Spin-off Links – December 2020

Recently Announced Spin-offs

XPO Logistics (XPO) recently announced that it will be spinning off its logistics business. Over the past year, management has been deliberating on how to unlock value given the company is trading at a discount. Management believes that by spinning-off the logistics segment, the structure of the conglomerate will be more simple and value will be unlocked through better understanding of the business. The spin-off will become the second largest logistics provider in the world and is the asset-light part of the business. The remaining company is a provider of less-than-truckload (LTL) and truck brokerage transportation services. Management believes that this remaining company will at least trade in line with peers, which they claim will be much higher than the company is currently valued at. The remaining company is similar to DHL and Old Dominion freight. The company currently trades at 11.8x forward EBITDA. Credit Suisse thinks the stock would be worth $179 if both parts were to trade in line with peers. The analysis looks reasonable to me. Here are my notes on the transaction.

International Paper (IP) announced that it will spin-off its printing paper business in order to focus the remaining company in industrial packaging. As a standalone entity, in addition to a portfolio of leading brands, SpinCo will have approximately $4 billion in sales, 8 mills with 2.9 million metric tons of annual capacity, and 0.4 million metric tons of coated paperboard capacity. SpinCo is not expected to initially pay a dividend and its dividend policy will be determined by its board of directors following the completion of the transaction. I am not a huge fan of the spin-off as the industry is in secular decline and IP will hold 19.9% of shares of the spin-off to sell at a later date, creating a spin-off overhang. The remaining company has $17bn in sales and is focused on industrial packaging. In 2019, industrial packaging and global cellulose fibers declined, which could potentially produce a turnaround story on the name. My notes can be accessed here.

New Residential (NRZ) announced recently that it has filed confidentially to IPO its mortgage origination business. Here’s a great article that summarizes the opportunity on the stock by Motley Fool. New Residential is primary a mortgage REIT or mREIT. The market is valuing New Residencial like a typical mortgage REIT on a price to book value multiple (0.88x). But it also has a mortgage originator. The market values mortgage originators at a multiple of earnings. Public mortgage originators include Rocket Companies (RKT: trades at 5.3x 2020 earnings), Pennymac Financial Services (PFSI: trades at 2.9x 2020 earnings), and Mr. Cooper (COOP: trades at 3.0x 2020 earnings). They trade at such depressed multiples because earnings are at a cyclical high due to the boom in new mortgage originations. New Residential decided to IPO its mortgage originator. Assuming the origination business trades at 3.0x 2020 net earnings of $667MM, it would be worth $1,969.5MM or 415MM ($4.75 per share). The origination business has a book value of $900MM or $2.17 per share. And NRZ is only getting valued at 0.88x of that $2.17 which works out to $1.90. So theoretically, NRZ could add $2.85 in value to the stock by IPO’ing the business. NRZ currently trades at $9.63. So this represents 30% upside. Plus NRZ pays a 6% dividend yield. Great WSJ article on non bank mortgage originators.

Recent Spin-offs

Recently, Aaron’s Holding (AAN) successfully completed the spin-off of The Aaron’s Co (AAN). The remaining company was renamed PROG Holdings (PRG). The spin-off (Aaron’s) is very cheap (8.0x FCF, 3.7x EBITDA) but looks unattractive to me. I’ve learned the hard way that it usually doesn’t pay to invest in businesses in secular decline. This week, I completed my deep dive (paywall) on PROG and have concluded that it looks interesting. PROG partners with third party retailers to offer a “Lease to Own” payment option. Since Aaron’s acquired it in 2014, Progressive has grown revenue by over 4x. Revenue and EBITDA at a 20%+ CAGR over the past 4 years. I see a massive runway for this business going forward. It has a tremendous opportunity to continue to grow.

Despite a rosy outlook, the stock trades at just 10.8x EBITDA. Looking out a few years, I think there could be considerable upside. Here’s a great interview where Osterweis Capital discusses the bull case form PROG Holdings.

Recently, Synnex (SNX), spun off Concentrix (CXNC), a global consumer experience (CX) solutions company. After completing my deep dive (paywall), I’ve concluded that Concentrix looks very interesting.

Over the past three years, the business has grown revenue and EBITDA at a CAGR of 33% and 36%, respectively, mainly through acquisitions but also through organic growth. The customer experience industry is defensive and benefits from secular tailwinds. Q4 revenue is expected to be at an all time high. Business is high quality with low capex requirements and a 66% “Greenblatt” return on invested capital. Concentrix is the number 2 player behind Teleperformance (French public company) yet the industry is fragmented and ripe for consolidation. Concentrix is an excellent acquirer. Concentrix is cheap on an absolute basis (12.6x free cash flow) and on a relative basis (9.9x ’20 EBITDA versus peers at 16.3x ’20 EBITDA). Concentrix’s best comp, Teleperformance, trades at 17.2x ’20 EBITDA.

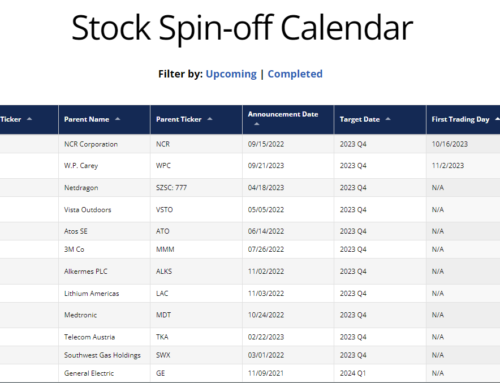

Upcoming Spin-offs

Constellation Software (TSX: CSU) announced back in September that it would spin-off Topicus.com. Constellation Software is a Canadian software company that grows by acquisition that has a great track record of returning value to shareholders. Constellation is primarily involved with vertical market software businesses that provide mission-critical software solutions. Topicus.com is a software company that provides vertical market software for banks, healthcare institutions, and education. Constellation shareholders will receive ~1.86 shares for every 1 share of CSU. I think the transaction is quite interesting although the structure of the spin-off is quite confusing. Constellation will retain voting control (via a single share with 50.1% of voting power) and given the quality of the company, I will keep looking into the name. Topicus.com was supposed to be spun-off in late November, but was delayed. However, management believes that the spin-off transaction will still occur later this year. Here are my notes on the name so far.

More Spin-off Links

Interview on LSYN Investment Thesis

Liberated Syndication Write-up from Pound the Rock

Osterweis Capital: Investment Case on Aaron’s and Progressive

Progressive Leasing: A Juggernaut Hiding in Plain Sight

Value Investor Club: BBX Capital

Greenlight Buys Synnex/Concentrix (SNX)

Dell Current Valuation on a Sum-of-the-Parts Basis

Vimeo raises $150M, while IAC is ‘contemplating’ a spin-off

Leave A Comment