2seventy bio: A Double with Downside Protection

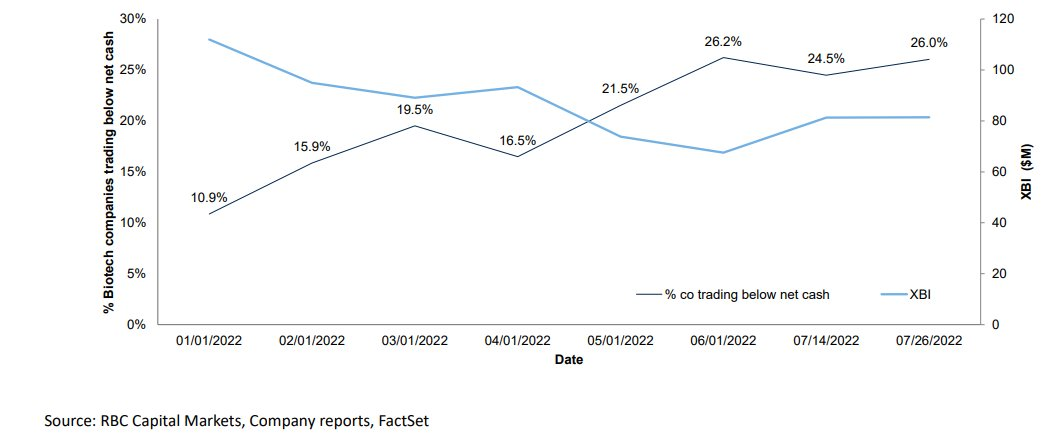

The biotech market is in a bear market and it’s been that way for a while.

XBI, the leading biotech ETF, is down 53% from its peak in 2020.

What is even more interesting is that a record number of biotechs are trading at negative enterprise values.

In other words, they have more cash on their balance sheet than their market cap. Theoretically, you could buy the entire company and pay for the acquisition with the company’s cash on its own balance sheet.

Here’s another chart showing the same thing…

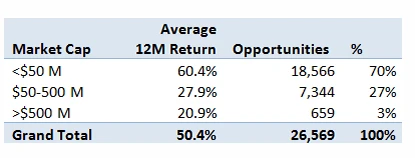

Typically, you will do quite well if you buy a basket of negative enterprise value stocks.

The CFA institute did a study and found that negative enterprise value stocks returned ~50% over a 12 month time frame between 1972 and 2012.

Broken Leg Investing did a similar study of negative enterprise value stocks between 1999 and 2016 and found that they generated a compound annual growth rate of 27%.

But there is a caveat.

Usually, most negative enterprise value stocks – especially in the biotech space – are burning a ton of cash.

I believe you would do quite well if you bought all negative enterprise value biotech stocks.

But betting on any individual negative EV biotech is a crapshoot.

That’s why my favorite biotech stocks are those with:

- A huge cash balance (no need to raise additional capital)

- An approved product with clear value

Introducing 2seventy Bio (TSVT)

TSVT was a spin off from Bluebird bio (BLUE) in December of 2021.

The rationale for the spin-off was to separate the company’s oncology assets into a new company (TSVT).

At the time of the spin-off, TSVT was well capitalized with significant cash and an approved product (ABECMA)

Nonetheless,the stock has sold off with the rest of the biotech market.

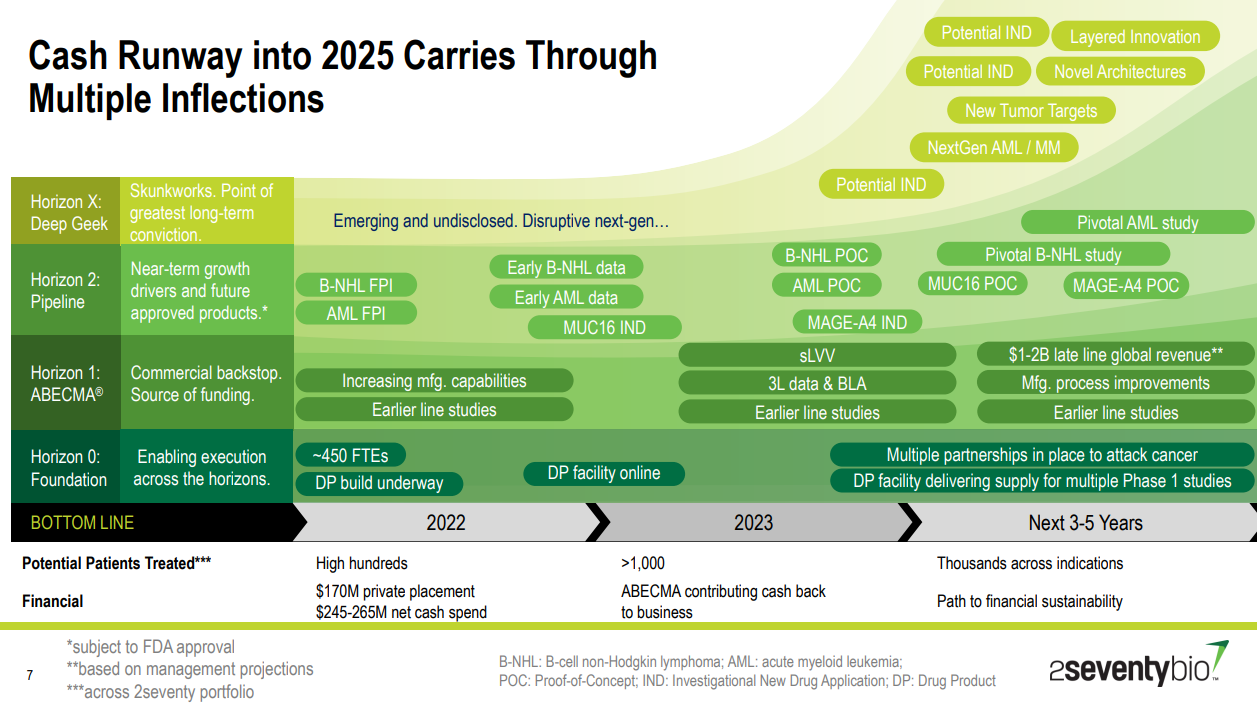

In March 2022, TSVT raised $170MM in a secondary capital raise at a $12.20 price.

The purpose of the capital raise to extend the company’s cash runway into 2025.

So where does that leave us?

TSVT Today

As of Q3 2022, TSVT has a market cap of $584MM.

It has cash of $323MM ($8.52 per share).

TSVT is not a negative enterprise value stock, but it has a large cash balance and will not have to raise cash until 2025 (as mentioned above).

It also has an approved product called ABECMA.

2seventy bio owns 50% of ABECMA and Bristol Myers (BMY) owns the other 50%.

ABECMA is a newly approved drug to treat multiple myeloma. The drug is currently only approved for 4th line of treatment, but it has a favorable efficacy and toxicity profile and will likely be moved up to early lines of treatment, increasing its sales potential.

ABECMA generated $107MM of sales in Q3 2022, representing 59% growth y/y and 22% growth q/q.

What is ABECMA worth?

ABECMA is currently generating $428MM in sales on an annualized basis with 59% annualized growth.

Typically, biotech drugs are sold at a minimum sales multiple of 3x.

Let’s just assume a 2.5x multiple to be conservative.

ABECMA is worth $535MM ($428 x 2.5 x 50%) or $14.11 per share today.

But the expected growth of ABECMA makes TSVT even more exciting.

Industry experts expects ABECMA to hit sales of $1.5BN by 2026.

Let’s be conservative and assume 2026 sales of $1BN.

In this scenario, TSVT will be worth $1.25BN ($1BN x 2.5 x 50%) or $32.96 per share.

TSVT trades at $16 today.

Putting it all together

Assuming zero value for TSVT’s pipeline, the stock is worth $23 today (ABECMA value $535MM + cash of $323MM).

Looking out to 2026, the stock is worth $42 (ABECMA value $1.25BN + cash of $323MM)

The best part of this setup is the downside is limited because TSVT will not have to raise cash until 2025.

Thus, the pipeline is like a free call option.

Finally, TSVT was a tax free spin-off meaning that it can’t be acquired for two years without triggering adverse tax consequences.

The two year anniversary of the spin-off is November 2023.

If its stock price stays depressed, TSVT will be a potential acquisition target for BMY or another large cap pharma.

How to Play It

While you could just buy TSVT stock, I think there’s a better way to play it through options.

Last month, I launched SSI: Ultra Options Advisory.

TSVT was our second recommendation.

Bruce and I recommended a strategy which enabled the following:

- Generate current income (100% annualized yield).

- Opportunity to buy the stock at a discount to its current price.

If this sounds interesting to you or you just want to learn about options, you should sign up.

Worried you won’t be able to follow along?

Have no fear. Bruce walks through each idea in painstaking detail, and both he and I are available to answer questions.

Finally, we are offering a 30 day 100% money back guarantee if you are not satisfied.

Hi Rich,

Thank you for a very interesting idea! Having looked through some of the negative EV pharma/biotechs out there it appears quite a few are COVID vaccine plays and are unlikely to get to a commercialized product given the sheer speed of technology development in the vaccine space. Likely the best value decisions some of those companies could make is to wind down, but experience tells me they won’t.

If I have to try to temper my optimism for 2seventy Bio it would be either:

1. Cell therapy has a very different margin profile when compared to small and large molecules

2. Track record of Bluebird Bio

Oncology is still a very hot field and the subcategory haeme onc is probably even hotter. It wouldn’t surprise me if this company ended up being acquired by a company wanting to build out their oncology franchise with little regard for deal economics or product economics (I’m looking at you GSK and Gilead).

Any thoughts on the secondary? I didn’t catch why they raised in press release, esp because it seemed they had enough until 2025.

Yes. The dilution is a bit annoying. Especially because the company has said that it has cash run way through 2025. But on the other hand, I don’t mind them raising cash when they don’t NEED to. Seems like there is strong institutional support from investors. By raising cash now, they avoid a situation where they need to raise cash they enter a dilution death spiral (many biotechs are in the this situation now).

Guidance for ABECMA is $520MM of revenue next year ((+73% growth).

Further ABECMA is expected to generated $200MM to $300MM of ooerating income in 2024 and 2025.

So the company is becoming self funding.

Currently, the company has about $9/share of cash (with the latest raise).

If you valued ABECMA at 2x revenue (I think this is reasonable/conservative), it is worth $500MM to TSVT or $10.66 per share. Add it all up and the stock is worth ~$20. And then there’s upside from there…

Peak sales guidance is $2BN to $3BN.

And TSVT can get acquired in December 2023 (2 year anniversary from its spin off). Seems like an obvious acquisition candidate for BMY or REGN who recently invested $20MM at a share price of ~18 per share.

So I think the value is definitely there.