Options Case Study: “Poor Man’s Covered Call”

One of the main motivations that Rich Howe and I identified when we were discussing launching the Stock Spin-off Investing Ultra Options Trading Advisory service (“SSI: Ultra” for short) was being able to introduce our subscribers to new option strategies that not just make them money from our trade recommendations but would also be strategies that they would learn to apply to other stocks they liked or existing positions in their portfolios.

This goal was a major reason that I made a Diagonal Call Spread (aka, the “Poor Man’s Covered Call”), the very first trade recommendation of SSI: Ultra. It combines an outstanding ability to capture longer term capital gains while simultaneously generating very high levels of recurring option premium income. I called it a “roll your own” high-yield income strategy, and it has more than lived up to its billing; currently, we are generating 6.8% in cash returns monthly on average, based on our initial investment.

In this case study, I want to revisit the details of our first SSI: Ultra trade and review our returns to date compared to our expectations.

Our first trade upon launching SSI: Ultra was a Diagonal Covered Call that involved buying the Warner Brothers Discovery (WBD) June 2024 $10 Call, while simultaneously selling the November 2022 $14 Call.

Our reason for picking WBD as our basis was based on the extensive and compelling analysis that Rich had already done in making WBD an official Stock Spin-off Investing pick:

Turning back to the transaction, a diagonal call spread trade looks like a covered call stock trade, except one typically buys an in-the-money (ITM) call option instead of the underlying stock. This greatly reduces the initial capital investment required, versus a regular covered call stock trade, and is the principal reason for the eye-popping yield levels from the income generated.

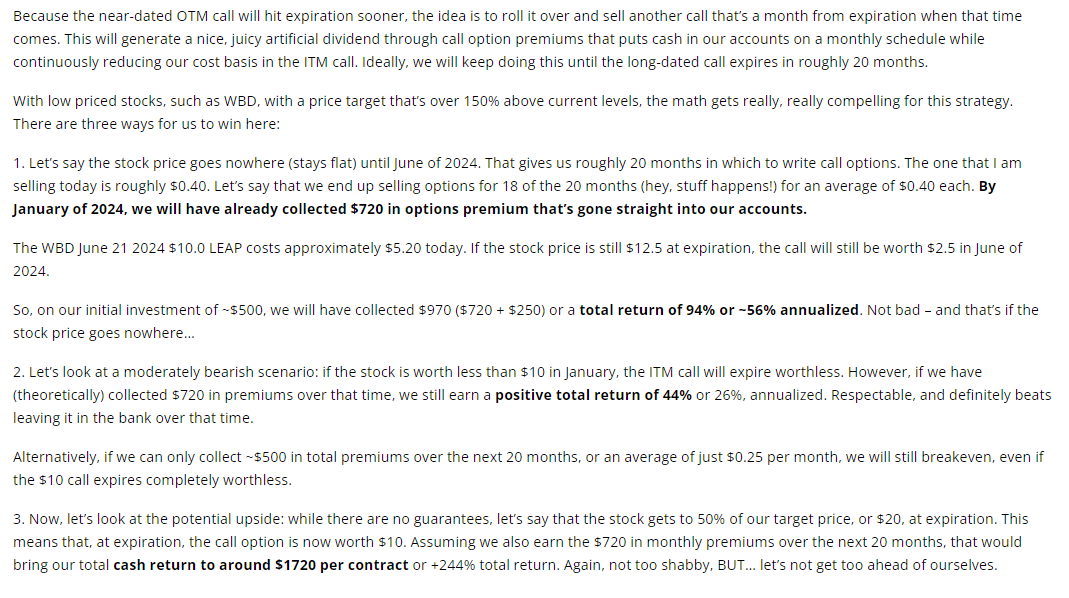

At the time, WBD stock was trading at $12.5/share, while the $10 LEAP call we purchased cost “only” $5.2/contract, and the $14 call that we sold brought us $0.41/contract. There are two ways to look at this trade:

- From a pure yield basis, we earned an immediate 7.9% return on the capital that we invested;

or

- If we instead used the option’s premium income we received to reduce our cost basis, our net cost would have been only $4.79, instantly lowering our breakeven price for the trade to just $14.79 with ~19 months still left to go before LEAP call expiration.

In the trade alert that I put out to our subscribers in recommending the trade, we laid out three potential outcomes as follows:

OUR INTERIM RESULTS

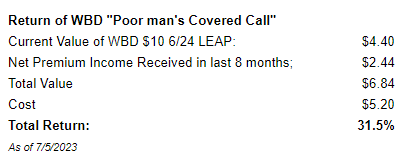

So, let’s now look at how the strategy has performed in the ~8 months since we launched.

Warner Brothers Discovery (WBD) is up about 3% over the past 12 months.

SSI: Ultra subscribers bought the WBD 6/24 LEAP for $5.20 and that contract is now worth $4.40.

Why is the contract worth less if WBD is up 3%?

As we are now ~8 months closer to expiration, the premium from the time value of the option has naturally decreased.

But in the 8 months that Ultra subscribers have owned the LEAP, they have received $2.44 in net option income.

So the “poor man’s covered call” strategy has generated a total return of 31.5%.

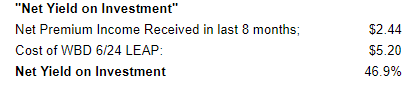

Alternatively, we could compare the cumulative option premium net income received ($2.44) to the initial cost ($5.20).

In this scenario, we have generated a 46.9% “Net Yield on Initial Investment “ and still have 11 more months of options premium to collect.

With 11 months to go until the LEAP expiration, and WBD trading around $12.93, we can see that our WBD Diagonal Call Spread trade is currently both a) well in the money on a net basis, and b) generating high monthly cash returns for our portfolios.

In short, everything is going according to plan!

If trades like this sound interesting to you, sign up for SSI: Ultra.

It is open for the first time in 8 months and enrollment will shut down on July 12.

This the first time since our initial launch that we have re-opened to take in new subscribers. Don’t miss this opportunity to sign up before the enrollment window closes again!

Leave A Comment