6 Rules for Options Success

In a few weeks, we are going to launch an options advisory service.

I’m extremely excited to have partnered with Bruce Harper, an options expert, to lead the advisory.

Bruce Harper, CFA, has been trading options personally and professionally for over 30 years. He has worked in multiple Treasury and Corporate Finance roles for Fortune 500 companies.

He graduated with a degree in Econometrics from Stanford University and earned his MBA in Finance from UCLA.

I’ve personally known Bruce for 4 years and couldn’t be more excited for him to lead our options advisory.

I asked Bruce to share his trading philosophy.

Without further ado, here’s Bruce…

1. Whenever possible be the Casino, and NOT the Player

To me this means:

- As much as possible, get paid option premiums OR reduce/avoid the cost of paying premiums;

- Exploiting the Law of Large Numbers; seek out trades where the probabilities are in my favor;

- Spreading my bets out as much as reasonably possible, seeking diversification in both types of strategies and in the choice of underlying stocks;

- Risk management: streaks happen, so make sure I can survive multiple trades moving against me at one time;

- Time only moves in one direction; make sure that my trades benefit from positive theta (positions that increase in value as time to expiration shortens), or that I build enough time in the trade to allow the catalysts that I am expecting to happen

2. Our Principal Objective is Exposure to the Underlying Stock

Let me be very clear: I am NOT trading options in the hopes of getting lucky betting on the direction of volatile stocks. While we could have launched a service for speculative trading, that wasn’t what I nor Rich were looking to do when we came up with the idea for SSI: The Options Advisory.

Rather, this service is focused on smart strategies to increase our exposure, and potential returns, from stocks we positively WANT to own. We are using options to efficiently effect that exposure, by insuring that we are either:

- Paying (much) less that purchasing the stock outright at the moment;

- Creating an income stream from ownership of the stock or option – getting paid while we wait for the catalysts that we are expecting;

- Hedging against a decline in the price of stock, to protect an existing position or paper profits that have been earned so far

At the end of the day, the ultimate success of the strategies will depend heavily on the performance of the underlying stocks. Let me be very clear about this: No strategy is profitable 100% of the time and no matter how conservative the strategy, if the price of the underlying stock declines enough, the trades will lose money. As the bear market of 2022 has shown us, options can never completely offset being wrong about the direction of a stock.

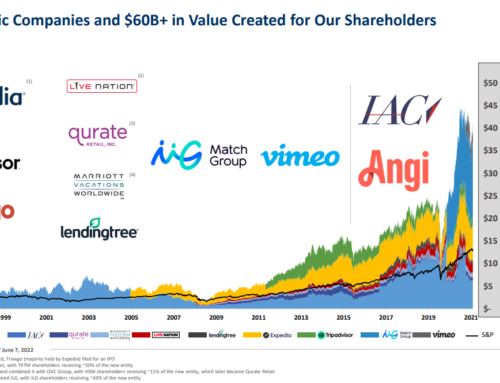

That’s precisely the reason that Rich and I believe that an options advisory service focused on the stocks that his fundamental research uncovers as part of Stock Spinoff Investing makes so much sense. We have strong convictions about their intrinsic value, and his performance track record speaks for itself.

Your level of conviction in the underlying stock is important. If you are not already convinced that the stock at its current price represents a worthwhile investment, you should remain skeptical that the options trade will be a good use of your risk capital.

3. Options are a Form of Leverage and Involve Risk: Always Practice Responsible Position Sizing.

Mathematically speaking, options have a lot in common with buying stocks on margin. Less money up front, but a greater percentage profit or loss in your capital invested based on the movement of the stock price.

Even though it’s the strategy most associated by retail investors, and online forums such as Reddit wallstreetbets, using options to speculate on directional price movements in volatile stocks is irresponsible as an investment strategy, and makes as much sense (and has the same probability of success) as taking out a loan to fund your next gambling spree.

To use a Las Vegas analogy, I would rather have a lot of smaller bets where the odds are predominantly in my favor (the Casino), versus one large bet with unfavorable odds, regardless of the payoff size (the Player).

No matter how mouthwatering the payoff sounds, or how much conviction you have that the catalysts for the stock will come to fruition, never risk any amount more than you would be willing to lose on a proportionate long position in the stock.

4. Avoid Binary Payoff Structures in Favor of Staggered, Asymmetric Ones

With all due respect, long only Puts and Calls are just glorified lottery tickets. They are binary because there are only two states: either the stock price is above the strike, or it isn’t.

Just as most people play the lottery despite knowing the odds are astronomically stacked against them, there’s a certain segment of option traders for whom the activity is just a means to getting their online gambling fix with a glossier veneer of complexity and sophistication, no different than playing on Draft Kings or in Daily Fantasy leagues. This doesn’t mean people can’t hit it big betting on deep Out of The Money calls and puts, but that’s not what we are trying to do.

In contrast, asymmetric payoff structures are ones that we would have to be a little unlucky to LOSE money and, even under the worst of circumstance, can ensure that our maximum loss can be strictly limited. When we make money from asymmetric structures, it will hopefully seem pretty boring, and so inevitable that it will be almost anticlimactic.

5. Get Paid Today and Get Paid Tomorrow

The one repeating pattern that you are likely to see in almost all the trades that I recommend, is an income generation component, usually in the form of selling option premium. As I aspire to be like the Casino, and not the Player, I am constantly looking for opportunities to put income in my pocket – both as a means of lowering the cost of options that I want to be long, and to just generate cash that will provide an immediate return in the present. Wherever possible, I try to create regularly recurring income sources, to turn the options that I own into cash generating machines over time, while maintaining the flexibility to also enjoy the capital gains that result when the catalysts I am expecting do come to fruition.

6. At the End of the Day, Only My Cash Returns Really Matter

I’m sure that no one finds the statement above, as written, controversial or in the least bit objectionable. Everybody is happier, ceteris paribus, if their brokerage accounts have a higher cash balance after a trade than before, right?

Nonetheless, remembering that “cash is king” is a helpful north star that will guide us as we contemplate trades.

TL/DR: I am looking for multiple trades in high conviction stocks where the statistical edge and direction of cash flow generation are in my favor. I know that some trades will not work out, but by having time and probability on my side, as long as the stock picks are good (I will leverage Rich’s recommendations), these strategies are proven to result in solid profitability over the long term.

I think the options advisory service will add tremendous value to Rich’s spin-off service. Can you tell us what is the recommended capital needed to trade these strategies? Thanks.

Thanks Nelson! To start $5K to $10K will be adequate!