Why Do Spin-offs Outperform?

While not every spin-off will outperform (I’ve learned this lesson the hard way), on average, they do quite well.

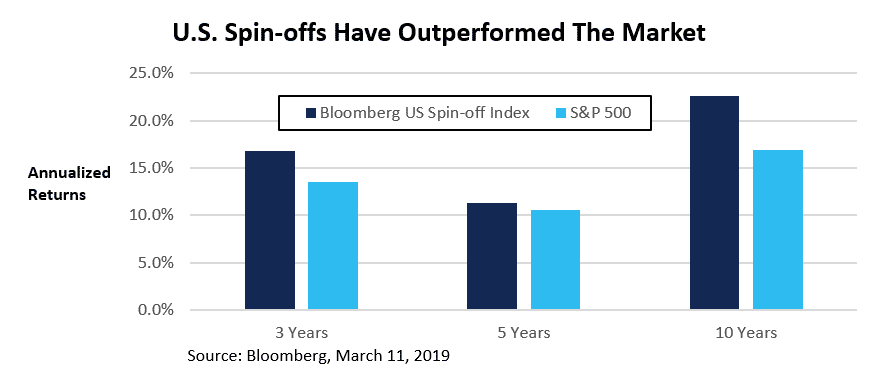

See below for long-term performance of Bloomberg spin-off Index vs. the S&P 500.

What drives the outperformance?

Usually stock spin-offs begin trading at a low valuation. This occurs for a couple reasons:

1) Spin-offs are distributed to investors (not sold like in an IPO) and so there is very little publicity regarding the new company. Generally, no or few analysts cover the stock and so it is not marketed to institutional investors. Further, the spin-off is usually much smaller than the parent company, and oftentimes, institutional investors are prohibited from owning shares in the spin-off. Let me explain. If a large cap mutual fund manager owns a large cap company which distributes a small cap spin-off, that mutual fund manager’s investment mandate prevents the manager from holding the spin-off. For these reasons, many investors sell their shares in the spin-off regardless of price or underlying value.

2) The management team of the new spin-off has very little incentive to promote the company initially. In fact, the management team is incentivized to not promote the stock. Why? Because management stock options are usually priced based on the first couple weeks of trading. The lower the stock trades initially, the greater value potential the options have.

And despite a very low initial valuation, spin-off companies tend to perform well. Why? Because “capitalism, with all its drawbacks, actually works” as Joel Greenblatt, famous spin-off investor, once wrote. Bureaucracy shrinks and entrepreneurial forces are unleashed. “The combination of accountability, responsibility, and more direct incentives take their natural course,” according to Greenblatt.

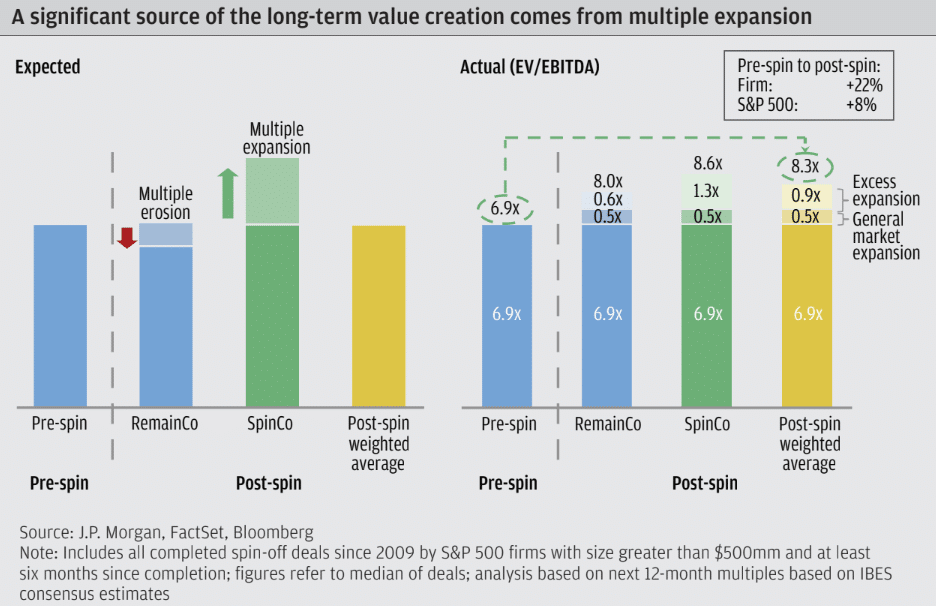

The combination of a low initial valuation and strong performance generally leads to a higher valuation and strong stock performance. J.P. Morgan looked at U.S spin-offs from 2009 to 2015 and found that the average valuation for spin-offs increased from 6.9x EBITDA to 8.6x EBITDA.

Source: J.P. Morgan

Any thoughts or questions? Comment below.

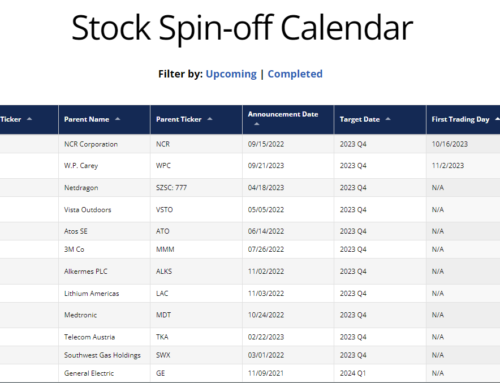

What does the updated research say on 3-year returns, post-spin-off for the spun-off entity?

Thanks for the questions, Joe. I will do some research and get back to you.

the last years comparision is s&P500 BEATS SPINOFF INDEXES BY A WIDE MARGIN.

CHECK IT OUT

You are right. The past year has not been a good one for spin-offs. however, over longer term periods, spin-offs continue to outperform.