Spin-off Overview

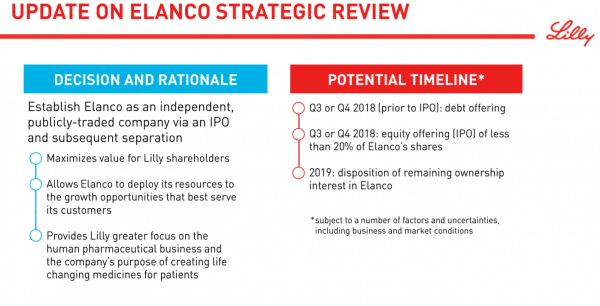

On July 24, 2018, Eli Lilly (LLY) announced that it would be spinning off its Animal Health business. LLY will be filing an IPO for less than a 20% stake in the Animal Health company. LLY expects to distribute the remaining shares to shareholders through a tax free spin-off subsequent to the IPO. Usually the distribution must occur at least 6 months after the IPO for tax purposes.

Source: Eli Lilly Slide Deck

Update:

LLY’s animal business, Elanco Animal Health, filed its S-1 on August 2, 2018. LLY recently launched its roadshow to meet with potential investors ahead of the IPO. Elanco is offering 62.9MM shares in the IPO and the underwriters have a 30-day option to purchase up to 9.4MM additional shares. The IPO is expected to price between $20.00 and $23.00. The company will trade under the ticker ELAN.

If the underwriter’s purchase option is exercised in full, LLY will own 80.2% of ELAN and 19.8% of ELAN shares will trade freely. The first day of trading is expected to be September 21, 2018.

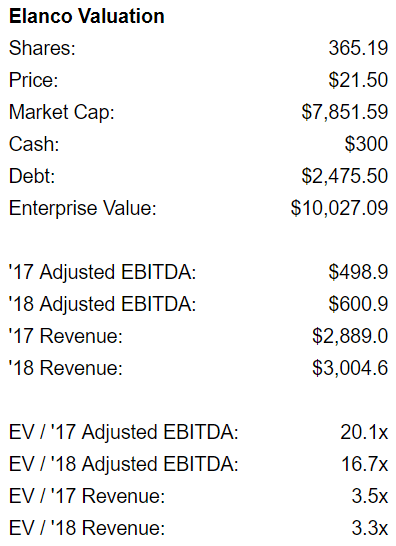

Let’s assume ELAN prices in the middle of its range at $21.50. In total, there will be 356.19MM shares outstanding. So the market cap works out to be $7,654MM.

ELAN is expected to have $300MM in cash and $2,475.5MM in debt implying an enterprise value of $9,829.5MM.

Financials

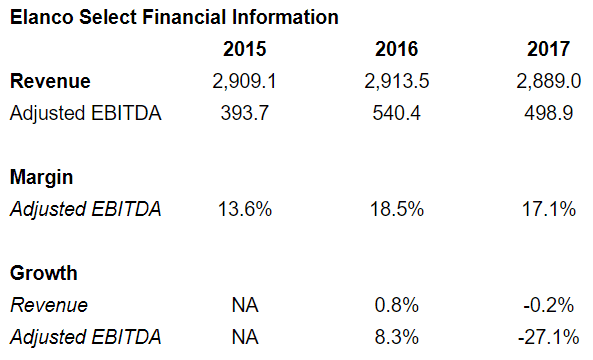

Per the S-1, Elanco disclosed the last three years of financials. See key trends below:

Source: ELAN S-1

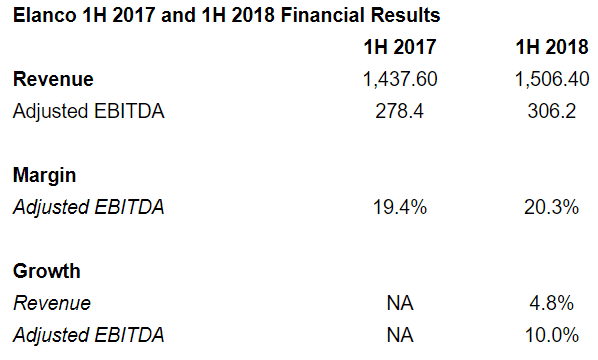

In the first half of 2018, the results have improved:

Source: ELAN S-1

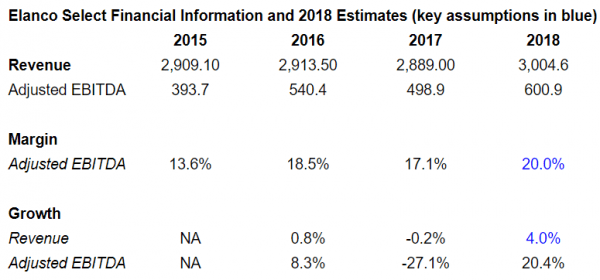

For full year 2018, I’m assuming ELAN generates 4.0% revenue growth and a 20.0% EBITDA margin – both assumptions seem reasonable given the performance in the first half of the year. These assumptions drive a 2018 revenue estimate of $3.0BN and a 2018 EBITDA estimate of $601MM.

Source: Author’s Analysis

Thus, at the center of it’s targeted IPO range ($21.50) ELAN will trade at 16.7x ‘18 EBITDA and 3.3x revenue.

Source: Author’s Analysis

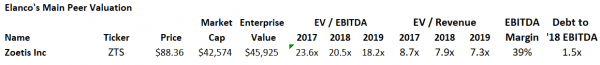

How does this valuation compare to its closest peer, Zoetis (ZTS)? As shown in the chart below, ZTS trades at 20.5x ‘18 EBITDA and 7.9x revenue, a significant premium to ELAN.

Source: Ycharts

Why is there such a difference?

A couple reasons:

1) Zoetis is the market leader and has grown faster over the past couple years. Over the past two years, ZTS has grown revenue at a 5.5% CAGR while ELAN revenue has been flat.

2) Zoetis has a superior margin profile with 39% EBITDA margins vs. ELAN’s ~20%.

3) LLY management is probably pricing ELAN’s initial IPO at an attractive valuation so that it performs well in initial trading.

Should you get in on the IPO?

Given that the initial valuation looks relatively low, I would recommend participating the IPO if you have the opportunity. We can look back at PFE’s IPO of Zoetis (ZTS) in 2013 to see how ELAN might perform in initial trading.

In February 2013, Pfizer proceeded with an IPO of ~18% of its ownership in ZTS. ZTS opened up ~21% in its first day and closed at $31.50. Shares continued to perform well and peaked in March at ~$35.06.

In May 2013, Pfizer announced that it would be distributing the remaining 82% stake in Zoetis through an exchange offer (investors could trade their shares of PFE for shares of ZTS). To incentivize investors to participate, the transaction was structured so that PFE holders would get 107% of the value of their exchanged shares in ZTS stock.

After Pfizer announced the exchange offer, ZTS traded down in anticipation of the market having to absorb the remaining 80% of shares outstanding. Shares troughed at $29.28 in July 2013.

Now back to ELAN. If you do not have access to the IPO, I would not chase the stock after the IPO. LLY plans to distribute the remaining ~80% of ELAN approximately 6 months after the IPO. I would bet that investors will have a chance to buy the shares at an attractive price when that spin-off occurs.

Is ELAN a good stock for the long term?

It all depends on valuation and initial trading, but ELAN is set up to be a great stock over the long term for several reasons.

First, Elanco is in a market that is fundamentally attractive. Per Elanco’s S-1,

“Animal medicines and vaccines represent a global market of $32.0 billion, based on 2017 revenue, and grew at a CAGR of 4% from 2007 to 2017, according to Vetnosis…..Companion animal medicines and vaccines represented $10.8 billion of revenue in 2017 and grew at a CAGR of 4% from 2007 to 2017, according to Vetnosis.”

Not only is there good, stable growth, but it’s also defensive which is especially attractive at this point in the economic cycle.

Second, its margins are ~50% lower than the margins of its closest peer, Zoetis. While some may view this as a negative, it’s actually a huge opportunity, as ELAN has a tremendous opportunity to grow EBITDA and increase its valuation over time. Zoetis began trading with EBITDA margins of ~22% and they have since increased to 39%. ELAN should be able to do the same. From reading the S-1, I don’t see any reason why ELAN is structurally any different than ZTS.

Third, ELAN will begin trading with significant but manageable debt. ELAN will have net debt to EBITDA of 4.1x. If this is paid down to 1.5x (the level of Zoetis), equity shareholders will reap the benefits.

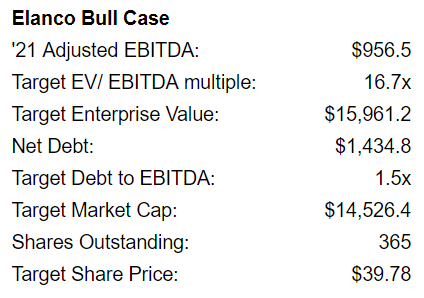

Let’s paint a picture of the bull case. First let’s assume revenue grows at 2% for the next three years, below recent market growth, but ahead of historical Elanco revenue growth. Next, let’s assume that EBITDA margins expand from ~20% to 30% (still at a discount to ZTS). Finally, let’s assume net debt decreases from 4.2x to 1.5x (same level as Zoetis) and shares outstanding stay flat (conservative as free cash flow could fuel share buybacks like at ZTS). The stock could almost double to ~$40. And this assumes no multiple expansion. See the math below:

Source: Author’s Analysis

Summary

If you have access to the IPO, I would consider participating. If not, wait to potentially buy when LLY spins off their remaining ~80% stake.

Resources from Eli Lilly:

Press Release – July 24, 2018

Slide Deck – July 24, 2018

S-1 – September 9, 2018

2018 10-K – February 22, 2018

Articles

Bloomberg – Eli Lilly to Spin off Animal Drugs Unit Opting Against a Sale – July 24, 2018

Leave A Comment