MSGS/MSGE Notes

January 20, 2023 Update

Madison Square Garden Entertainment (MSGE) announced on Jan 13 that it plans to proceed (it had previously announced that it was evaluating the transaction) with a tax free spin-off of its live entertainment business. The transaction is expected to be completed in March 2023.

The SpinCo, will be made up of its traditional live entertainment business, which includes a diverse collection of venues in New York and Chicago, as well as the Company’s entertainment and sports bookings business, taking on the name Madison Square Garden Entertainment Corp, while the existing company will be renamed MSG Sphere Corp.

MSGE will spin 67% of economic interest in the new company to current shareholders and retain the other 33%.

Yet Another Value Podcast (MSGE thesis starts around minute 30) does a great job of outlining the SOTP thesis. It seems as if the stock is trading at a big discount to it SOTP valuation. For me to get comfortable investing, I need to see the Form 10 statement (hasn’t been published yet) to determine 1) what is entertainment co’s profitability (it has asset value but will it generate earnings) and 2) how debt will be split up.

October 6, 2020 Update

- Boyar Value Group published a video presentation in which they discuss MSGE/MSGE. That part of the presentation starts at 16:25 of the presentation.

- Have a different view of the Dolans (they control MSGE/MSGS). Think it can pay to invest along side them.

- They have taken a relatively shareholder friendly approach. With Cablevision, paid a $10 per share dividend to optimize balance sheet, paid an industry leading regular dividend, spun off MSG (which was a good decision), and decided to sell Cablevision right before cord cutting accelerated (great timing).

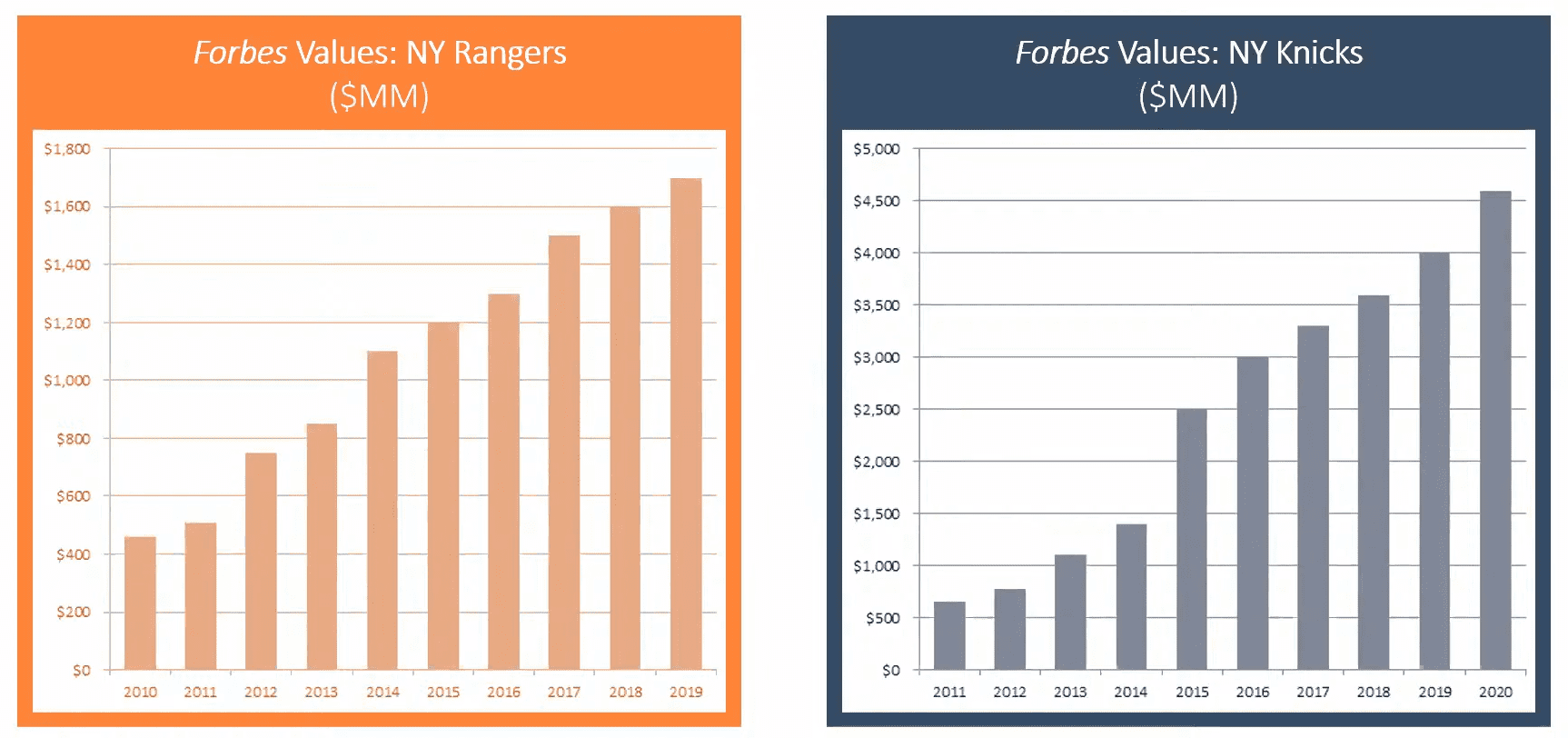

- Sport teams valuations have exploded:

- Knicks: 2009-$586MM, 2020-$4.6BN

- Rangers: 2009-$416MM, 2020-$1.65BN

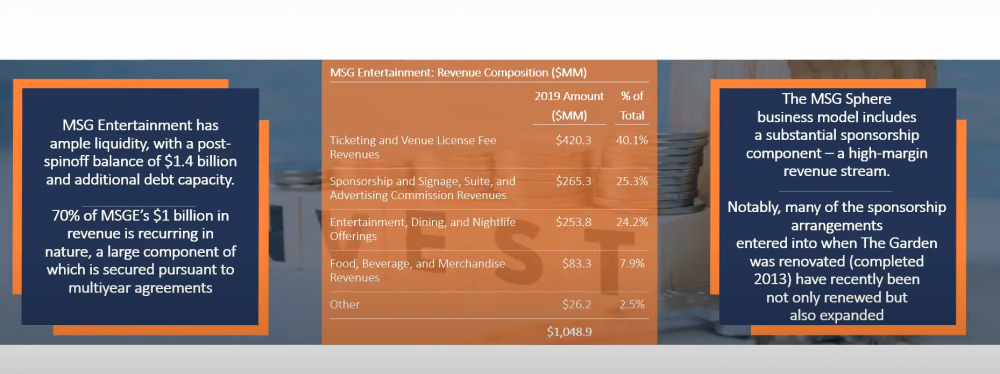

- Like MSGE:

-

- Lot of pent up demand for live entertainment. Majority of tickets sold by Live Nation have not been refunded. People are waiting for pandemic to pass.

- MSGE has $350MM share repurchase authorization.

- Silver Lake owns 8% of the company. Perhaps Dolan takes it private with Silver Lake’s co-investing?

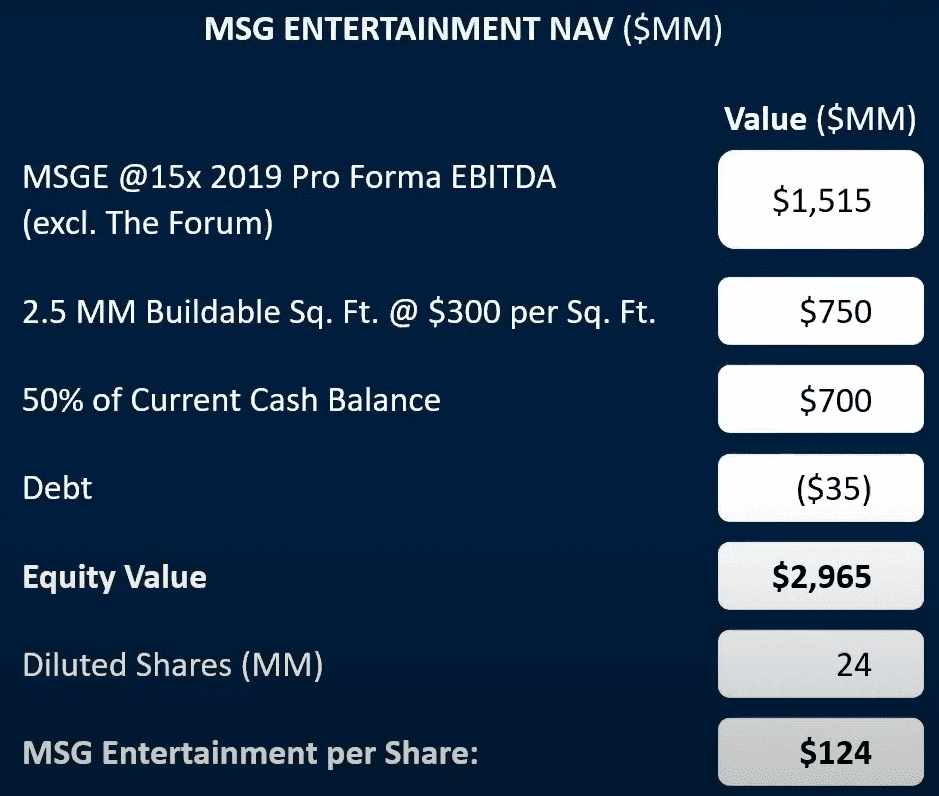

- Boyar’s Valuation of MSGE:

-

- My thoughts:

- Using EBITDA but capex is very meaningful. MSGE spent $452MM in the latest fiscal year although majority was related to the Sphere

- Also cash number is old. Cash is down to $1.2BN. Cash balance doesn’t reflect $200MM in deferred revenue and money due to promoters. Also, company is currently burning $25MM per month (!!!) or $300MM per year. This is a surprisingly high number and I get the sense that there isn’t urgency because they have so much cash.

- I think it’s worth between $64 and $105 per share. Some good upside, but not asymmetric.

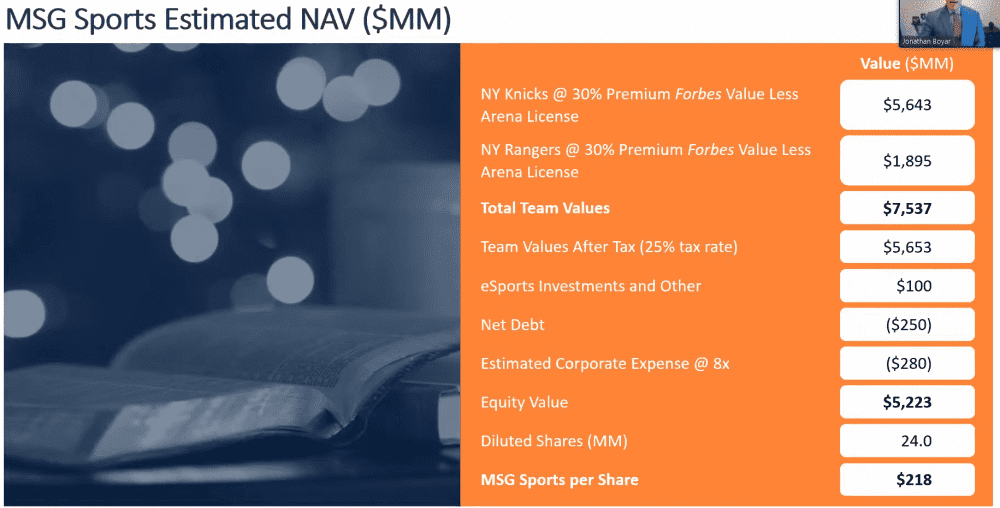

- MSGS:

- At current valuation you are paying for the Knicks (not even) and getting the Rangers for free.

- Tax angle: MSGS was structured as the parent so it can be sold at any time with out adverse tax consequences.

- MSGS was positioned as a return of capital story. Once pandemic concerns fade, will probably see capital returned to shareholders through dividends or buybacks.

- Estimate that ~75% of revenue is from recurring or highly recurring sources.

- Currently, MSGS generates $145MM annually from local sports rights. That number is expected to increase to $250MM in 2035.

- Think teams will ultimately be sold. Would be many billionaires who would want to buy Rangers/Knicks.

- States’ ongoing adoption of mobile gambling should continue to buoy the value of sports rights

- My thoughts:

-

-

- Estimate of MSGS Fair Value:

-

-

- My thoughts:

- I take a more conservative approach: Knicks: $4.6BN, Rangers: $1.65BN (in-line with Forbes).

- Boyar also assumes a 25% tax on the value of the franchises, but my understanding is that there would not be taxes associated with the sale of the Knicks or the Rangers because the sports company was structured as the Remainco.

- The nice thing about pro sports franchises is I expect them continue to grow in value over time, so if MSGS stays where it is, the discount to fair value will only grow.

- My thoughts:

Leave A Comment