The ODP Corp (B2B Business) Spin-off Notes

June 21, 2022

- The company decided to keep the entire business together.

Following the completion of that review, the Board of Directors unanimously determined it is in the best interests of the Company and its shareholders not to divest the consumer business at this time. In reaching its conclusion, the Board was assisted by its financial and legal advisors, and its process included further discussions of the non-binding proposals with the potential buyers to ascertain additional details about the proposed terms and conditions. It also consisted of evaluating the expected value to the Company of such proposals, taking into account the proposed structure, economic terms, certainty, expected timing and potential regulatory requirements.

Further, due to current market conditions, the Board also determined not to resume the Company’s previously announced potential public company separation at this time and instead to maintain all of its businesses under common ownership. That separation process had been put on hold earlier this year pending evaluation of potential opportunities to divest the Company’s consumer business.

March 10, 2022 Update

Greenlights Capital Investment Case:

December 22, 2021 Update

May 7, 2021 Update

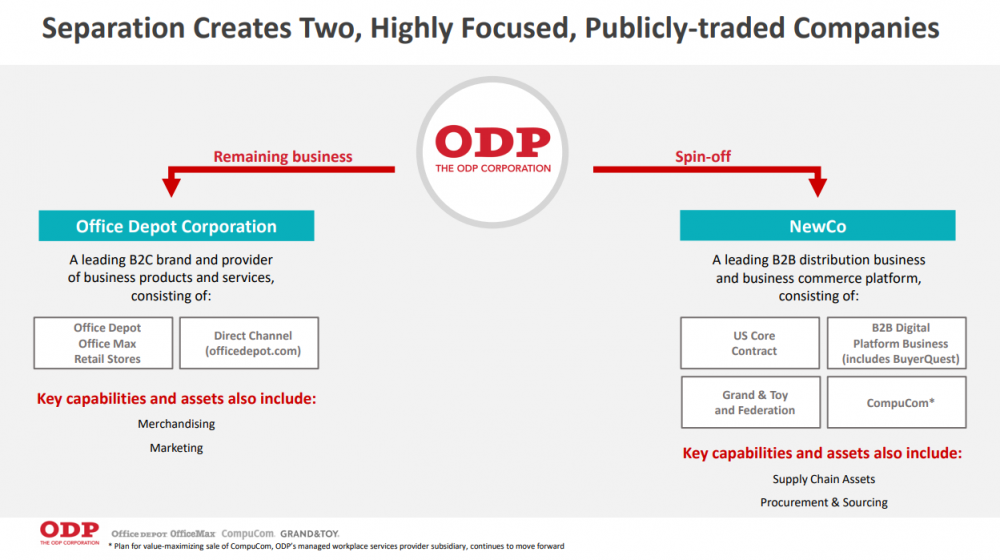

- On May 5, 2021, The ODP Corporation (NASDAQ: ODP), announced its is looking to break up into two companies: ODP and “NewCo”.

- ODP is a provider of retail consumer and small business products and services distributed through 1,100 Office Depot and OfficeMax locations as well as the eCommerce presence, officedepot.com.

- “NewCo”, is a B2B solutions provider serving small, medium and enterprise level companies taking on the following segments: Use Core Contract, CompuCom, and Grand & Toy and Federation.

- Spin-off is expected to be tax-free.

- The separation is expected to occur during the first half of 2022.

- “Maximizing the strategic focus and financial flexibility of each entity and aligning their go-to-market strategies and capital investments will enable us to meet customer demand. In addition, positioning their respective growth trajectories and shareholder specific return profiles will achieve appropriate market valuations.” – Gerry Smith, Chief Executive Officer of the ODP Corporation.

- Here is the presentation.

- Background:

- Staples which was acquired by PE shop Sycamore Partners continues to pursue an acquisition of ODP.

- ODP has rebuffed acquisition efforst saying that the deal wouldn’t pass regulatory hurdles.

- ODP has been cutting costs and trying to push into services.

- It acquired CompuCom in 2017 for $1BN as a hedge for declining demand for core office supplies such as paper.

- Staples which was acquired by PE shop Sycamore Partners continues to pursue an acquisition of ODP.

- Here are the spin-off slides:

- Initial thoughts:

- This looks like an interesting situation.

- The business is in secular decline, but is extraordinarily cheap at an EV/revenue multiple 0.2x and price to cash flow of 3.7x.

- Meanwhile, they are in the process of selling their CompuCom business and breaking up the remaining business.

- Finally, Sycamore Partners, a ruthless PE shop who has a phenomenal track record of returns, is trying to merge the business with Staples. This transaction would make all the sense in the world as Sycamore could cut costs and pay itself hefty dividends even if long term the business goes bankrupt.

- More work to do on this one!

Great writeup – thank you for the overview! Can you shed light on which asset(s) Sycamore Partners is attempting to merge with Staples?

Ami ludo g atoba spin kalaincam kortasau kento kivana hellpsau

Ami kiincam. Loratapabonasàr