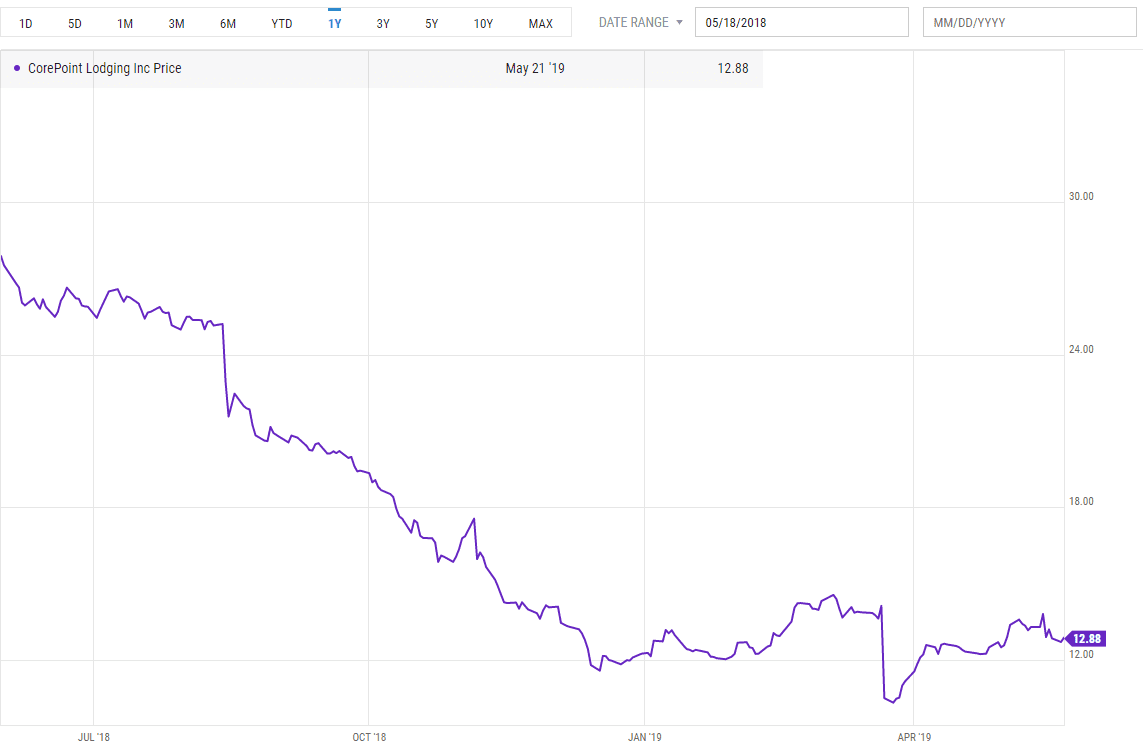

CorePoint Lodging is Down 50% – Is it a Buy?

Background (courtesy of Yet Another Value Blog):

La Quinta used to consist of two businesses: the La Quinta brand / franchise and the ownership of 317 La Quinta hotels. In early 2017 the company announced a plan to pursue a taxable spin-off that would split the owned real estate into a REIT and leave behind the high margin franchise / brand management business. In early 2018, the plan changed slightly: the company announced that they were selling the La Quinta franchise / management business to Wyndham, and concurrent with the sale they would spin off the REIT as a company known as CorePoint Lodging. The sale of La Quinta closed on May 31, 2018 and the CorePoint spin-off began trading the next day.

What Was Supposed to Happen

Taxable Spin-off

This was a taxable spin-off, and many speculated that management was low-balling the company’s potential. After all, they had an incentive to do so in order to minimize the tax payment that the company would be required to pay Wyndham. The other benefit of a taxable spin-off? There is no two year restriction on a sale of the company.

Earnings Upside

Pro-forma EBITDA for CorePoint in 2017 was ~$207MM. However, Hurricane Irma hit CorePoint Hotels hard in 2017. And 8% of owned rooms were out of service. Management estimated during the Q4 2017 call that the 2018 impact of hurricane would be $28MM to $35MM. EBITDA was expected to start to normalize in 2019.

Capital Investment Program

Between Q4 2016 and Q2 2018, CPLG spent ~$180MM on a renovation project. Assuming a 8.5% ROIC on that investment, it had the potential to add ~$15MM in annual EBITDA.

Synergies from La Quinta and Wyndham

Over time, La Quinta will be integrated into Wyndham’s systems. As a result the hotel will benefit from lower online travel agency costs (referral fees paid to Priceline, Kayak, etc.), cheaper advertising costs, and ability to market to other Wyndham loyalty customers. How much is that worth? I don’t know, but Yet Another Value Blog estimated $10MM which seemed reasonable based on his assumptions.

Adding it all up and you get $263MM in run rate EBITDA. Applying a 11x multiple, inline with peers, yields a $2,893MM enterprise value. Subtract $975MM of net debt, yields a $1,918MM market cap or $16.25 per share.

Further, the La Quinta franchise was being acquired for $8.40 in cash. So the total company looked like it was worth $24.65. In the months leading up to the spin-off, La Quinta was trading in the high teens, implying significant upside would be unlocked.

What Happened Next

The La Quinta acquisition closed and Corepoint (CPLG) began trading at $27.53 ($13.76 on a reverse split adjusted basis). So the thesis played out as expected.

But then guidance came out below investor expectations…

Q2 2018 Conference Call (August 2018)

- Management issued 2018 EBITDA guidance for $182MM (midpoint), significantly below 2017 pro-forma EBITDA of $207MM.

- Management noted $18MM to $22MM of hurricane related costs.

- Shares traded down ~8%.

Q3 2018 Conference Call (November 2018)

- Management lowered the midpoint of 2018 guidance from $182MM to $177MM due to weaker performance in certain Texas markets.

- Management noted that all properties that were impacted by the hurricane should be open by next year except for Fort Myers which will be open in early 2019.

- The 2019 EBITDA benefit from re-opening these properties will be $13MM to $17MM, not $18MM to $22MM because of increased operating costs and insurance premiums.

- Management expected a 2019 EBITDA benefit of $7MM to $9MM from repositioning of hotels.

- Shares traded down ~3%.

Q4 2018 Conference Call (March 2019)

- 2019 Guidance: $179MM (midpoint).

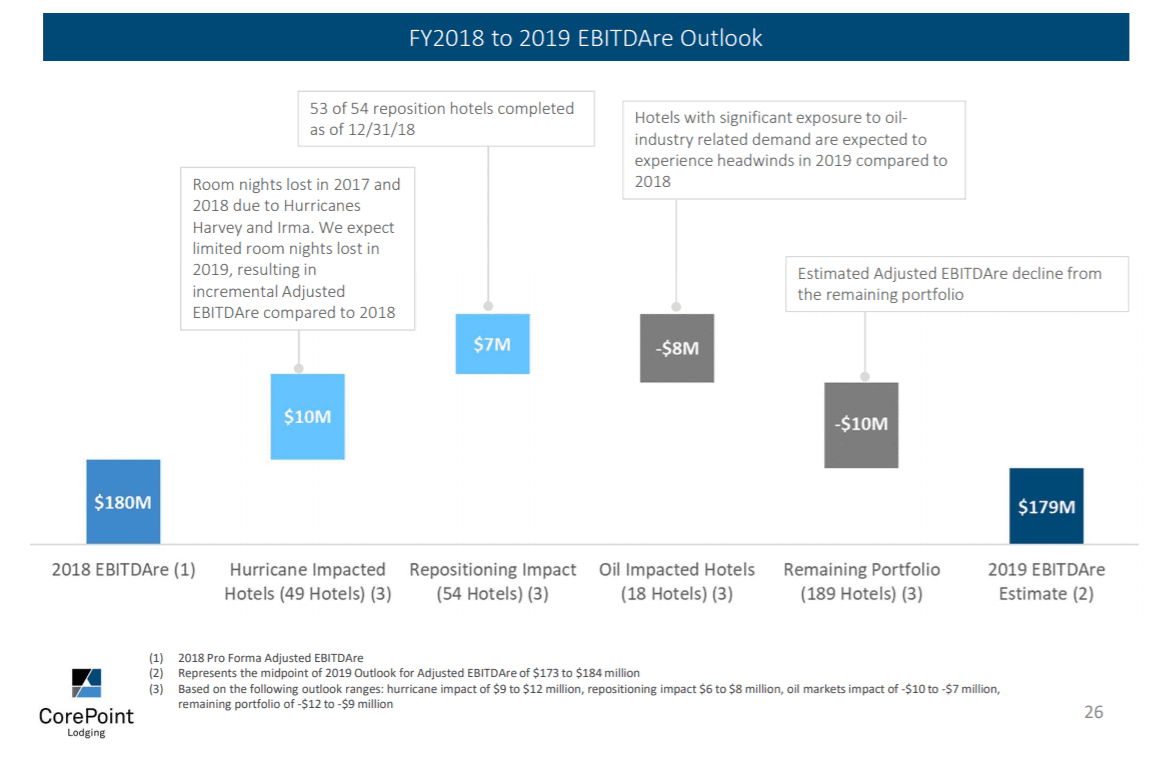

- Expect $10MM from hurricane impacted hotels coming back online and $7MM from repositioning.

- Hotels with significant oil related demand (West Texas) exposure are facing headwinds due to new supply coming online. Expect these hotels to decline by $8MM.

- For the remaining portfolio, expect EBITDA to decline by $10MM in 2019 due to operating cost pressures. Comparable REVPAR growth is tracking at 2.5%, but costs are more than offsetting that growth.

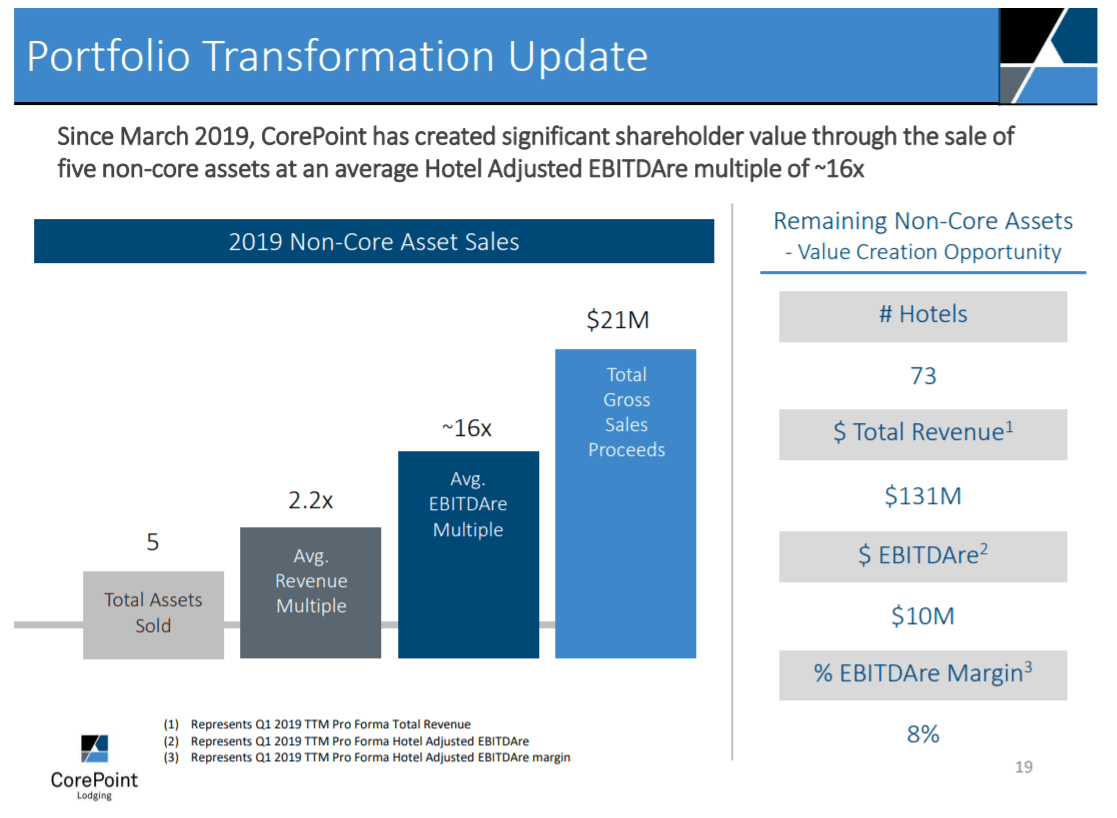

- Announced that a strategic review had identified 78 (out of 315) hotels that are non-core and lower margin. Will consider selling them. Note since this announcement, 5 non-core hotels have been sold.

- Shares traded down ~23%.

Q1 2019 Call (May 2018)

- Maintained 2019 EBITDA guidance of $179MM(midpoint).

- 54 hotel strategic repositioning program is nearing completion. Spent $230MM. Guided to $7MM EBITDA improvement from these hotels in 2019.

- Shares traded down ~7%.

In summary, Corepoint Lodging’s first year has been rough…

What Happens Now

The Bear Case

The slide below does a nice job of showing CPLG’s various headwinds and tailwinds for 2019.

Source: CPLG Slide Deck

CPLG currently has 310 hotels. 103 have been recently renovated (hurricane related repairs or repositioned hotels). The remaining 212 are facing headwinds. The oil related hotel headwinds are self explanatory, but the decline of the other 189 hotels is more concerning.

What is causing the EBITDA headwinds for these 189 hotels?

On the most recent call, management noted that operating expenses are higher than expected. In particular, management cited increases in payroll, property taxes, third-party travel agent commissions, and property insurance. The elevated property insurance is related to the hurricane impacted hotels. But I don’t fully understand the drivers of the other expenses.

The other big outstanding question is whether a portion of those remaining 189 hotels need significant capital expenditure in order to be repositioned for growth. Management has identified 73 (originally 78 – 5 have been sold) hotels as potentially non-core, but what about the remaining 116? If they will require significant capex, then the $230MM that was spent on repositioning the 54 hotels wasn’t growth capex but maintenance capex.

In 2018, CPLG generated $111MM in operating cash flow. It spent $167MM on capex. For 2019, let’s assume operating cash flow remains flat at $111MM. Management has given guidance that it will spend $70MM to $75MM of capex. This implies the company will generate $38.5MM of free cash flow in 2019.

However, if CPLG needs to make further capital investments to reposition 111 hotels, it could consume all operating cash flow for the foreseeable future (in 2016 and 2017, CPLG spent $144MM and $218MM of capex, respectively).

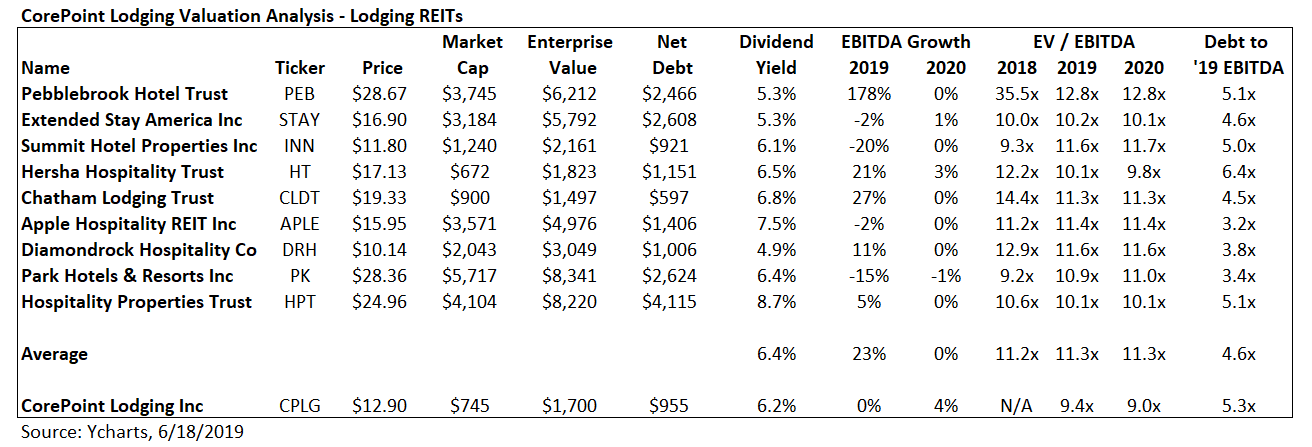

Further, we are late in the economic cycle and CPLG is an economically sensitive company with $1,031MM of debt and a 5.3x Net Debt + Preferred Stock / Adjusted EBITDA multiple. Importantly, CPLG’s debt has a 6 year average duration and so I’m not worried about bankruptcy in a recession.

We don’t have financials for LQ or CPLG during the Great Financial Crisis so it’s impossible to know how steeply EBITDA and revenue declined during the last recession. However, I looked through several other hospitality REITs to get a sense of how they performed. Hersha Hospitality Trust (HT) saw revenue decline by 25% and EBITDA decline by 63%. Diamondrock Hospitality (DRH) saw revenue decline by 26% and EBITDA decline by 46%. Hospitality Properties Trust (HPT) saw revenue decline by 13% and EBITDA decline by 63%. The comps aren’t perfect, but I think they are instructive.

The next recession probably won’t be as bad as the Great Financial Crisis, but hotel REITs (including CPLG), would still experience significant earnings declines. As a result, there would be significant downside for CPLG even assuming no multiple contraction.

The Bull Case

Let’s assume the same 2019 EBITDA headwinds/tailwinds remain in place for 2020:

- Positives:

- +$10MM from hurricane impacts hotels coming online

- +$7MM from repositioning efforts

- Negatives:

- -$8MM from new supply of West Texas hotels

- -$10MM from operating cost pressures

In addition, CPLG will benefit from being fully integrated into the Wyndham systems. The benefits will include lower online travel agency costs (referral fees paid to Priceline, Kayak, etc.), cheaper advertising costs, and ability to market to other Wyndham loyalty customers. Let’s assume that this could add $10MM of EBITDA (borrowing from Yet Another Value Blog).

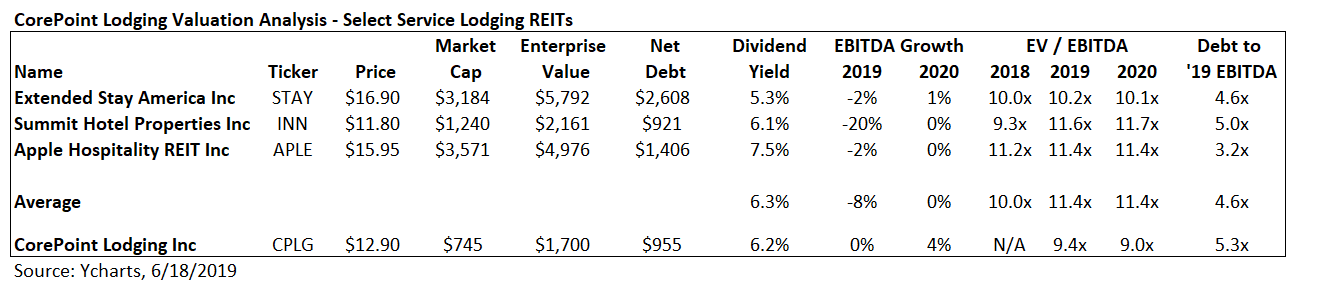

Taking these assumptions, CPLG could earn $188MM in EBITDA in 2020. This compares to consensus expectations of $189MM. If CPLG is able to generate $188MM of EBITDA in 2020, it will be notable as the company will be the fastest growing (it’s a low bar!) leisure REIT in its comp group (see below).

Relative Valuation

Compared to other lodging REITs, CorePoint looks cheap.

However, the best comps are CPLG’s pure play select service competitors, INN, APLE, and STAY.

If we isolate those comps, CPLG continues to look cheap.

Asset Sales

Another way to think about CPLG’s value is on an asset sale basis.

In the past two quarters, CPLG has sold 5 hotels, generating $21MM of gross proceeds.

As shown above, the asset sales have taken place at an average EV/EBITDA multiple of 16x and an average revenue multiple of 2.2x.

The hotels that were sold were non-core and as such, lower quality than the rest of CorePoint’s hotels. Nonetheless, let’s value the remaining portfolio based on the transaction multiples of the non-core asset sales.

In 2019, we expect CPLG to generate revenue of $881MM and EBITDA of $188MM. On a 2.2x revenue multiple basis, CPLG’s remaining hotels are worth $1,939MM. On a 16x EBITDA multiple basis, the remaining hotels are worth $3,000MM. Averaging the two methods, we get $2,473MM. Subtracting net debt of $985MM and we get an implied market cap and share price of $1,488MM and $25.61. This implies significant upside.

Let’s take a slightly different approach.

CPLG’s plan is to sell the remaining non-core hotels. If the hotels were sold at the same revenue multiple, they would generate $288MM of gross proceeds. If they were sold at the same EV/EBITDA multiple, they would generate $160MM of gross proceeds. Averaging the two approaches results in expected gross proceeds of $224MM. We can subtract 5% to account for transaction costs which results in net proceeds of $213MM.This will be used to pay down debt.

Net debt (including preferred equity) currently stands at $985MM. We can subtract the $213MM from net debt to arrive at an expected net debt number of $772MM.

We are expecting $188MM of EBITDA in 2020. The non core hotels are generating $10MM of EBIDTA so we need to subtract that from our 2020 EBITDA estimate which yields $178MM.

CPLG currently trades at 9.4x ‘19 EBIDTA. So let’s assume it continues to trade at the same valuation. This would imply a fair enterprise value of $1,673MM.

Let’s subtract $772MM of net debt to arrive at our expected equity value of $901MM or share price of $15.50 (58.1MM shares outstanding).

In both cases, it appears that there is upside.

Finally, Blackstone owns 29.4% of the company. The most efficient way for Blackstone to monetize its stake would be through a company sale. Furthermore, the spin-off was not a tax free transaction so there is no two year restriction on a company sale (most spin-offs are tax free).

It’s never a good idea to base an investment case around an acquisition. However, the possibility of a sale of the company is a clear positive.

Conclusion

While it does appear that Corepoint represents a solid value at its current price, I’m still not ready to recommend the stock. The stock is highly levered and in a cyclical industry. I will continue to monitor the stock and may recommend it if I see improving EBITDA and revenue trends. Insider buying would also be encouraging. Despite the large decline in CPLG’s share price, there has hardly been any insider buying.

What do you think? Is it a buy? Comment below.

I think the big issue is the fee load they pay is massive for their RevPAR profile. Agree it’s cheap, but those hotels aren’t making good NOI margins.

Thanks for the comment. I guess it’s a function of the company not focusing on the higher end segment of the market (like their select service peers). As a result, the fee load is disproportionately high.