How to Buy Your Favorite Stock at a Discount

One of my favorite strategies for adding to a favorite stock is by selling puts.

When you sell a put, someone is paying you cash today to buy a stock below its current price.

What’s the catch?

You must genuinely want to own the stock and be prepared with available cash to purchase it if it falls below the exercise price upon expiration.

Remember, never sell a put on a stock you wouldn’t be happy to own!

Today, I’m going to walk through two examples of how I executed this strategy and why I thought it was a good idea

Jackson Financial (JXN)

Jackson Financial financial is a name that I’ve followed closely since the time it was spun off from Prudential PLC.

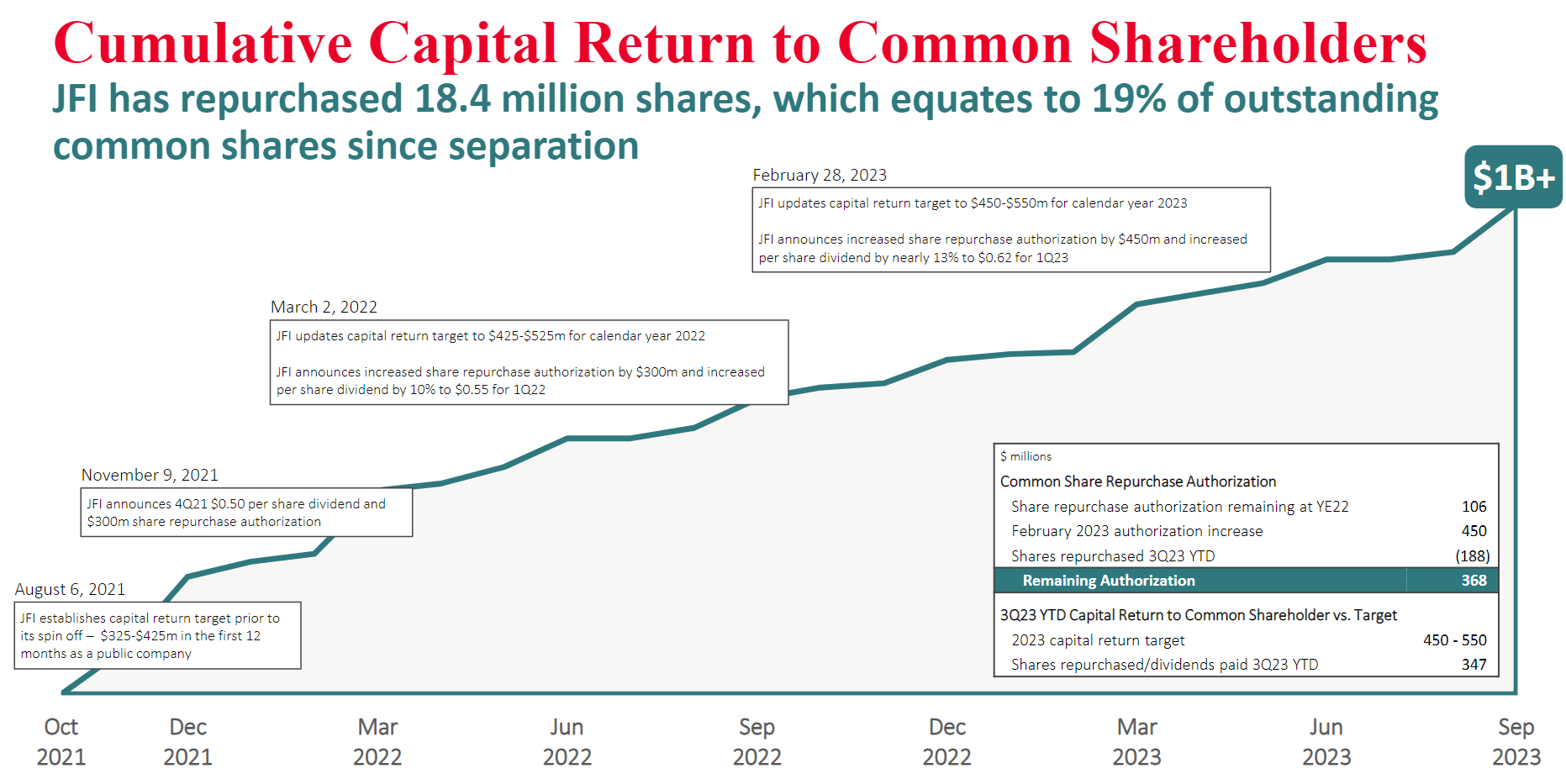

Jackson specializes in variable annuities, and while it’s not the sexiest business in the world the company generates gobs of cash and has been consistently returning cash to shareholders.

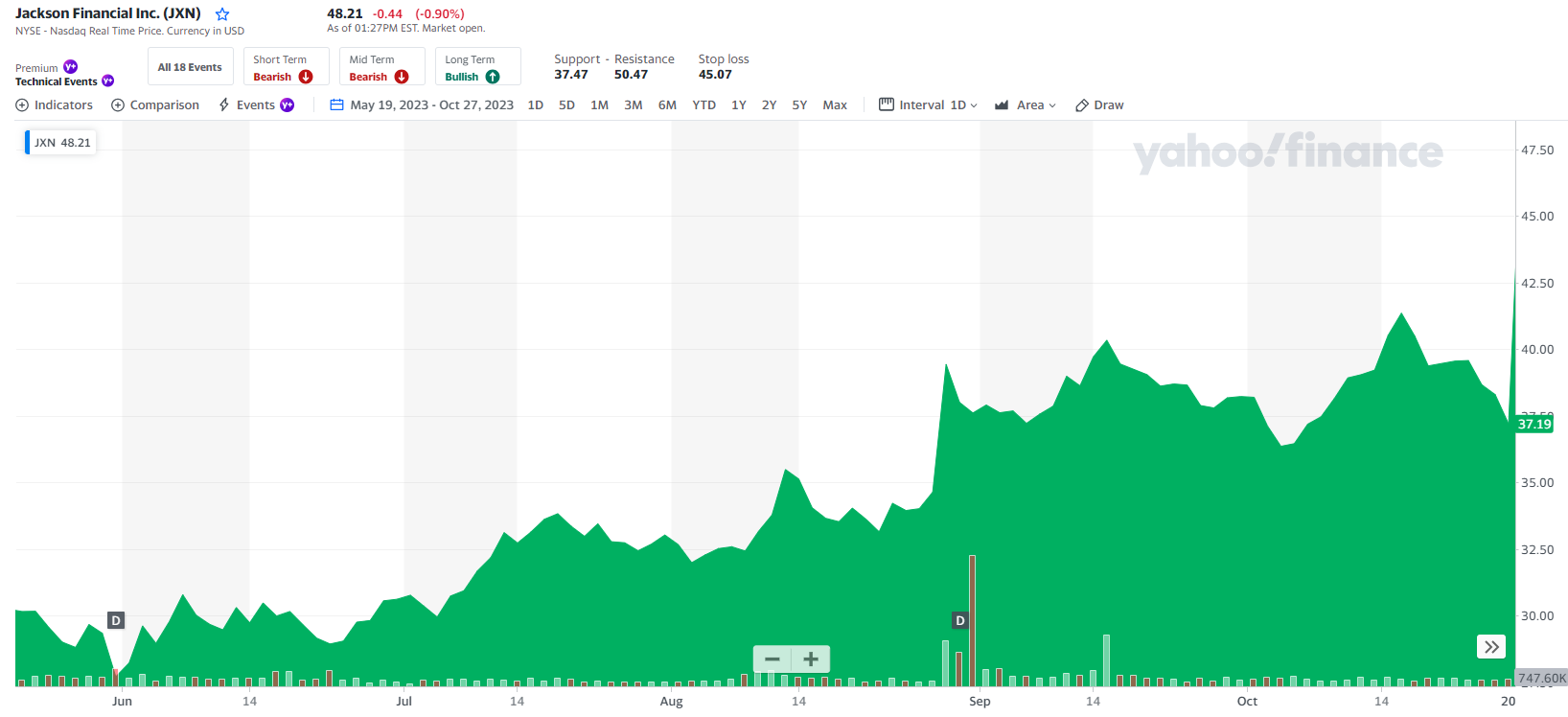

Anyway, in May 2023 the company reported a quarter that the market didn’t like and the stock fell precipitously.

I didn’t think the quarter was that bad and figured I would buy some more stock on weakness.

Instead of just buying the stock at $30, I decided to sell a June 15, 2023 put with a strike price of $35 for $6.50.

That allowed me to pocket $650 of cash immediately.

Ultimately, the put was exercised and I was forced to buy 100 shares of the stock at $35.

But factoring in the $6.50 of option premium that I had already pocketed, my effective purchase price was $28.50 (($35-$6.50).

This was a trade that we recommended to our Ultra Options Advisory subscribers here.

How’d it work out?

Pretty well!

Now let’s move on to example #2.

IAC Inc (IAC)

This idea is more actionable.

IAC Inc (IAC) is one of my favorite stocks today, I consider it a core holding.

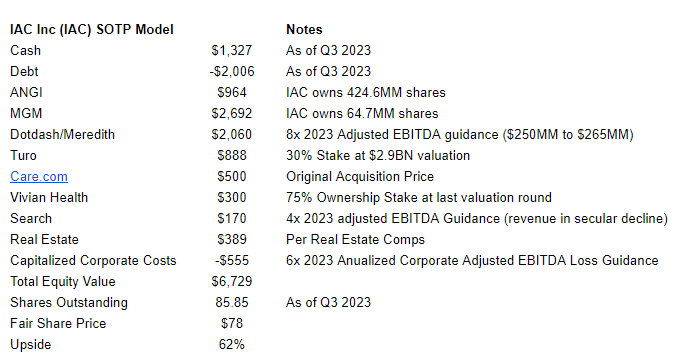

By my math, IAC is trading at a nice discount to its SOTP valuation.

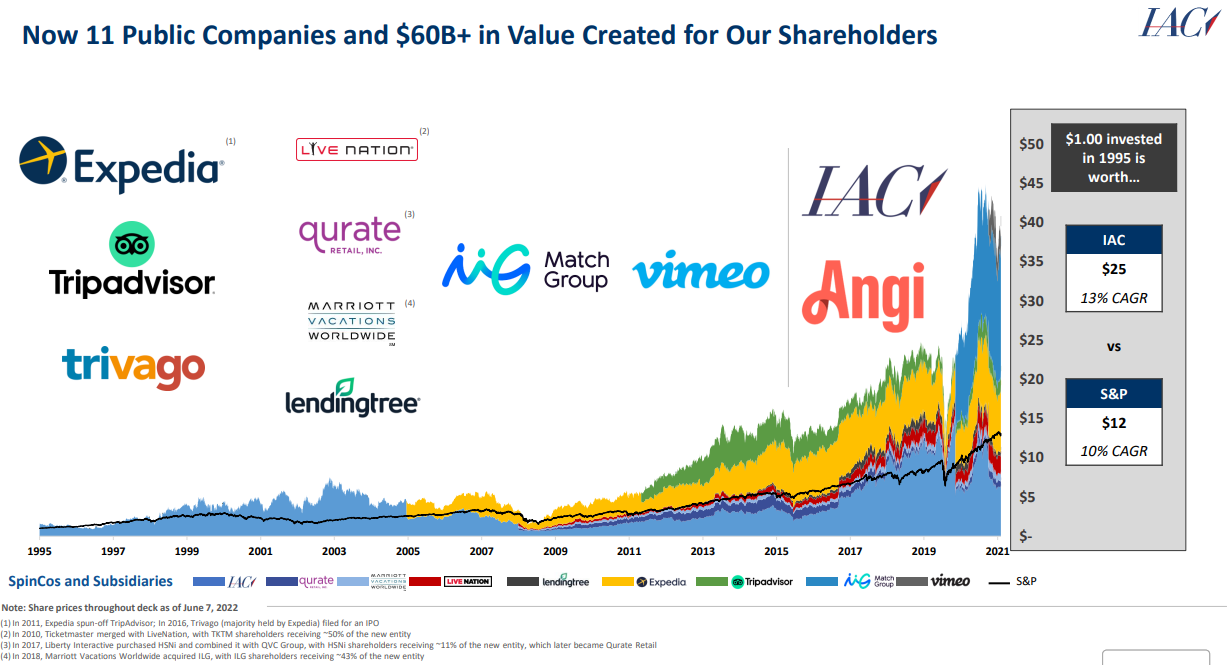

But most importantly, IAC has a track record of realizing shareholder value, primarily through spin-offs.

It’s not a matter of if the parts will be spun off to shareholders but when.

As such, I consider IAC a core holding and want to build my position now that the stock is back in the $40s.

Today, IAC trades at $48.31.

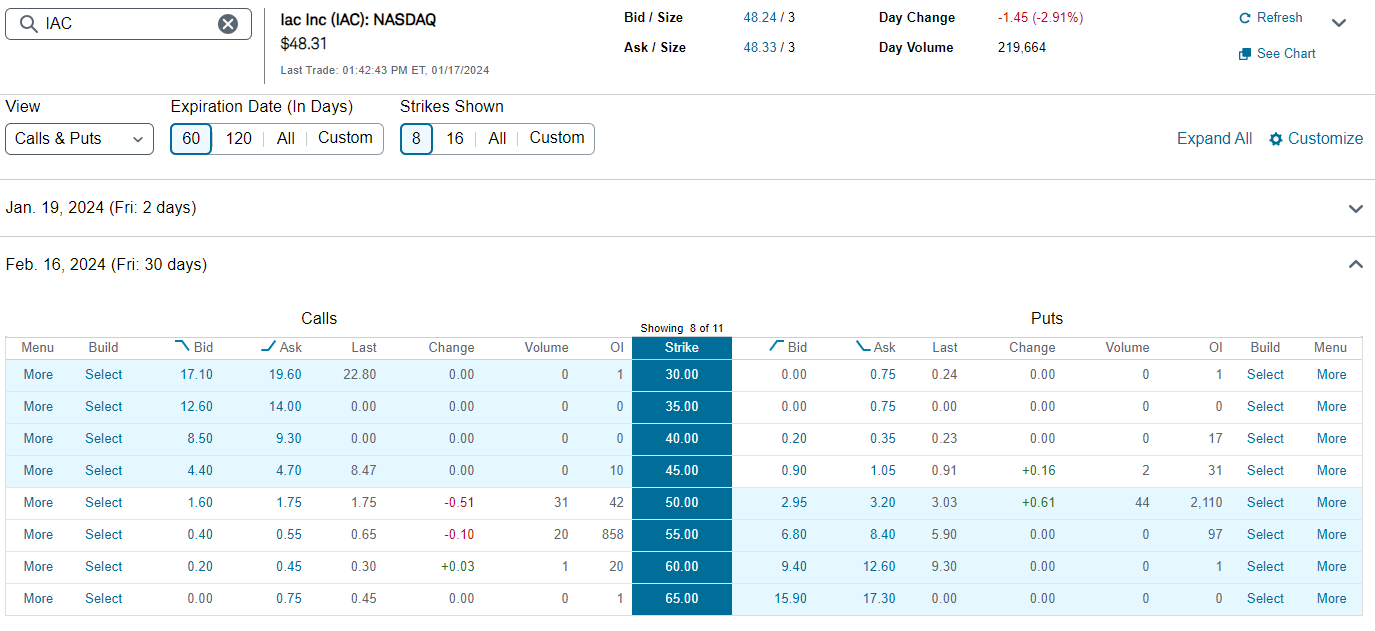

You can sell a put expiring in February with a $50 strike price for $3.00. There are many other options available as well (see below for the February option chain).

If you sell the $50 put, it adds $300 of cash in your account today.

If the option is exercised, you are forced to buy the stock at a net price of $47 ($50-$3).

But that’s a good thing. I already like the stock at the current price.

What happens if IAC rallies above $50?

Then you get to keep the $300 of option premium and you can sell another put and repeat the process.

Two quick caveats:

- When you sell a put, your downside is substantial. For example, say IAC declares bankruptcy tomorrow, and the stock plummets to $0. In this scenario, you will lose $4,700 (100 * (50-3)).

- Don’t sell a put unless you like / want to own the underlying stock. See caveat #1.

Interested in more ideas like this?

Join the waiting list for our Ultra Options Advisory and you will be the first to know when it re-opens.

.

Leave A Comment