Encompass Health Potential Spin-off (Home Health and Hospice) Notes

January 21, 2022 Update

- On January 19, 2022, Encompass Health (EHC) announced it will spin off its home health health and hospice business. This decision is the conclusion of a strategic review which began in December 2020.

- The spin-off is expected to take place in the first half of 2022.

- The company hasn’t decided whether this will be a partial spin-off or a full spin-off.

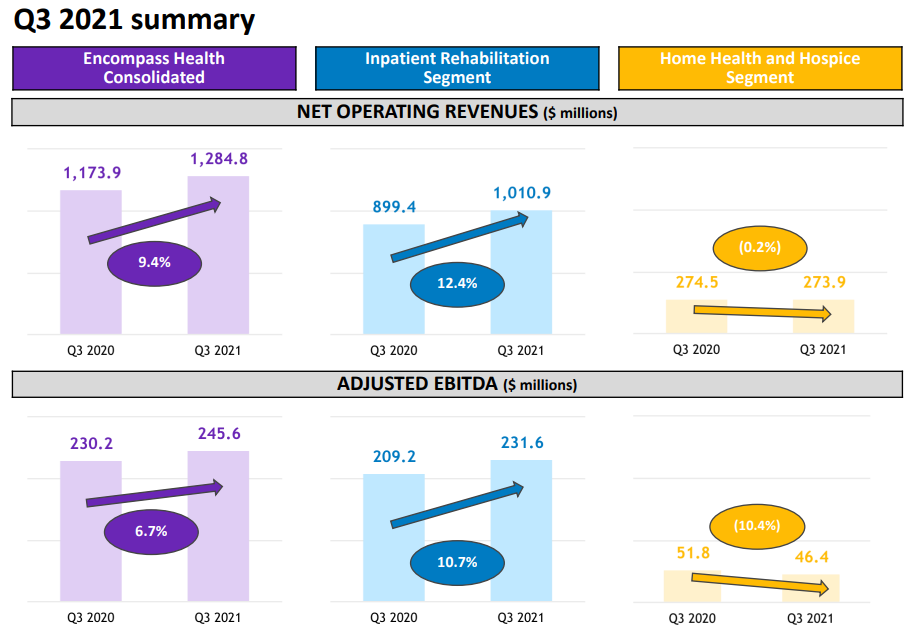

- Here are results as of Q3 2021 (source):

- What is Home health and hospice revenue and EBITDA?

- Annualized revenue of $1.1BN. $186MM of annualized EBITDA.

- According to Credit Suisse the best comps for Home Health and Hospice are AMED (12.7x TTM EV/EBITDA) and LHCG (16.2x TTM EV/EBITDA).

- Assuming a 13x multiple, the Home Health and Hospice business is worth $2.4BN on an EV basis.

- What is RemainCo revenue and EBITDA?

- Annualized revenue of $4.0BN. Annualized EBITDA of $926MM.

- Credit Suisse believes a 9x EV/EBITDA (I need to confirm this is appropriate) is appropriate for RemainCo.

- Assuming a 9x multiple, RemainCo is worth $8.3bnn on an EV basis.

- Currently, EHC trades at an enterprise value of $9.7BN vs. $10.7BN (implied by SOTP). Thus, this transaction should unlock ~$1BN of equity value.

December 24, 2020 Update

- Credit Suisse published a recent report on EHC.

- Best comps for EHC’s Home Health and Hospice business are AMED (28x 2021 EBITDA) and LHCG (trades at 23x 2021 EBITDA).

- Prior to the pandemic EHC’s Home Health and Hospice had organic growth inline with peers. In the pandemic, growth has lagged peers due to higher Medicare FFS mix (slower to recover from COVID), geographic mix (40% of rev from FL/TX), and a higher exposure to elective procedures (15% vs 8% for AMED).

- Nonetheless, growth should reaccelerate post COVID.

- Valuation:

- Assuming a 20x-25x multiple for the home health and hospice business and a 9.5x-10x multiple on the in-patient rehabilitation business, implies a fair value of $83-$97 ($90 at the midpoint). Stock currently trades at $83.

- Jana has invested in the stock, but EHC has considered views of all shareholders.

December 18, 2020 Update

- Encompass Health (EHC) recently announced that it is exploring strategic alternatives for its home health and hospice business. While the plans aren’t set in stone, the company is considering an IPO, spin-off, mreger, or sale.

- The home health and hospice business accounts for 24% of 2019 revenues. If this segment were to be spun-off, the remaining company plans to focus on its core business of inpatient rehabilitation. Part of the story is that the company seems undervalued on a sum-of-the-parts basis, and such a transaction could allow some value to be realized. A similar move was made last year with The Ensign group (ENSG) and The Pennant Group (PNTG), a spin-off of a home and hospice business that has lead to significant realization of shareholder value. I could see something similar happening to Encompass Health. We will continue to monitor this situation.

- The name traded positively on the news of a potential transaction, but has retracted some of the gains. EHC currently trades at around $83 (14.2x 2020E EV/EBITDA).

Leave A Comment