How to Invest in Biotech (without being a specialist)

I know many investors who don’t invest in certain sectors because they require specialized expertise.

A few of the most common examples:

- Financials

- Energy

- Biotech

And there is definitely something to be said for staying within your circle of competence.

But for better or worse, I don’t rule out any sector as long as I can develop a thesis that is easy to explain and compelling.

Today, I’m going to talk about the biotech sector and why the entire sector looks interesting.

Finally, I will share two case studies that highlight examples of opportunities that are available in the market today.

In both cases, you didn’t have to have specialized healthcare knowledge to recognize the opportunity.

Better yet, there are plenty of additional opportunities in the biotech space today.

First, let’s talk about the Biotech Sector.

The Biotech Sector is in a bear market.

Biotech bear markets on average result in a drawdown of 50% and last 438 days on average.

The Biotech Index is currently down 52% since its peak in February 2021.

The current bear market has lasted 744 days.

Judging from history, the current biotech bear market is either over or almost over.

There are other signs that now might be a good time to look at biotechs.

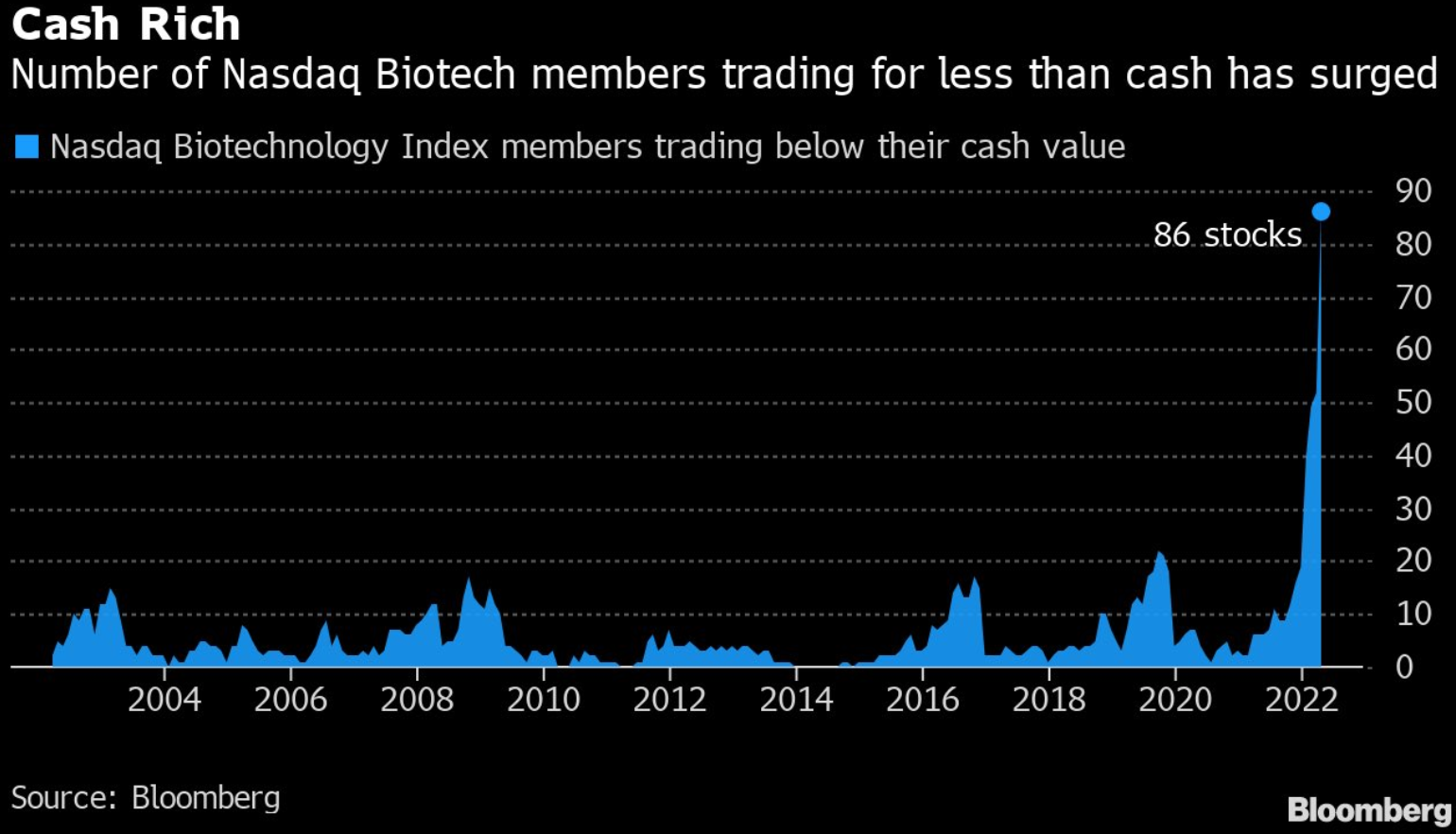

For example, a record number of biotechs are trading for less than cash on their balance sheet.

So the industry set up looks good.

Now let’s get to some case studies.

Yumanity (YMTX) / Kineta (KA)

“Special dividend” is one keyword that I like to monitor.

It usually unearths interesting opportunities.

On December 5, 2022, Yumanity announced that it would pay a special dividend in the range of $1.34 to $1.43.

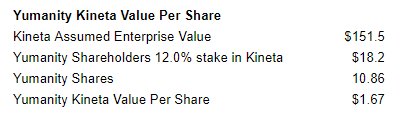

Further, as part of a reverse merger process, Yumanity shareholders would receive 12% of a new company called Kineta.

Kineta had previously been a private biotech but wanted to take over the YMTX public listing.

At the time, YMTX traded at $1.74.

I knew I was going to get $1.34 to $1.43 back via the special dividend.

I just had to ascribe value to Kineta.

How much was Kineta worth?

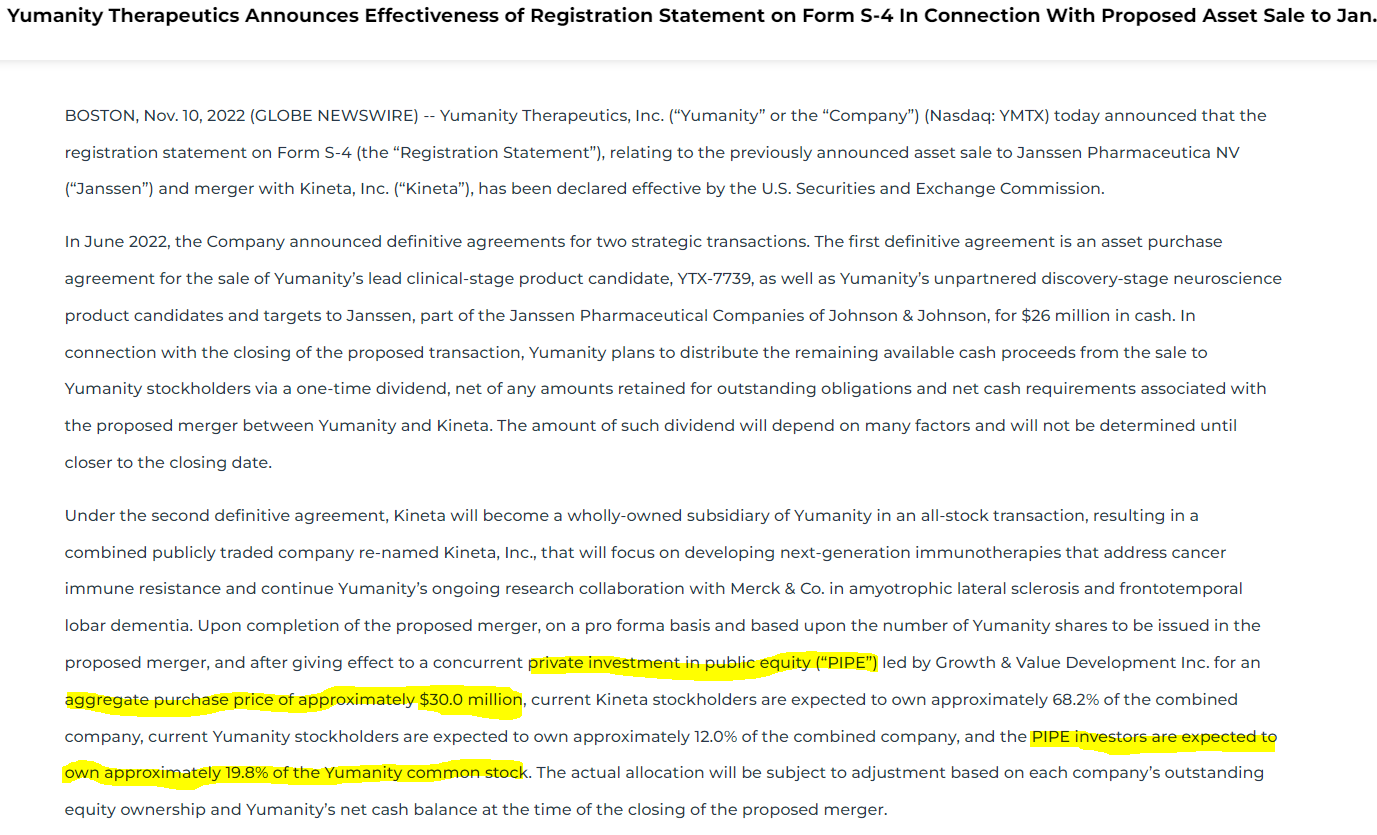

A November 2022 press release stated that private investors were going to participate in a private investment in public equity (PIPE) which valued Kineta at $151.5MM.

I then multiplied $151.5MM x 12% and then divided that number by Yumanity shares outstanding.

That left me with a Yumanity Kineta Value Per Share of $1.67.

Let’s summarize….

In early December, YMTX traded $1.74.

Investors would receive a minimum special dividend of $1.34 and the value of Kineta is estimated to be worth $1.67 per share.

This looked like a quick 73% return.

What about the downside?

In a worst case scenario, Kineta is worth $0 in which case, I’ve only received the $1.34 special dividend.

This works out to 22% downside. Not good but not a disaster.

But I knew that Kineta was worth SOMETHING.

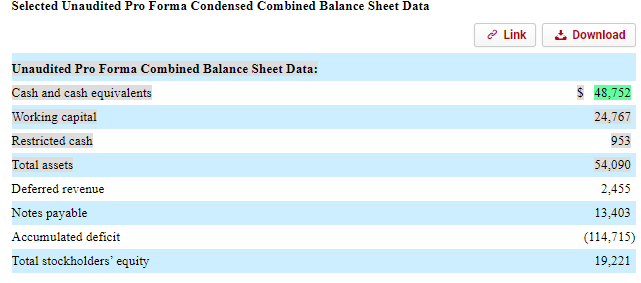

Pro forma for the transaction, Kineta was expected to have $48.8MM of cash or $0.53 per share of cash on its balance sheet.

So it looked like a good risk adjusted trade.

How did it work out?

Great!

I bought YMTX shares for $1.74 on December 15, 2023, received a $1.43 on December 23, 2023 and just sold my Kineta (KA) shares for $7.09 (or $1.01 per YMTX share as there was a reverse split).

Works out a 41% return in two months.

No bad!

And notice how I didn’t make a single mention of pipeline drugs or phase III trials?

There are such good opportunities in the biotech market that you don’t need to be a sector specialist to take advantage.

Catalyst Bio (CBIO)

Catalyst Bio was a similar situation.

In early 2022, after difficulty raising capital for a phase III trial, Catalyst Bio decided to shut down operations and pay out cash to shareholders.

In October 2022, the investment case for Catalyst Bio was extremely simple.

The stock was trading for $0.54 yet the company had guided to future distributions of $0.64 (basic balance sheet math backed up this guidance).

Further, CBIO was attempting to sell a phase III hemophilia asset.

I didn’t have high confidence that any proceeds would be generated from the hemophilia asset, but it wouldn’t take much to move the needle.

For example, a $50MM sales price would result in additional proceeds of $1.59 per share (almost 3x the then current share price).

So the investment case was simple, high likelihood of good return (+19%). Low probability of high return (in cash hemophilia asset sold).

But an attractive risk/adjusted return.

How’d it work out?

This one is still playing out but here’s what happened since October:

- Catalyst paid out a $0.24 special dividend.

- Catalyst distributed a CVR that entitles CBIO shareholders to future cash distributions (I estimate this is worth $0.32 per share).

- Catalyst reached an agreement to enter into a reverse merger with GNI Group (a Chinese health care company) for a 2.5% stake in the new company that is worth ~$8.5MM or $0.27.

Add it all up and we paid $0.54, and we have received or will receive value of $0.83, a 54% return in ~6 months.

Plus, we have upside if the phase III hemophilia assets are sold.

Pipeline

I have no biotechs that I’m ready to buy today, but there are several that I’m digging into including Sesen Bio and Magenta Therapeutics.

you can add GRPH

Thanks for sharing Todd! I will dig into GRPH.