TechnipFMC Spin-off Notes

January 14, 2020 – Update

- TechnipFMC (FTI) announced that it is will proceed with the spin off that had been previously delayed.

- The Spinco will be an engineering and construction company focused on the liquid natural gas market (they construct liquid natural gas floating processing facilities both onshore and floating).

- It generates ~$6BN of sales.

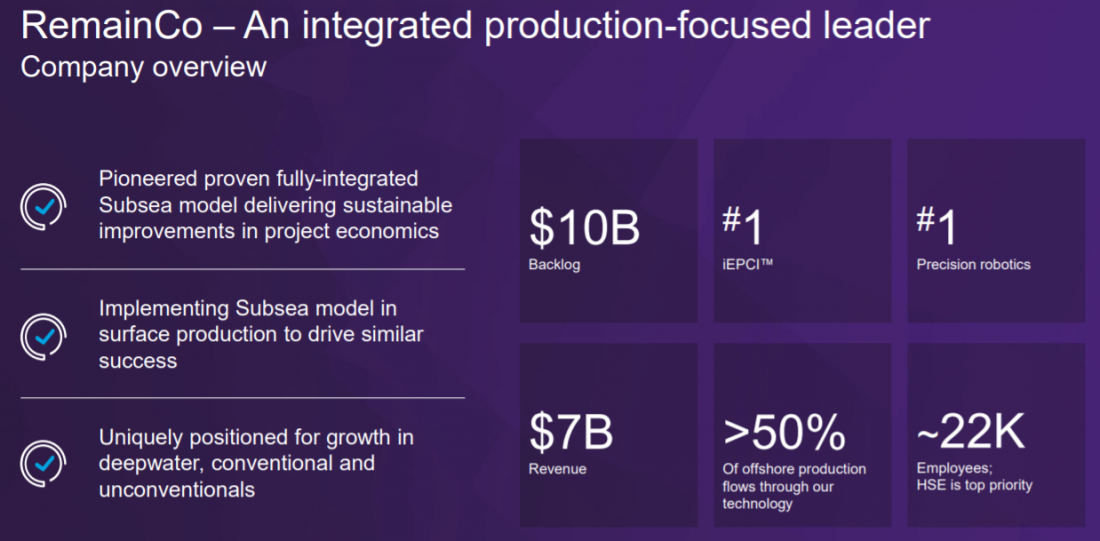

- Remainco will be a offshore oil and gas services provider.

- It currently generates $7BN of sales.

- This transaction isn’t too interesting to me for a couple reasons:

- 1) both businesses have pretty low margins

- 2) they are both in the cyclical energy industry (lesson learned!)

- 3) both companies will be relatively equal in size, so there will not be any indiscriminate selling.

- However, of the two businesses, I think the spin-off will be more interesting given its exposure to the growing liquid natural gas market.

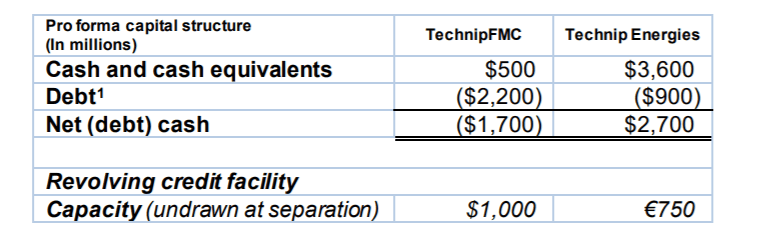

- Also, the spin-off is going to be capitalized with $2.7BN of net cash which is quite significant.

October 22, 2020 – Update

From quarterly conference call:

Sean Meakim

Got it, thank you for that. I appreciate that explanation. And then I think the other really critical piece for the stock today is getting to a resolution on Technip Energies. And so clearly, Doug, you know, your commitment to the spin has been unwavering. Can we maybe just get a little more transparency around the gating items to executing the spin? And are there any other dual tracks that you’re running around value creation with this business? Just looking to really, I guess get as much granularity we can on how we get to the finish line on that piece? Thank you.

Doug Pferdehirt

Certainly, Sean and thank you for the question. You’re absolutely right. I remain steadfast in my conviction to the creation of Technip Energies, as an independent company. The strategic rationale remains unchanged. And I would say, if anything, it has become clearer in the importance of moving forward with such a transaction.

I think it’s important though when we think about your question around what could be triggers, et cetera, is to reflect back on, you know, what led to the decision, a difficult decision at the time to defer the transaction. And that, you know, to me, there was really three factors that weighed into that decision. One was complete panic in the financial markets, driven by both the pandemic as well as the commodity price.

There was a lot of – secondly, there was a lot of uncertainty in our clients’ plans at the time. And then finally, it really came down to ensuring that we had an environment that was conducive to what I’d like to say us leaning in versus us leaning out in terms of our position within the industry.

So when we fast forward to today, certainly there’s still anxiety and uncertainty in the market, and there always will be. But I think we’ve come past that point of just a complete fear and panic and, you know, a concern about where the bottom could actually be.

In terms of the industry, I think it’s been quite remarkable. And as evidenced in our Q3 results here in the inbound numbers that we just shared with you for Subsea, if anyone’s done them, you know, had an opportunity to look at the math, it’s a 1.1 book to bill for the third quarter for Subsea, which was quite a substantial win and winning very important and strategic projects and 50% of those being direct awarded to our company. We’re in a really unique position.

And that really takes us to the third part, which is, you know, we’re leaning in, we’re winning. So when you kind of put those three together, I would say, we feel we’re in a very different environment than we were in at the time that we suspended, where we didn’t know what our customers plans are going to be, for instance, we weren’t sure what impact it was going to have on our backlog. I can reaffirm today there have been no cancellations at our backlog.

We didn’t know what impact it was going to have on our supply chain and our ability to be able to execute and deliver some of the world’s most complex and strategic projects. And as our financial results indicated across all 3 of our business segments, we continue to execute very well. So we’re in a different situation now, Sean. We’ll continue to look at what is the right timing and what is the right scenario and structure to move this transaction forward. But it would be our intent to continue to move in that direction.

April 22, 2020 – Update

From quarterly conference call:

Back in March, we also announced our decision to postpone the company’s separation into two diversified pure-plays. This was a very difficult decision, particularly given the latent stage of separation activities. However, the strategic rationale remains unchanged and we are fully committed to completing the transaction over the medium term. And to further emphasize this point, we have renamed the Onshore/Offshore segment to Technip Energies and have completed nearly all of the work required to ensure that the two companies are ready for separation when the markets sufficiently recover.

August 26, 2019 – Update

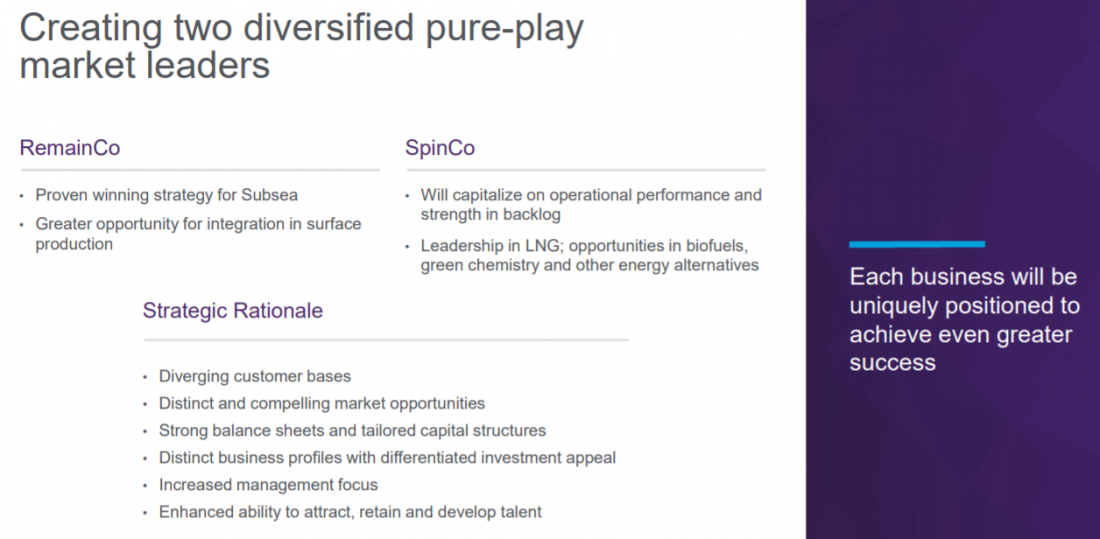

- On August 26, 2019, TechnipFMC (FTI), an offshore oil and gas services company, announced that it would be breaking up into two companies, reversing a merger from only three years ago.

- The Spinco will be an engineering and construction company focused on the liquid natural gas market (they construct liquid natural gas floating processing facilities both onshore and floating).

- It generates ~$6BN of sales.

- Remainco will be a offshore oil and gas services provider.

- It currently generates $7BN of sales.

- This transaction isn’t too interesting to me for a couple reasons:

- 1) both businesses have pretty low margins

- 2) they are both in the cyclical energy industry (lesson learned!)

- 3) both companies will be relatively equal in size, so there will not be any indiscriminate selling.

- However, of the two businesses, I think the spin-off will be more interesting given its exposure to the growing liquid natural gas market.

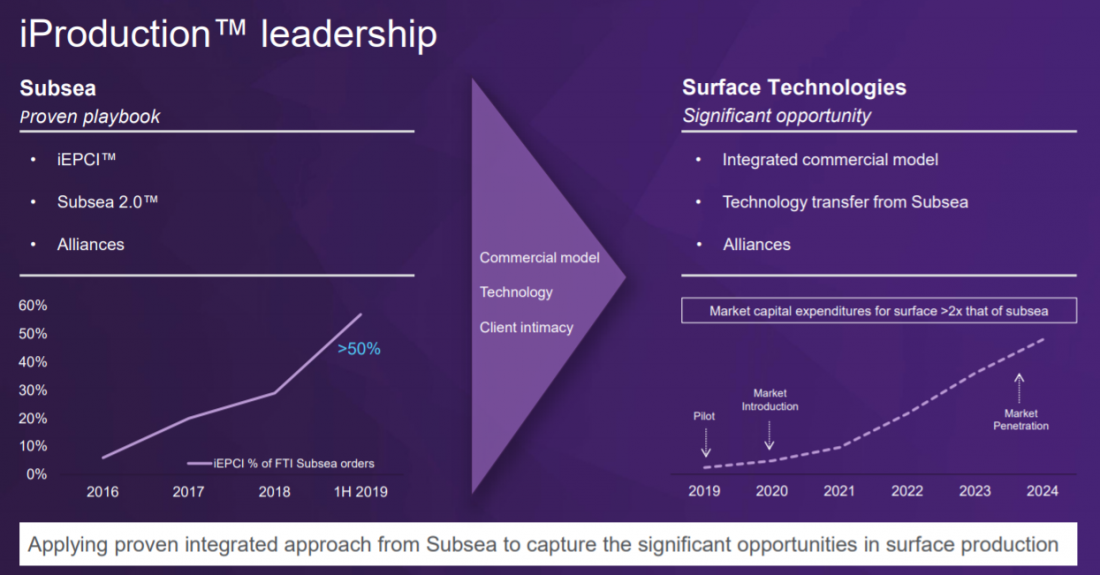

- Spin-off slide deck presentation.

- Select slides from presentation.

Leave A Comment