Spin-offs with Insider Buying (March 2021)

This month, there has been a surprisingly large amount of insider buying.

As usual, we will go in alphabetical order.

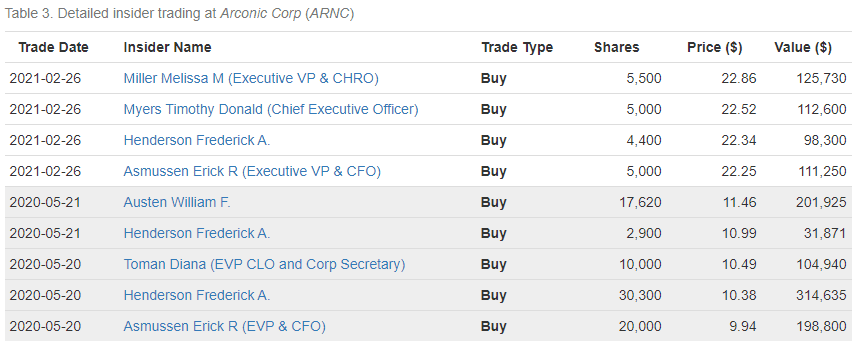

Arconic Inc (ARNC)

Arconic is a 2020 spin-off from Howmet Aerospace (HWM).

It is focused on global rolled products, aluminum extrusions, and building and construction systems. Think large customized sheets of aluminum for automobiles and airplanes.

Arconic also has an ESG angle as aluminum is viewed as more environmentally friendly (and stronger!) than steel.

The stock has performed well (it was spun off at the start of the pandemic) and should benefit from a recovering economy in 2021.

It’s not expensive trading at 5.0x forward EBITDA. It’s closest peer Kaiser Aluminium (KALU) trades at 10.5x forward EBITDA. On a forward PE basis, Arconic.trades at 15x versus KALU at 24x.

And insiders stepped in aggressively in February to buy in the open market.

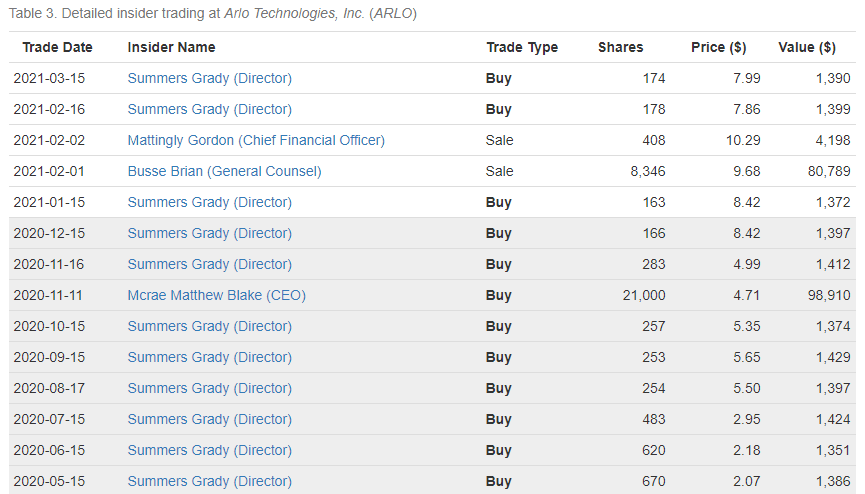

Arlo Technologies (ARLO)

Arlo is a company that we’ve covered in the past couple of posts, but we will mention it again because director, Grady Summers, bought more stock in the $8 range.

Arlo is a 2018 spin-off from Netgear (NTGR). The spin-off had a rocky start but has recently regained momentum.

Arlo sells low margin cameras in a competitive market but has started to charge for video storage that used to be free (after a free trial period). The model is starting to work and Arlo expects $100MM of service revenue in 2021 with 50%+ gross margins.

The stock trades at an EV/sales of 1.2x which is arguably cheap for a company with $100MM of rapidly growing services revenue.

Adestella Investment Management summarizes the investment case nicely.

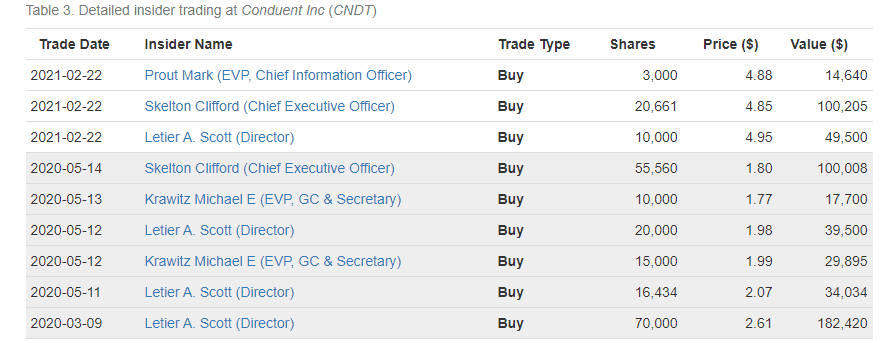

Conduent Corp (CNDT)

Conduent is a business processes outsourcing company that was a 2016 spin-off from Xerox.

It stumbled quickly out of the gate but appears to be turning a corner as revenue and margins have stabilized.

And insiders are buying shares in the open market….

The stock is very cheap at an EV/EBITDA multiple of 6.6x and an EV/Revenue multiple of 0.6x.

Peers trade at 12x EBITDA and 1.5x Revenue.

Carl Icahn owns ~18% of the company.

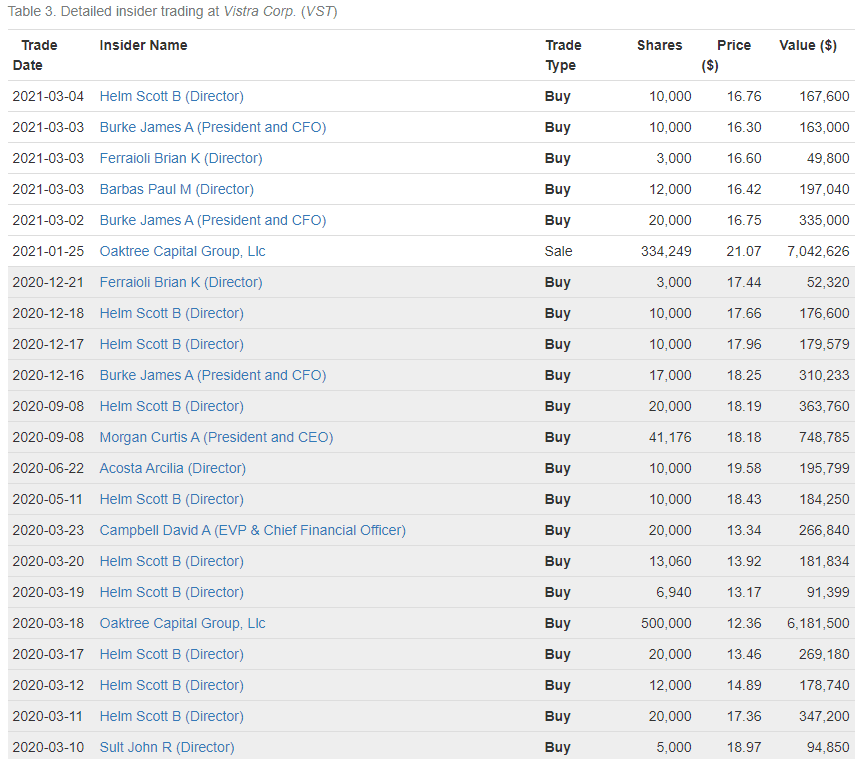

Vistra Energy (VST)

In 2007, in the largest LBO in history, TPG, KKR, and Goldman Sachs teamed up to buy TXU for $45bn ($8.3bn in equity and $36.7bn in debt).

By 2014, TXU had to file chapter 11 due to its crushing debt load. Vistra Energy (VST) is the post-reorg equity of TXU Corporation.

Vistra is one of the largest power producers (nuclear, coal, and nat gas) and retail energy providers in the U.S.

Vistra took a big hit when it announced a $900MM to $1.3BN adverse impact due to Texas’ recent winter storm.

Since the announcement, Vistra has lost $2.9BN in market cap which seems like an overreaction given the company has plenty of liquidity.

Management agrees and has been buying stock in the open market.

Leave A Comment