Spin-off Overview

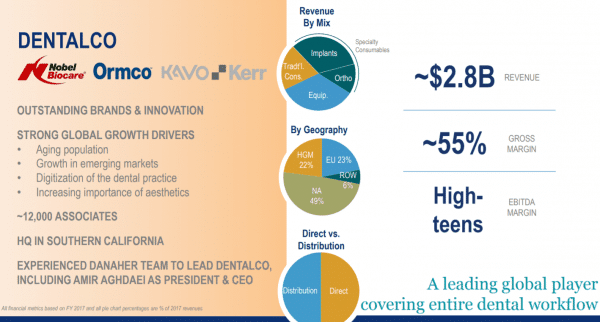

On July 19, 2018, Danaher (DHR) announced that it would be spinning off its Dental business in a tax free transaction. Expected timing is Q3 2019. DentalCo will be comprised of Danaher’s current Dental segment operating companies: Nobel Biocare, Ormco, and KaVo Kerr. The segment generated revenue of nearly $3 billion in 2017, and is expected to have an investment-grade credit rating and a global team of approximately 12,000 associates.

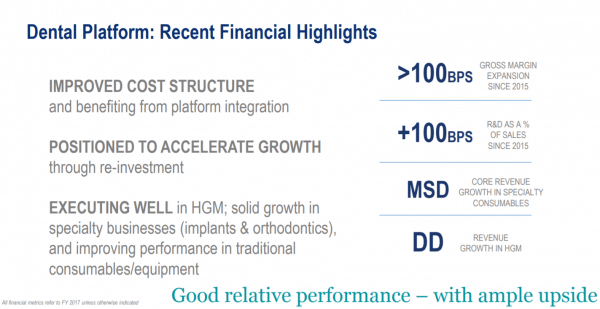

Source: Danaher Slide Deck

Background:

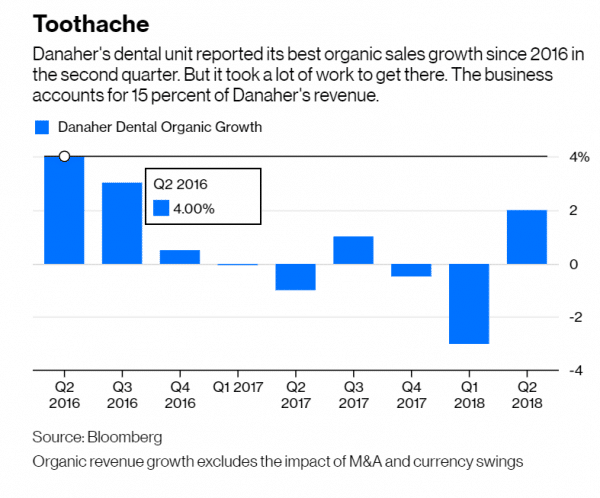

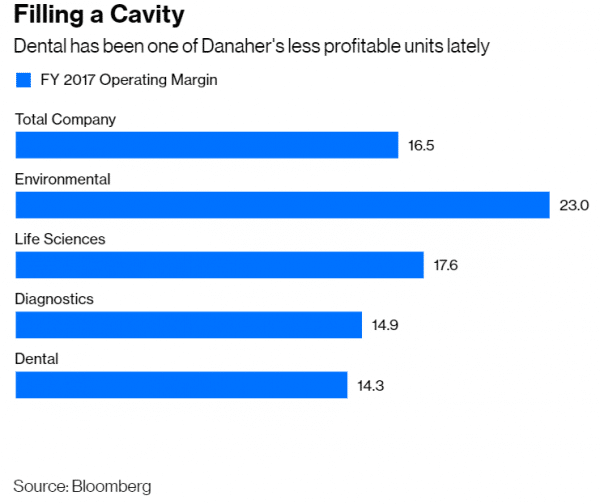

From Bloomberg:

The $73 billion maker of life-science equipment and water-purification technology on Thursday announced it would spin off its dental unit. It’s a move that I’ve long argued makes sense. This is Danaher’s second spinoff in about as many years, having separated out its Fortive Corp. industrial tools business in 2016. Fortive has essentially become a Danaher 2.0, and its success is proof that applying the company’s vaunted operating system and acquisition-driven strategy on a more focused scale pays off. But at Danaher 1.0, the transformation felt incomplete.

The dental unit has been a sore spot for Danaher amid otherwise strong organic growth and profitability. Talking about and trying to fix that business sucked up an increasing amount of executives’ time. And while there are signs that efforts to cut costs and invest in new growth initiatives at the dental unit are yielding results, the turnaround efforts had undoubtedly become a distraction and both companies should be better off as separate entities.

RBC analyst Deane Dray points out that Danaher was already trading at a premium to his sum-of-the-parts value, and yet shares of the company spiked more than 7 percent on news of its breakup. Sum-of-the-parts estimates are more art than science and often underestimate the opportunities afforded by a breakup. It’s hard to handicap what more focused management teams can do with costs and growth initiatives once they’re unshackled from a larger parent company. But judging from the market reaction, the early verdict from investors is that the only thing better than two Danahers is three Danahers.

Resources from Danaher:

Press Release – July 19, 2018

Slide Deck – July 19, 2018

Articles

Bloomberg – Danaher Breakup Offers Lessons for Industrial Conglomerates – July 19, 2018

Hi,

I’ve been a Danaher stock holder for over 20 years & an ex-employee of Fluke. I received Fortive stock when it was spun off, but nothing so far for DentalCo or any other spin-offs.

Please help me.

Regards,

Don Dedinas 847-924=6484