A “SOTP” Horror Story

Sum-of-the-part or SOTP analysis is a key tool that I use when analyzing a spin-off.

Most conglomerates trade at a “conglomerate discount” and so SOTP analysis can be useful to understand if a spin-off will create value.

However, SOTP analysis cannot be followed blindly.

I just published a case study on a Korean company that was trading at an 83% discount to its SOTP value.

The investment looked like a no brainer. But it was anything but…

We Need to Talk About the 83% Discount

Let’s go all the way back to 2021…

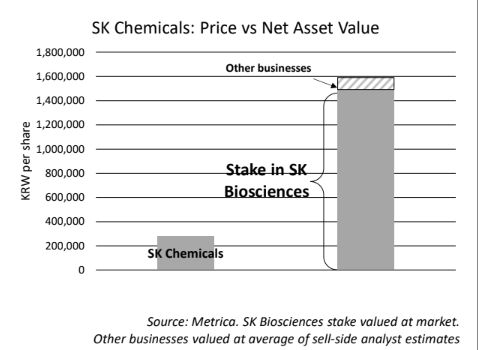

A google search alert flagged that an activist investor, Metrica Partners, was urging SK Chemicals to close the gap between its share price and its NAV.

What was the gap between share price and NAV?

83% (!!)

Said another way, SK Chemical was trading at 17% of its NAV.

I’ve seen a lot of conglomerates and 20-30% discounts are to be expected. But 83%? That seemed absurd.

So I dug in.

The basic setup was as follows….

SK Chemicals is a Korean chemical and pharma company.

In 2021, it owned a 68% stake in SK Biosciences, another public company.

At the time, SK Chemical’s stake in SK Biosciences was worth over 5x its market cap.

Further, SK Chemical had other valuable business.

The activist, Metrica Partners, urged a very sensible plan…

SK Chemical should sell an 18% stake in SK Biosciences and use those proceeds to pay SK Chemicals a special dividend of over 100% of its current market cap.

Better still, SK Chemical would continue to own a controlling stake in SK Biosciences.

Win win for everyone right?

Wrong.

Management sat on its hands.

And ignored the proposal.

What happened next?

Both stocks performed horribly:

Luckily, I never pulled the trigger and invested in SK Chemical, but it provided a useful case study.

What was my key learning?

Wait Until the Catalyst is Imminent

Be wary of any SOTP analysis unless management has agreed to take specific actions to force the market to close the valuation gap.

Most think you need to get into a stock before a spin-off is announced to benefit, but I’ve learned that’s typically not the case.

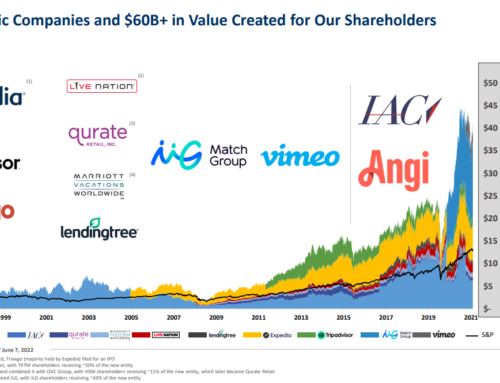

For example, IAC Inc (IAC) spun off its stake in Match Group Inc (MTCH) in 2020. In the two months leading up to the spin-off, IAC (ex its stake in MTCH and ANGI) was trading at a negative $2.0BN enterprise value.

Wait for opportunities like this!

alyw9d