Tenneco Spin-Off Quick Summary – March 4, 2019

Resources from Tenneco

TEN 3Q18 Earnings Slide Deck – October 26, 2018

TEN Slide Deck at Wolfe Research Conference – January 16, 2019

TEN Slide Deck at J.P. Morgan Conference – February 25, 2019

TEN Spin-Off Press Release – April 10, 2018

TEN Acquisition Closure Press Release – October 1, 2018

Other Resources

With Or Without Federal Mogul, The Street Just Doesn’t Care About Tenneco Now – Seeking Alpha

Tenneco And Federal-Mogul Deal Points To Compelling Upside – Seeking Alpha

Icahn’s $5.4 Billion Exit Strategy Soothes Auto-Parts Retailers – Bloomberg News

Overview

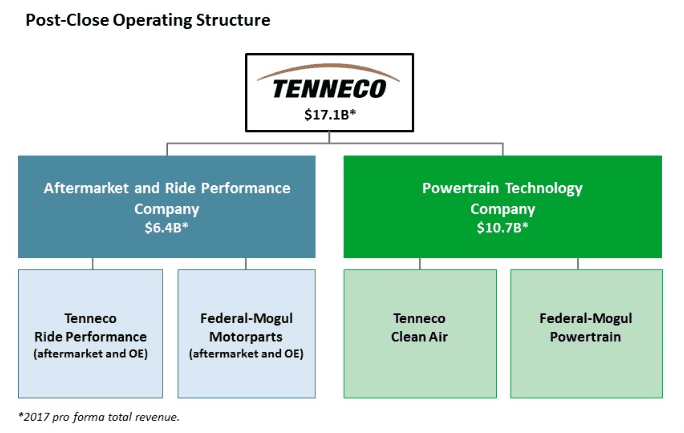

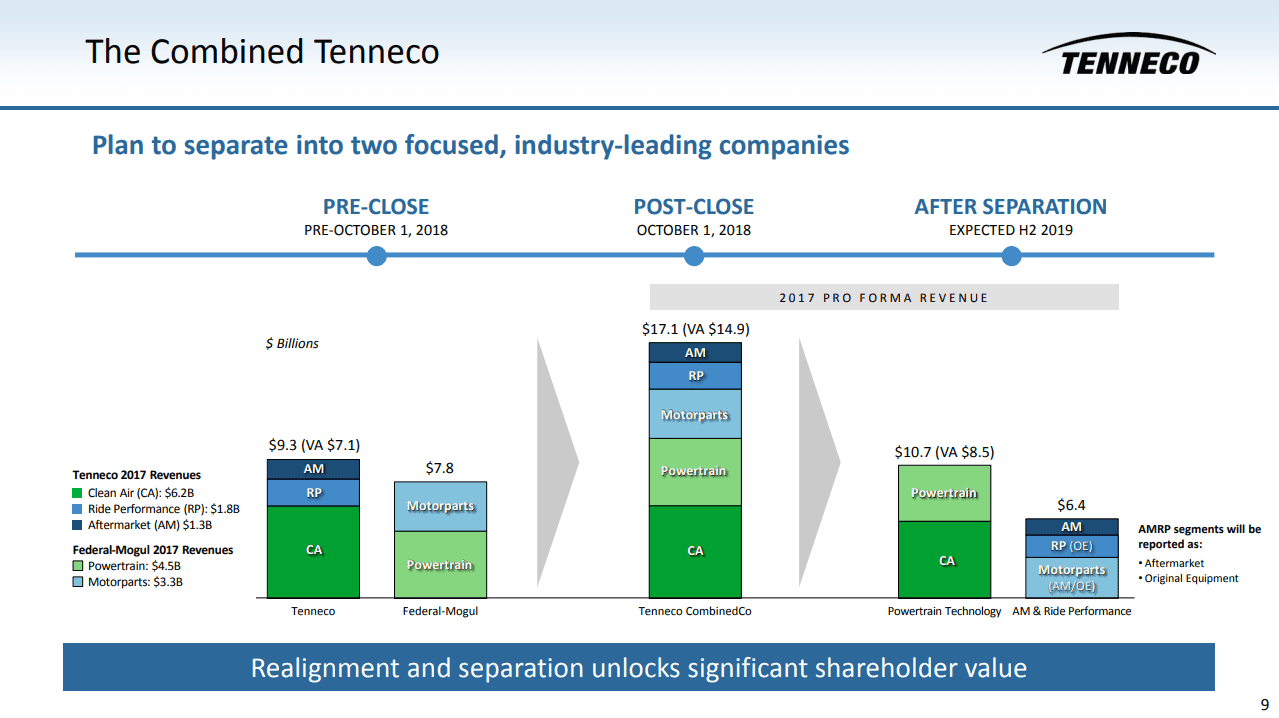

On April 10, 2018 Tenneco (TEN) announced that it intended to acquire Federal-Mogul from Icahn Enterprises with plans to then create two public, independent companies through a tax-free spin-off. The total transaction value of the acquisition, completed October 1, 2018, was $5.4BN funded through cash, Tenneco equity and assumption of debt. The spin-off, expected to take place in the back half of 2019, will establish an aftermarket & ride performance company, as well as powertrain technology company.

Tenneco is currently positioned as a market leader in the design, manufacturing, and distribution of Ride Performance and Clean Air products in addition to technology solutions for diversified markets. Federal-Mogul exists as a global supplier to original equipment manufacturers (OEMs) and the aftermarket.

The Aftermarket & Ride Performance company (DRiV) will be a combination of Tenneco’s Ride Performance business and Federal-Mogul’s Motorparts business. The company will serve both OEMs and the aftermarket. Management expected $6.4BN in combined pro forma revenue for fiscal 2017.

The Powertrain Technology company will be one of the largest pure play powertrain suppliers through the combination of Tenneco’s Clean Air product line and Federal Mogul’s Powertrain business, which will also serve both OEMs and the aftermarket. Management expected $10.7BN in combined pro forma revenue for fiscal 2017.

Background

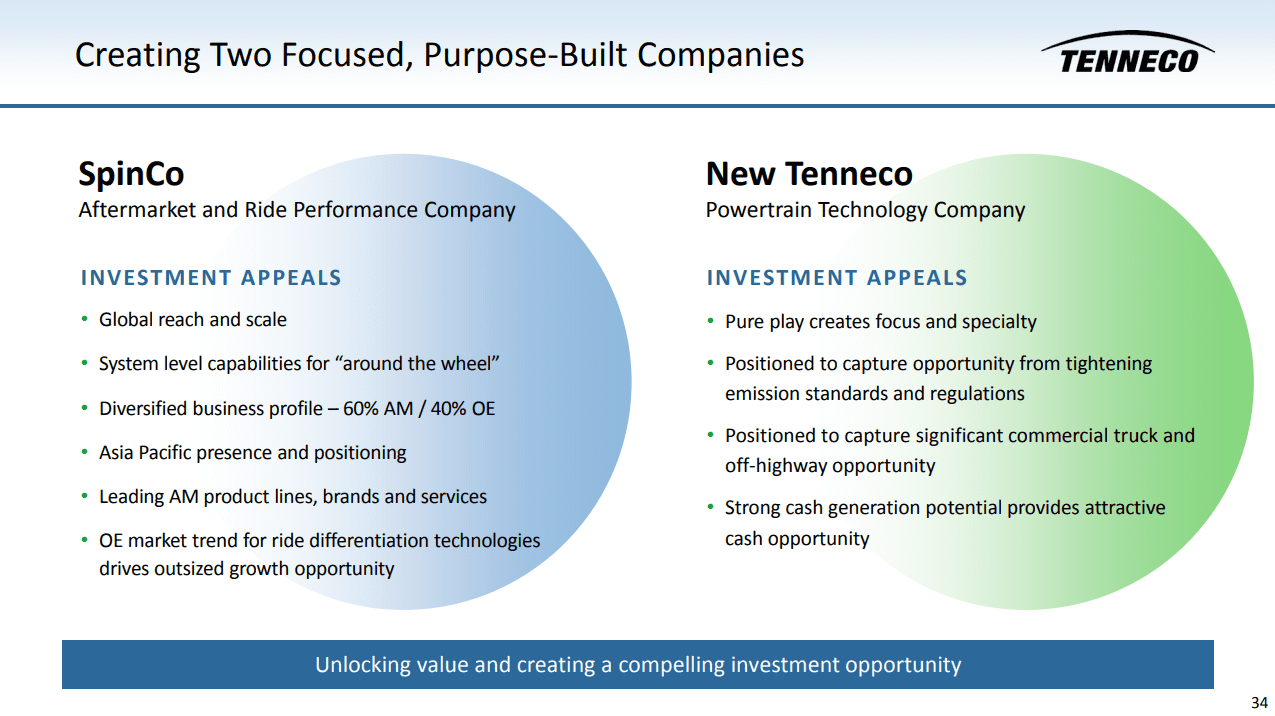

The spin-off is driven by Tenneco management and support from Carl Icahn, who outline four strategic rationales for the transaction. First, the spin-off allows each company the ability to be more focused leaders in their respective markets. Second, management believes increasing the scale of each company will benefit performance. Finally, it will both enhance each company’s ability to focus capital investments to drive growth, as well as provide investors with distinct investment opportunities with the creation of two different pure plays. Ultimately, management sees this as a way to unlock shareholder value by creating two pure plays.

Aftermarket and Ride Performance Company (“DRiV”)

The first new public company will encompass Aftermarket and Ride Performance. Tenneco announced that it will be named “DRiV”. Management states the the company will have broader aftermarket product coverage and stronger distribution channels, which should strengthen its position in high-growth regions such as China and India. Management also plans to capture opportunities within e-commerce in the aftermarket.

On the OEM side, the company will have a portfolio of braking and suspension technologies that are in high demand from manufacturers. Increased focus on comfort, safety, electrification, and autonomous driving should serve as demand tailwinds. It will be led by current Co-CEO of Tenneco, Brian Kesseler.

Powertrain Technology Company (“New Tenneco”)

Again, the powertrain technology company will be positioned as a pure play powertrain supplier through the combination of Tenneco’s Clean Air product line and Federal Mogul’s Powertrain business. Similar to the Aftermarket and Ride Performance Company, this will combine market leaders with the ability to innovate and meet changing needs of customers as environmental impacts draw more attention.

The company will focus on products intended to improve engine performance, as well as to meet pollution regulations and fuel economy standards. The company will also see demand tailwinds from hybridization and expanded global market opportunities. “New Tenneco” will be led by current Co-CEO, Roger Wood.

Also significant in this transaction is the partnership with Icahn Enterprises, which acquired Federal-Mogul in 2008. The firm expects to retain significant ownership of Tenneco (approximately 9.9%). Carl Icahn states, “I am very proud of the business we have built at Federal-Mogul and agree with Tenneco regarding the tremendous value in the business combination and separation into two companies. We expect to be meaningful stockholders of Tenneco going forward and are excited about the prospects for additional value creation.”

On October 1, 2018 Tenneco announced the closure of the acquisition of Federal-Mogul, preceding the planned spin-off. Deal terms consisted of $5.4BN through a combination of $800MN cash, 5.7MN shares of Tenneco Class A common stock (9.9% voting interest), 23.8MN shares of Non-Voting Class B common stock, and assumption of debt. Tenneco’s existing senior credit facilities were replaced with a $1.7BN term loan A, a $1.7BN term loan B, and a $1.5BN revolver.

Additionally, Keith Cozza, President and CEO of Icahn Enterprises, was added to Tenneco’s board of directors. In terms of valuation, Federal-Mogul was acquired at 0.75x EV/TTM Revenue and 9.2x EV/TTM EBITDA (according to Bloomberg). Immediately following the acquisition, Tenneco was levered to approximately 3.0x Net Debt/EBITDA, but targets 2.5x by the end of 2019.

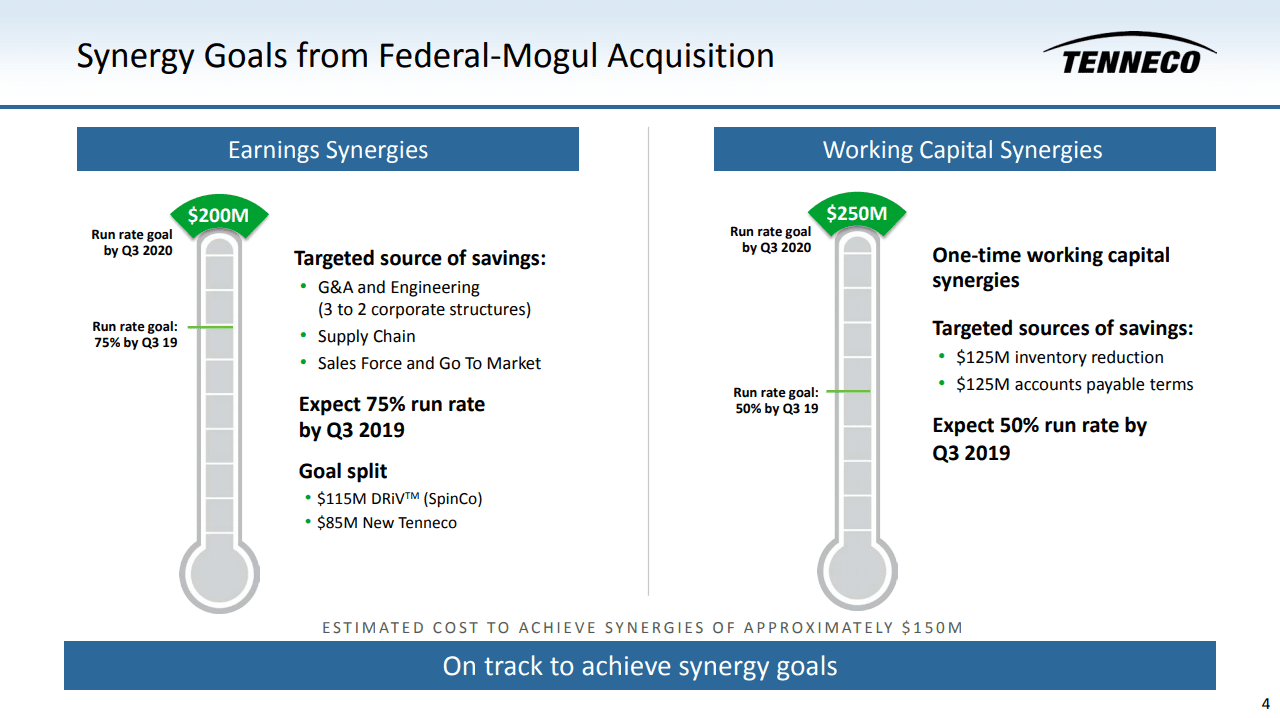

In terms of synergies, management expects a combined $450MN. These will be split between $200M in earnings synergies ($115MN DRiV and $85MN New Tenneco) and $250MN in one-time working capital synergies. These will stem from $125MN in inventory reduction, as well as $125MN in accounts payable terms. On the cost side, management expects approximately $150MN in savings, which should be incremental to margins for both companies.

Aftermarket and Ride Performance Company (“DRiV”)

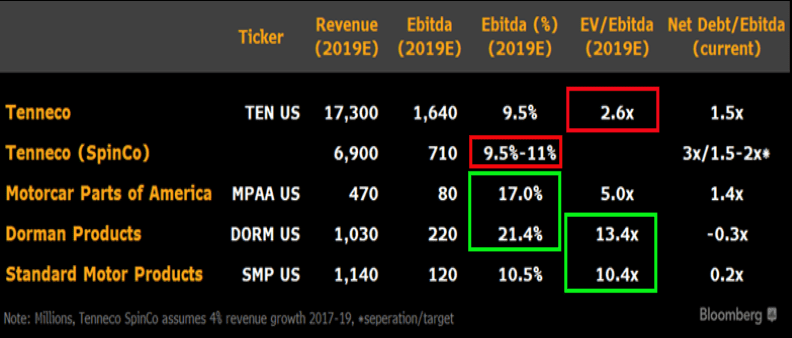

With respect to valuations for Spinco, the picture looks complicated due to margin weakness relative to peers, despite scale advantages. Below is a quick comp set from Bloomberg outlining this situation.

Powertrain Technology Company (“New Tenneco”)

According to Bloomberg, Tenneco (TEN) is currently trading at 2.6x EV/’19 EBITDA. After the spin-off, the remaining company appears to be most similar with BorgWarner Inc (BWA). BWA currently trades at a premium to TEN at 5.6x EV/’19 EBITDA. The new company could see some upward multiple re-rating, likely leading to upside. However, TEN’s lack of EV content and lower margins could cause a valuation gap, limiting upside potential.

Leave A Comment