Thryv Holdings (THRY) Notes

1/11/2021 Update

- Good article laying our the bull case

- 2 companies.

- 1 bad company that is in secular decline.

- 1 SAAS company that looks cheap.

- John Paulson is pushing for the company to spin off the good company.

- Bad business is $1.1BN in revenue declining 20% per year. Yellow Pages.

- 2 companies.

- Management:

- The company is run by Joe Walsh. He owns over 6% of the company via call options. So, it’s fair to say that he wants to see the stock do well. Previously, he built a competitor to the Yellow Pages, sold it to a larger company, then grew it more, then sold that to a public company.

- John Paulson asked about potential spin-off:

- Whole company is being valued right now on cash that its generating.

- Thryv will be the platform that many businesses uses to run its business. Going to be a great asset.

- Not too concerned that value is not being recognized right now.

- Probably is a time out in the future when it may make sense to separate these businesses. Two businesses benefit tremendously from being together.

- Not overly concerned that haven’t crystalized that future value today.

- Just want to build a company that is really helpful for small businesses.

- Think there will be a re-rating when growth is recognized.

- Honestly probably grew too fast for a while. Sold to some customers that probably shouldn’t have sold to. Took a while to work those off.

- Now have a tight client profile. Know exactly who they should sell to.

- Probably is a benefit from separating these businesses. But his prediction is the companies will benefit from being together over the next couple of hears.

- Paulson pushed back and said spin-off shouldn’t happen tomorrow but should happen within the next year. He owns 10% of the stock.

10/8/2020 Update

- Good Barron’s article highlighting Thryv Holdings (THRY). Notes from article:

- Yellow pages publisher and cloud-based marketing services company.

- Started trading on Thursday via direct listing.

- Why direct listing?

- No need to raise cash.

- Profitable and generates plenty of cash to fund operations and growth.

- Didn’t want to pay millions in fees and dilute insiders through issuance of more shares.

- Thryv was created in a 2017 merger between “Dex Media, a Yellow Pages publisher that filed for Chapter 11 bankruptcy protection in 2016, and YP Holdings, another Yellow Pages publisher.”

- Thryv is almost 60% controlled by Mudrick Capital, a distressed debt investor that had been a creditor of Dex Media. Other institutional investors own 32% of the company.

- Most of revenue is generated from its marketing services segment, which includes print Yellow Pages, Internet Yellow Pages sites (Yellowpages.com, Superpages.com, Dexknows.com, etc.) and search marketing services.

- 2019: $1.4BN in revenue (down 20% from 2018), $35.5MM in profit.

- 1H 2020: Revenue of $622MM (down 18% y/y), but profit rose to $39.6MM from $37.8MM.

- How the company should be viewed according to the CEO:

- Two compatible parts:

- The large but shrinking marketing services business (Yellow Pages).

- Generates tons of cash which fund investment into SaaS business.

- A faster growing, cloud-based, business providing digital platforms for over 40,000 small businesses.

- Has been growing ~30% per year.

- Cloud business has accelerated due to the pandemic. Interesting claim because S-1 says “SaaS” revenue growth has been basically flat in 2020.

- The large but shrinking marketing services business (Yellow Pages).

- Two compatible parts:

- Here is the company’s prospectus (S-1) which it filed to go public.

- Here is the company’s analyst day slide deck.

- Some notes/observations:

- Seems like a name to watch.

- On the margin, I’m cautious as majority of its business is in secular decline and they may be overselling their “cloud” component. It’s not a big enough driver to move the needle yet.

- Also, it has significant debt which is a problem for a business in secular decline.

- On the positive side, the business generates a ton of free cash flow. It generated $244MM of free cash flow in 2019 and generated $85MM of FCF through the first half of the year (or $170MM annualized).

- As of 6/30/2020, the company had 30,829,14 shares outstanding. At its current price of $11.10, it has a market cap of $342MM. So it’s trading at a free 2x free cash flow. Seems very cheap, even for a company in secular decline.

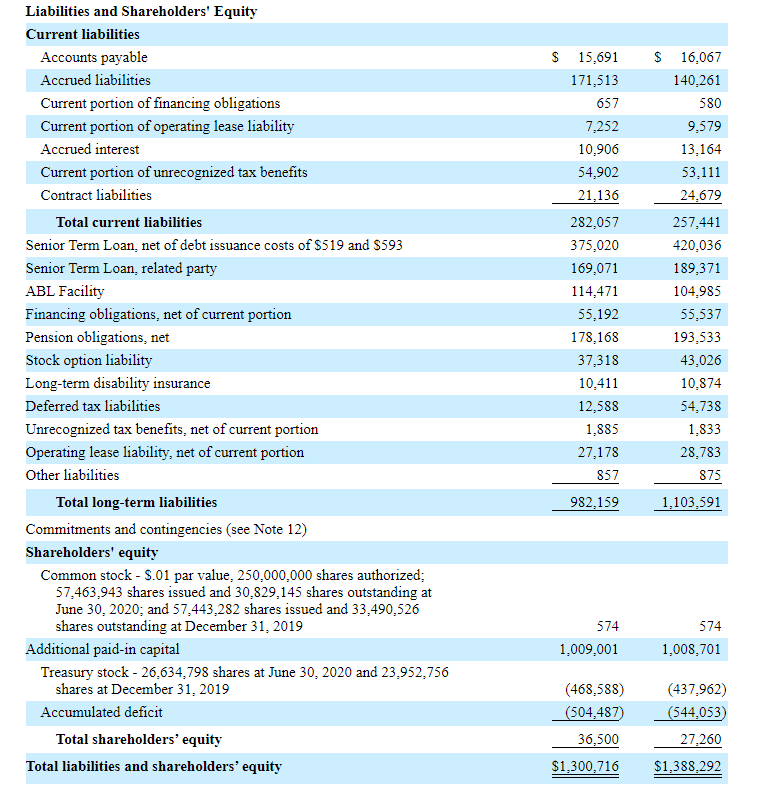

- It does have significant debt. Here’s a snapshot of its liabilities.

-

- The company has ~$836MM of debt/pension obligations.

- As such, the company has an enterprise value of ~$1,178MM.

- Adjusted EBITDA during the first half of 2020 was ~$231 or ~$462MM. Thus, it’s trading at 2.5x adjust EBITDA. Again, it looks cheap.

- I will continue to dig into the company, but it usually doesn’t pay to invest into businesses in secular decline even at a cheap price. If I can get an insight that the “SaaS” business is actually growing and differentiated, it might be worth an investment.

Leave A Comment