholders and create a platform to continue to enhance the tools provided to people with diabetes. While the “NewCo” will be a new, publicly traded company, the Diabetes Care business roots in BD’s introduction of the world’s first specialized insulin syringe in 1924. Today, this business is the leading producer of diabetes injection devices, producing approximately 8 billion injection devices annually and serving 30 million patients, more than any other company in the world.

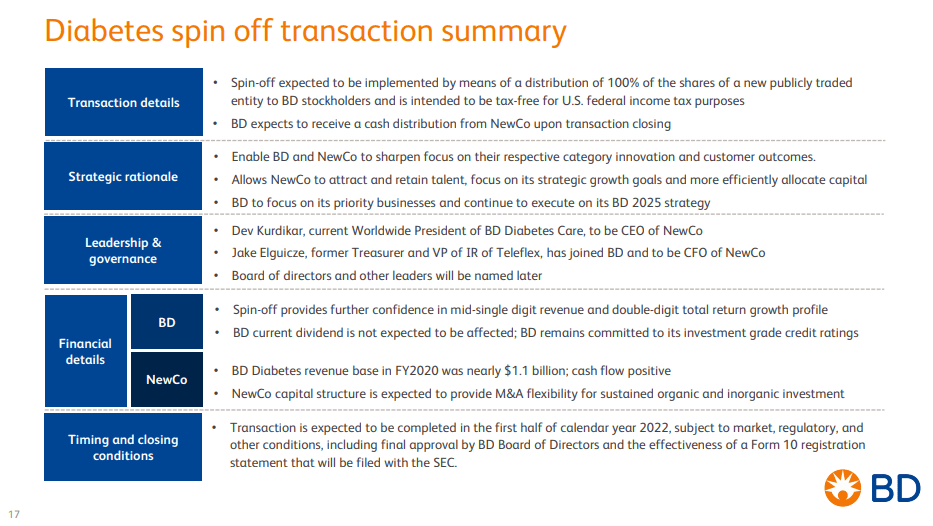

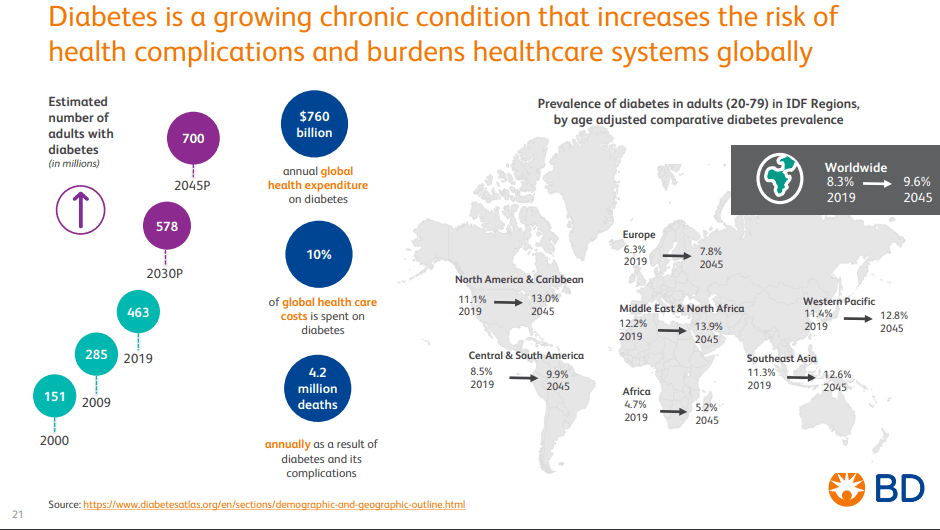

- In fiscal 2020, the Diabetes Care business (mainly insulin pens and syringes) generated revenue of nearly $1.1 billion. Today’s diabetic population, estimated at 463 million individuals worldwide, is expected to increase to 700 million by 2045.

- NewCo’s revenue and manufacturing footprint are geographically diverse. In fiscal 2020, the Diabetes Care business generated revenues of nearly $1.1 billion, with 48% of revenues generated outside of the United States, including 17% of revenues from emerging markets.

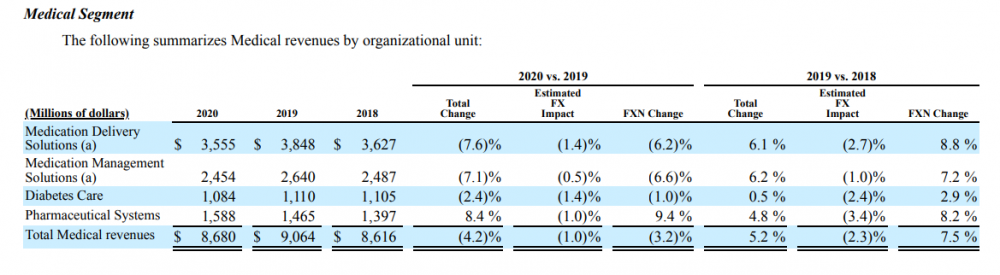

- BDX believes the spin-off will accelerate growth in core business. This implies that Diabetes Care has a slower growth outlook. Here is segment revenue from BDX’s last 10-K. In 2019 (normal year prior to pandemic), diabetes care grew 0.5% while every other divison grew significantly more.

- The spinoff is expected to be tax-free and to be completed in the first half of 2022.

- “The spinoff will allow BD to strengthen its growth profile, enables a greater investment focus on our other core businesses and high-growth opportunities, and makes a greater impact for our customers and patients.” – Tom Polen, chairman, CEO and president of BD

- Dev Kurdikar, Worldwide President of Diabetes Care, will be CEO of NewCo:

Thanks Tom, and hello to everyone listening to today’s call. I’m incredibly excited to embark on this journey. I see a tremendous opportunity to build shareholder value and advance care for patients who suffer from diabetes.

I’m also very humbled, to be leading this amazing organization. The Diabetes Care business has a long history of caring for patients living with the disease, dating back to BD’s introduction of the world’s first specialized insulin syringe, almost 100 years ago in 1924.

Since then, BD has played a leading role in the delivery of insulin, including helping to drive the adoption of insulin pens, which utilize our pen needle technology, as a leading modality for insulin injection.

Our Diabetes Care business now reaches more diabetic patients, than any other medical device company in the world today. We manufacture eight billion devices per year and are the global leader in insulin injection devices.

As Tom mentioned earlier, the business generated nearly $1.1 billion in revenue in fiscal 2020, derived from the sale of insulin injection devices such as, pen needles and insulin syringes as well as other accessories.

One factor that attracted me to this opportunity was the global breadth of the business with 48% of the revenues generated outside the United States, including 17% in emerging markets. And why is this important?

As you can see on slide 21, diabetes is a growing chronic condition across the globe, with some of the higher prevalence rates expected to be in the emerging market regions.

The International Diabetes Federation estimates that the number of adults living with diabetes is expected to grow from 463 million in 2019 to 578 million in 2030 and 700 million by 2045.

Most of these patients will likely continue to rely on traditional injection devices for their insulin needs. The rapid growth of the disease will likely place a significant burden on healthcare systems around the world, as patients with diabetes are often afflicted with multiple co-morbidities like cardiovascular disease, hypertension, diabetic retinopathy and lower limb complications.

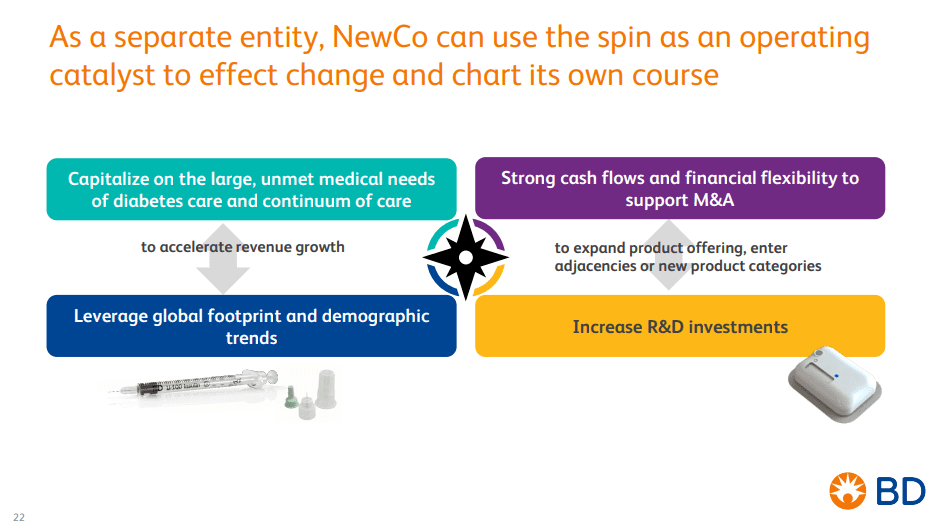

While I’ve only been with the company for a few months now, I can assure you that my passion and vision for NewCo is one of growth. Injection devices like pen needle and syringes are likely to remain a key part of their treatment paradigm for people with diabetes on a global basis for the foreseeable future. We will look to leverage our global footprint to capitalize on these demographic trends.

However, we’ll also look to invest in novel insulin delivery technologies, including our internal type 2 patch technologies. We also plan to supplement our internal R&D product development efforts more broadly and accelerate our growth profile through strategic M&A to broaden our product offerings and enter adjacencies on new growth categories.

Let me end by saying how excited and humbled I am to have this opportunity to lead NewCo. I am confident that our team will work tirelessly to advance care for our patients while building shareholder value.

- In terms of valuation, my best guess is that the diabetes will trade at a discount to

Leave A Comment