Glaxo/Pfizer Consumer Healthcare Joint Venture Spin-off Notes

July 15, 2022 Update

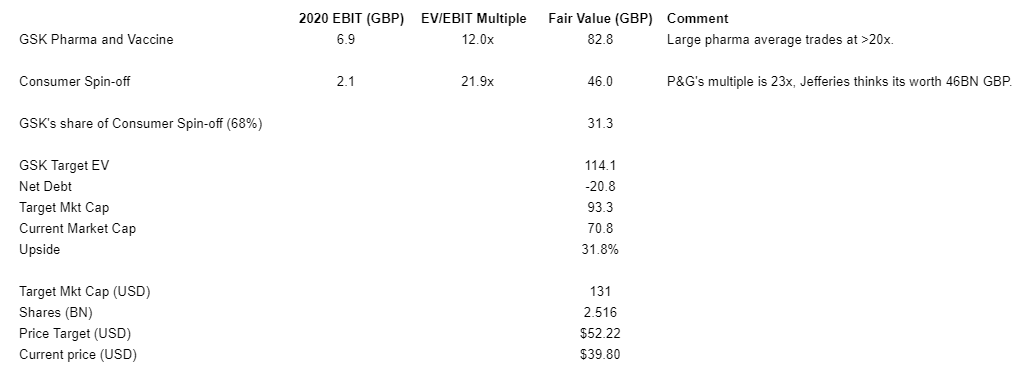

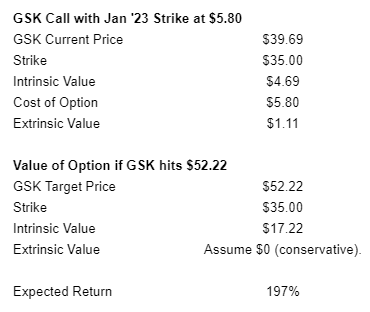

- Value Situations discusses Haleon (SpinCo) and why there will likely be an overhang on shares (I agree)

July 7, 2022 Update

- The Haleon/Consumer Healthcare spin is expected to happen this month

- The SpinCo will be burdened with ~$12b in debt

- SpinCo is expected to be valued between $45b and $53b

June 3, 2022 Update

Good article on why Pfizer wants to sell its consumer sector holdings

- Pfizer’s position in Haleon (Consumer business with Glaxo) is valued at $15.8b

- This liquidation would only add to their already cash-heavy balance sheet from vaccine sales

- The cash would go towards fortifying the pipeline

February 15, 2022 Update

Good write up on how the spin will help RemainCo

- Profit is expected to grow by 12-14% in 2022 for RemainCo

- Sales are expected to grow by 5-7% in 2022 for RemainCo

January 20, 2022 Update

Good write up on why Unilever offered to buy the Glaxo/Pfizer spin

- Unilever is looking not just to acquire the Consumer Healthcare spin, but also use it to shift into areas with more growth potential

- Unilever offered 50b GBP: 41.7b GBP in cash and 8.3b GBP in stock

- GSK rejected the bid and Unilever said they would not raise it

Good write up explaining why the GSK/PFE spin is so valuable

- The Unilever offer valued GSK Consumer at 18.5x (50b GBP) this year’s projected EBITDA

- Competitors like Colgate-Palmolive trade at 17x at that multiple GSK Consumer would be worth 46b GBP

- There is also the possibility of other bidders like Procter & Gamble or Reckitt Benckiser

January 11, 2022 Update

- Glaxo/Pfizer gave some updates on the spin in a recent presentation

- The spin will be a global consumer healthcare business

- ~$14b in net sales in 2020

- 22.1% operating margin

- They serve 100 different markets

- 20 consumer healthcare brands with >$100m in sales including Advil, Sensodyne, and Centrum

- The CEO designate is Brian McNamara

August 5, 2021 Update

July 28, 2021 Update

-

GlaxoSmithKline’s Demerger Plan Has Failed To Excite Investors

GlaxoSmithKline: A Look at its Consumer Health Demerger and a Shingles Approval

July 1, 2021 Update

- Good article on consumer health market and potential consolidation.

- Elliott Letter to GSK

June 23, 2021 – Update

- GSK recently hosted its analyst day (with a 129 page slide deck!).

- Some key details:

- The spin-off will happen by the middle of 2022 (consistent with prior guidance).

- The dividend will decrease by 31% on a combined basis. GSK RemainCo will distribute 40% to 60% of its earnings (down from ~80% currently).

- GSK will spin-off 80% of its stake in the Consumer business.

- Prior to spin-off, it will receive a 8BN pounds.

- Shortly after the spin-off, it will monetize the remaining 20% stake in the business that it owns.

- Remainco outlook:

- GSK’s goal is to grow revenue by 5% annually and profit by 10% from 2021 to 2025. This is above consensus expectations.

- Dolutegravir patent expiry in 2028.

- Leverage will be up to 2.0x (net debt to EBITDA).

- Want to increase operating margin from mid 20s to >30%.

- Spend how much on R&D?

- Spin-off outlook:

- As a reminder, the consumer spin-off is a JV between Pfizer and GSK.

- GSK owns 68% of the JV. Pfizer owns the remaining 32%.

- GSK has been optimizing the consumer spin-off. For example, it has divested/reviewed for divestiture several brands.

- In 2020, core sales (excluding divestitures/brands under review) grew 4%.

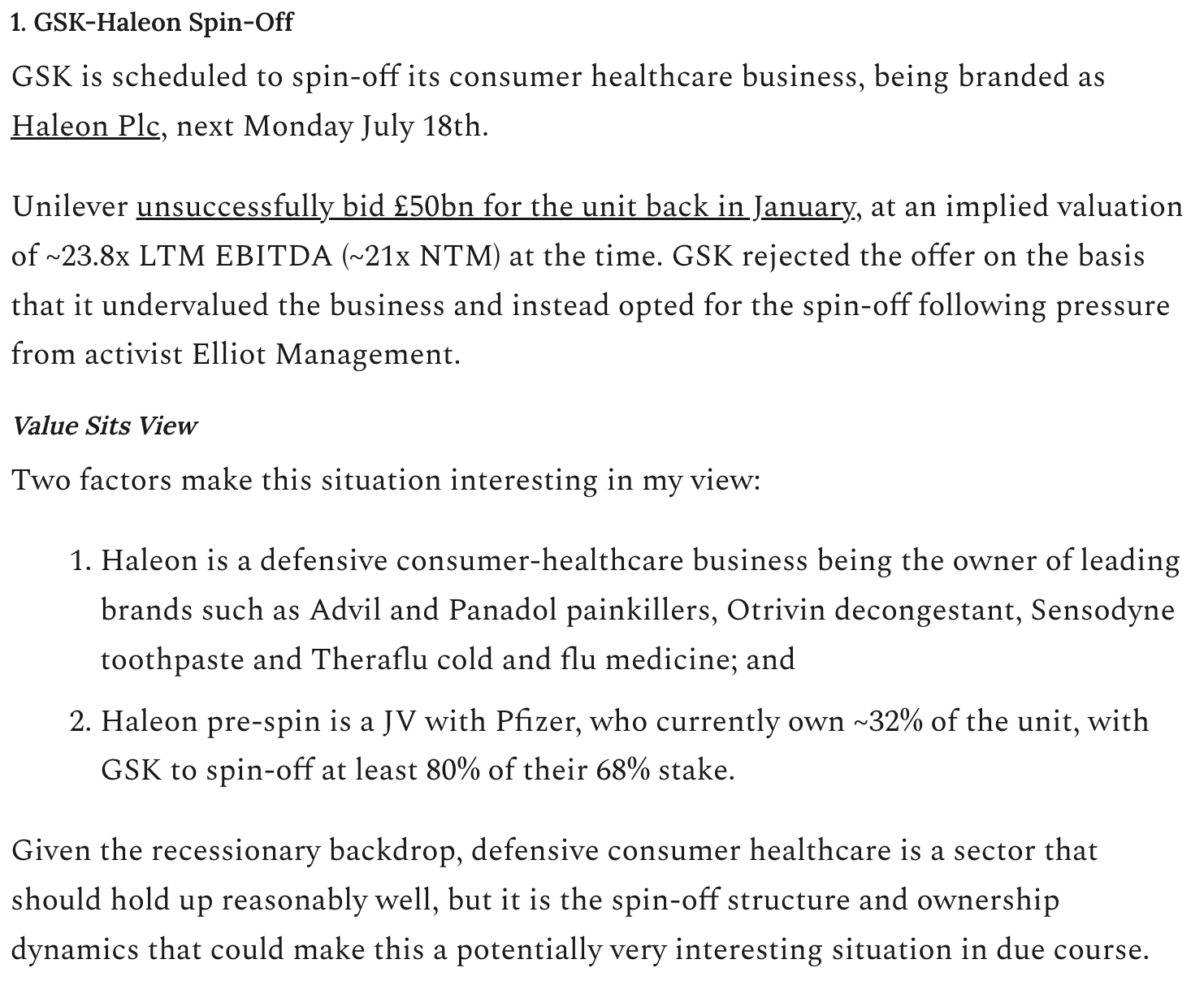

- Core sales are 9.5BN pounds. Consumer operating margin is 22.1%. Imples 2.1BN GBP of operating profit.

- Jefferies estimates the consumer JB is worth 46BN which implies a 22x EV/EBIT multiple. (PG trades at 23x).

- Spin-off will have leverage of up to 4.0x net debt to adjusted EBITDA.

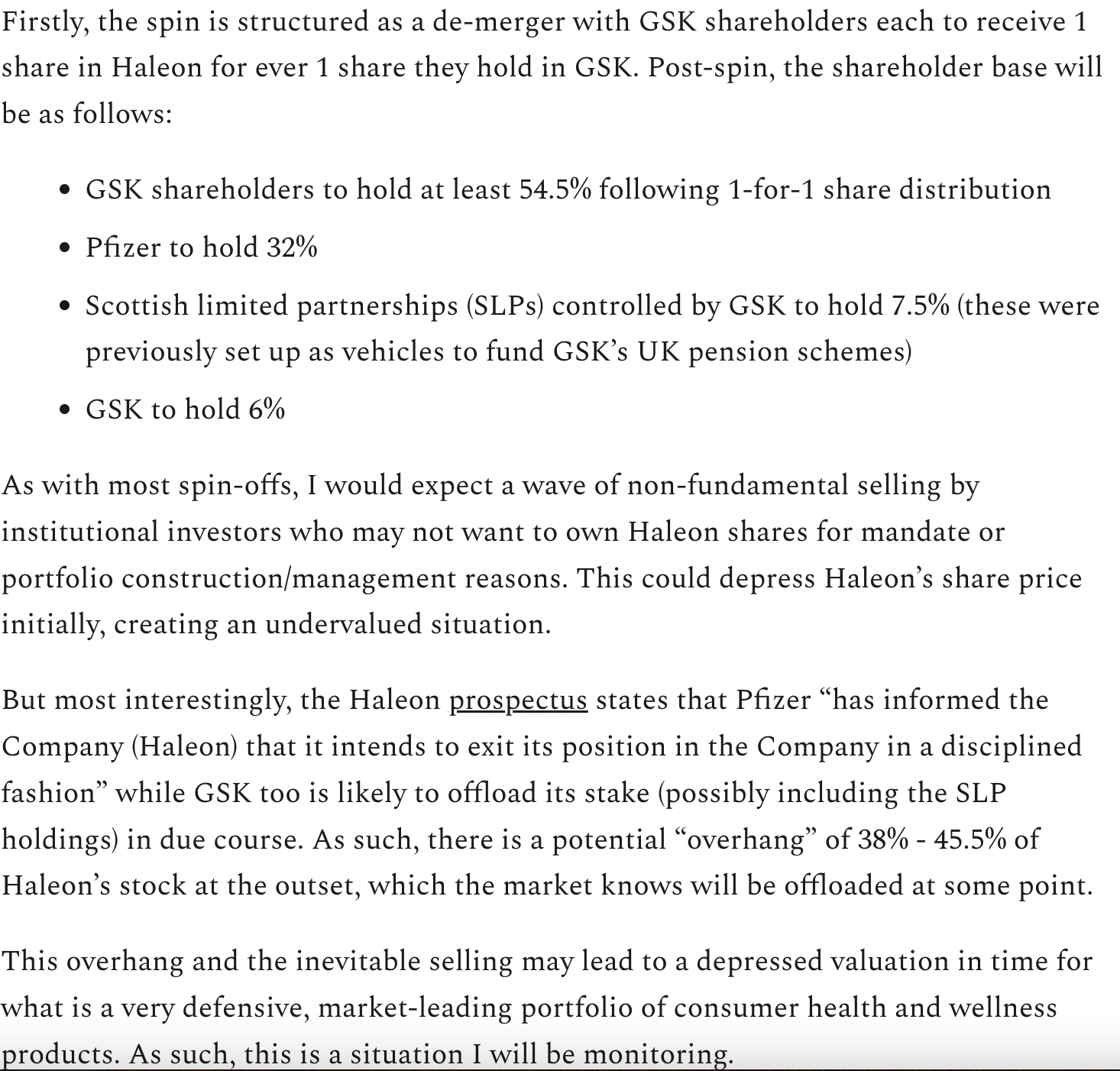

- On a SOTP basis, I think GSK is worth ~$52, ~30% upside.

- I think the options may be more attractive than owning the stock.

February 3, 2021 – Update

- Article arguing GSK is undervalued.

- Spin-off won’t become publicly traded until July 2022

- This a good article diving into what the consumer business should be valued at.

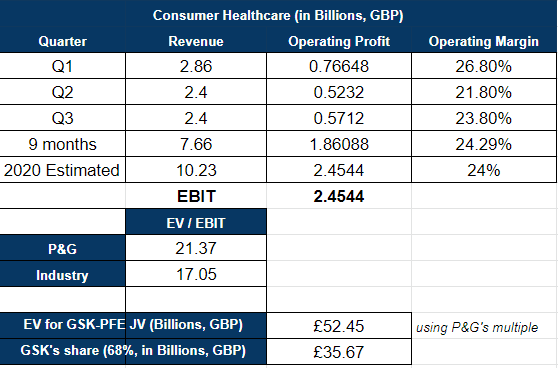

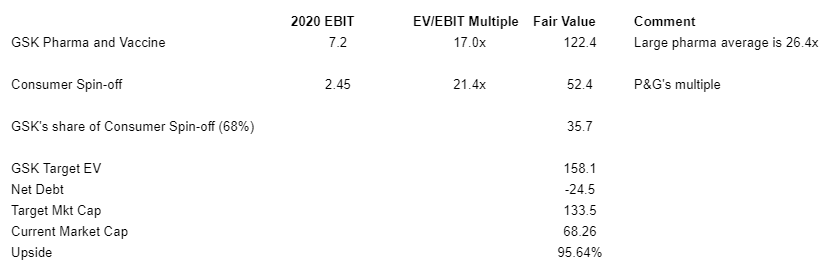

- Author argues GSK share of consumer business should be worth 35.7 billion GBP assuming it trades at P&G’s multiple.

-

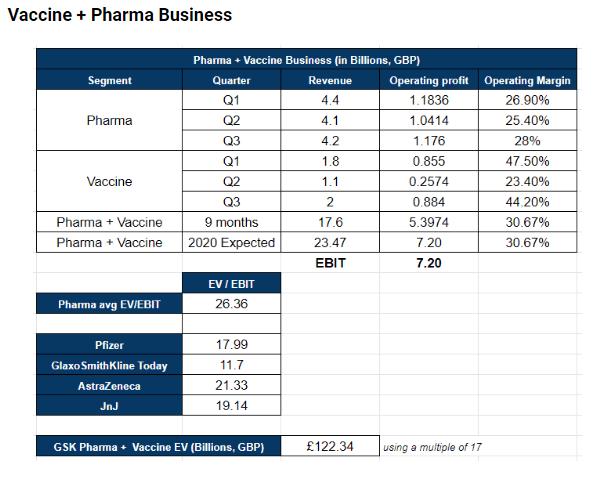

- He values the pharma and vaccine business at an EV/EBIT multiple of 17x which yields an enterprise value of 122.3 billion GBP.

-

- Factoring 23 billion GBP of debt and fair enterprise value is ~158 billion GBP versus current enterprise value of 94 billion GBP.

- Looks interesting. In the meantime GSK pays a 5% dividend.

- Using the assumptions above, looks like there is almost 100% upside. I need to double check all these assumptions, but it looks interesting.

December 16, 2020 – Update

- Good Seeking Alpha article arguing that GSK is undervalued.

December 19, 2019 – Update

- On December 19, 2018, GlaxoSmithKline (GSK) and Pfizer (PFE) announced that they would be merging their consumer health businesses into a joint venture. The joint venture is expected to close in the second half of 2019.

- Within three years of closing, the joint venture will be spun off into a separate public company. The joint venture will have sales of $12.7BN. GSK will have a 68% controlling equity stake while PFE will own the remaining 32%. The combination will bring together a large category of consumer health brands, including GSK’s Sensodyne, Voltaren and Panadol and Pfizer’s Advil, Centrum, and Caltrate.

- The Joint Venture will be the global leader in OTC products with a market share of 7.3% ahead of its nearest competitor at 4.1%.

- Overview of transaction.

How many shares if the new company will I receive