Spin-offs with Insider Buying (March 2022)

I recently scanned my spin-off / special sits watch list for insider buying and found 7 stocks that are worth highlighting.

Let’s go in alphabetical order…

Altisource (ASPS)

Altisource is an old 2009 spin-off.

For a period of time, it was one of the best performing spin-offs of all time, then it came crashing down to earth.

The investment case boils down to a wave of foreclosures coming which will drive revenue and earnings growth for Altisource.

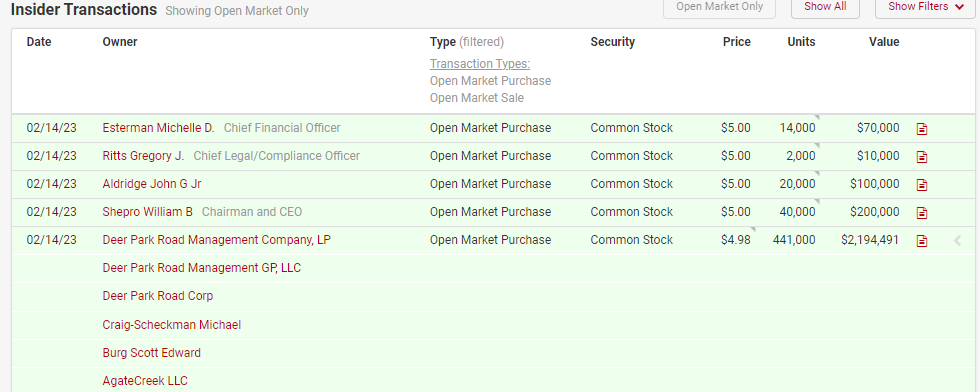

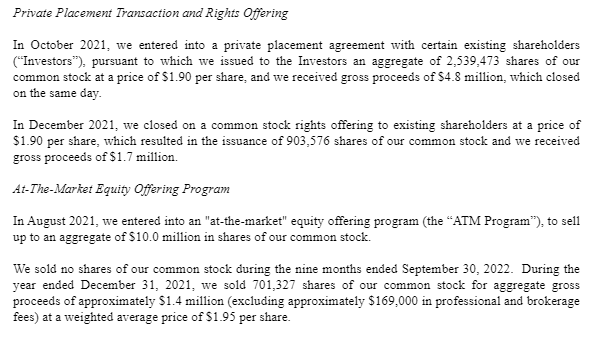

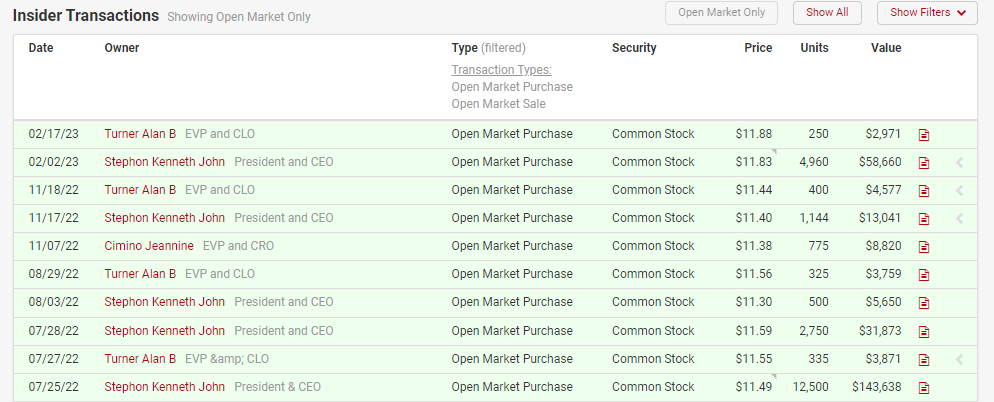

Insiders believe the story and participated in a recent secondary offering.

While this is certainly encouraging, I’m not sold.

Despite rising foreclosure activity, ASPS was barely breakeven on an EBITDA basis in Q4 2022. For the full 2022 year, ASPS generated negative $17MM of EBITDA.

With $176MM of net debt remaining, the situation looks a bit precarious.

I will continue to watch this one for signs of further operational momentum.

ComScore (SCOR)

This one looks interesting.

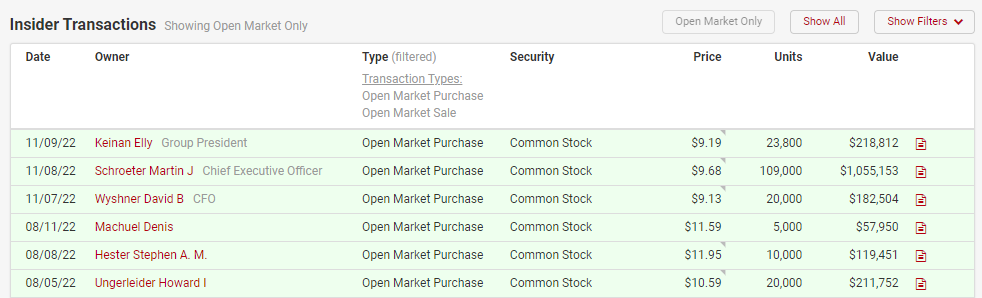

ComScore isn’t a spin-off but got flagged because of insider buying.

Using TIKR, we can see that SCOR looks optically cheap at 7x forward EBITDA and 4x FCF.

However, it looks highly levered based on how TIKR calculates its enterprise value (EV of $334MM vs. $110MM market cap).

But if you dig into the financials, you see that it has basically no net debt and preferred equity that will be converted into common shares (1.04x is current conversion multiple).

So I think the pref shouldn’t be treated as debt but as common.

If you agree with my logic, SCOR effectively has no debt.

So what does ComScore do to make money?

It is a global information and analytics company that measures advertising, content, and consumer audiences.

So kind of like Nielsen which was recently acquired for 10x EBITDA by private equity.

Its customers include digital publishers, television networks, movie studios, content owners, brand advertisers, agencies and technology providers.

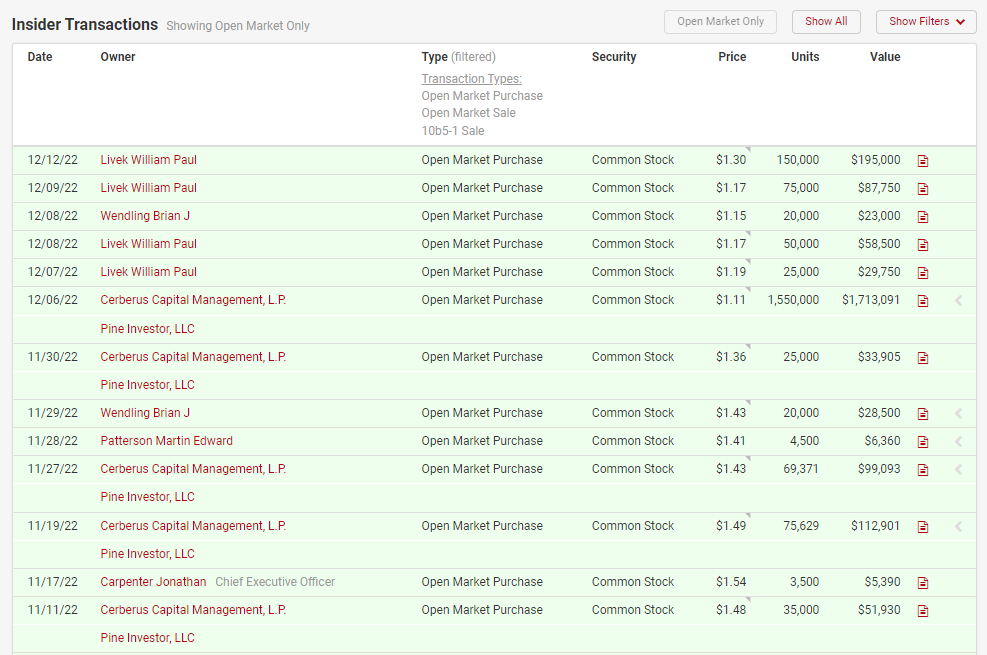

Despite a challenging advertising market in 2022, SCOR was able to grow revenue and EBITDA.

Guidance for 2023 is more of the same with low single digit revenue growth and “double digit” EBITDA margin.

Mgmt expects to exit Q4 2023 with 15% EBITDA margins, implying 300bps of margin expansion throughout the year.

This would correspond to $50MM of EBITDA.

As such, SCOR is trading at 4.2x forward EBITDA.

Seems too cheap…

Kyndryl (KD)

Kyndryl is a name that I’ve been getting a ton of questions on.

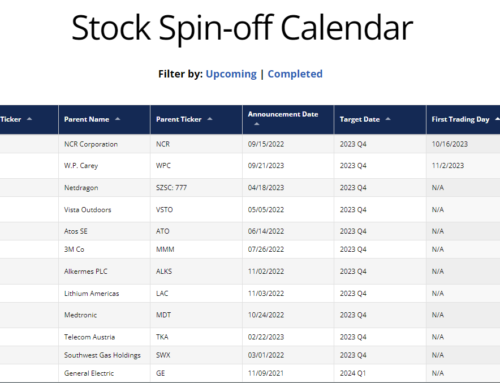

It’s 2021 spin-off from IBM that got absolutely crushed but has staged a remarkable turnaround.

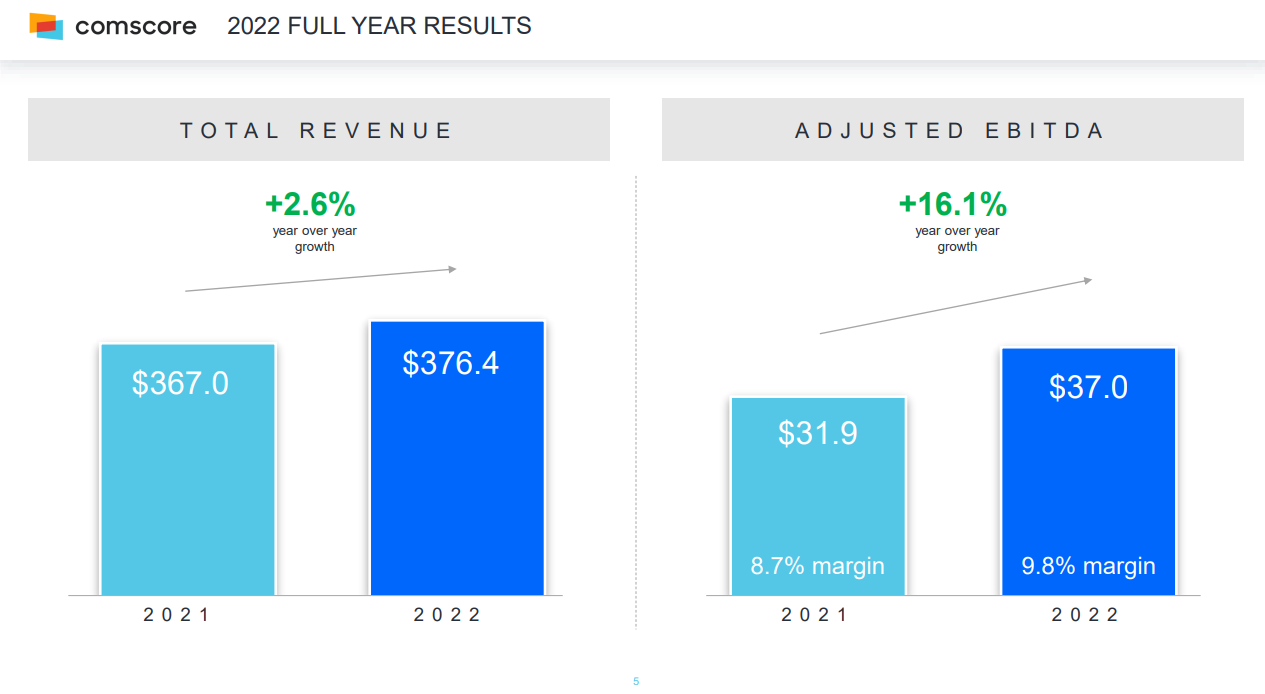

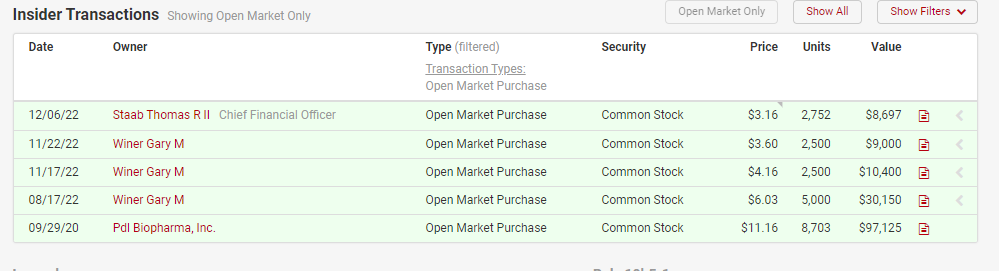

Insiders bought a bunch of stock this fall and look like they timed it perfectly as the stock is up almost 100% since then.

While KD’s valuation has always looked enticing, I avoided the stock for a couple reasons;

- Revenue was shrinking and a turnaround didn’t look imminent.

- The company didn’t generate any free cash flow.

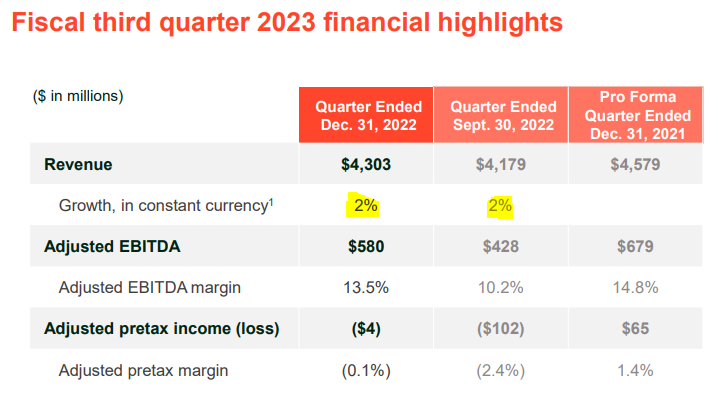

It looks like point 1 is changing. Notice the positive constant currency revenue growth in the last two quarters:

However, guidance for the full year is still for flat revenue growth and -7.5% reported revenue growth.

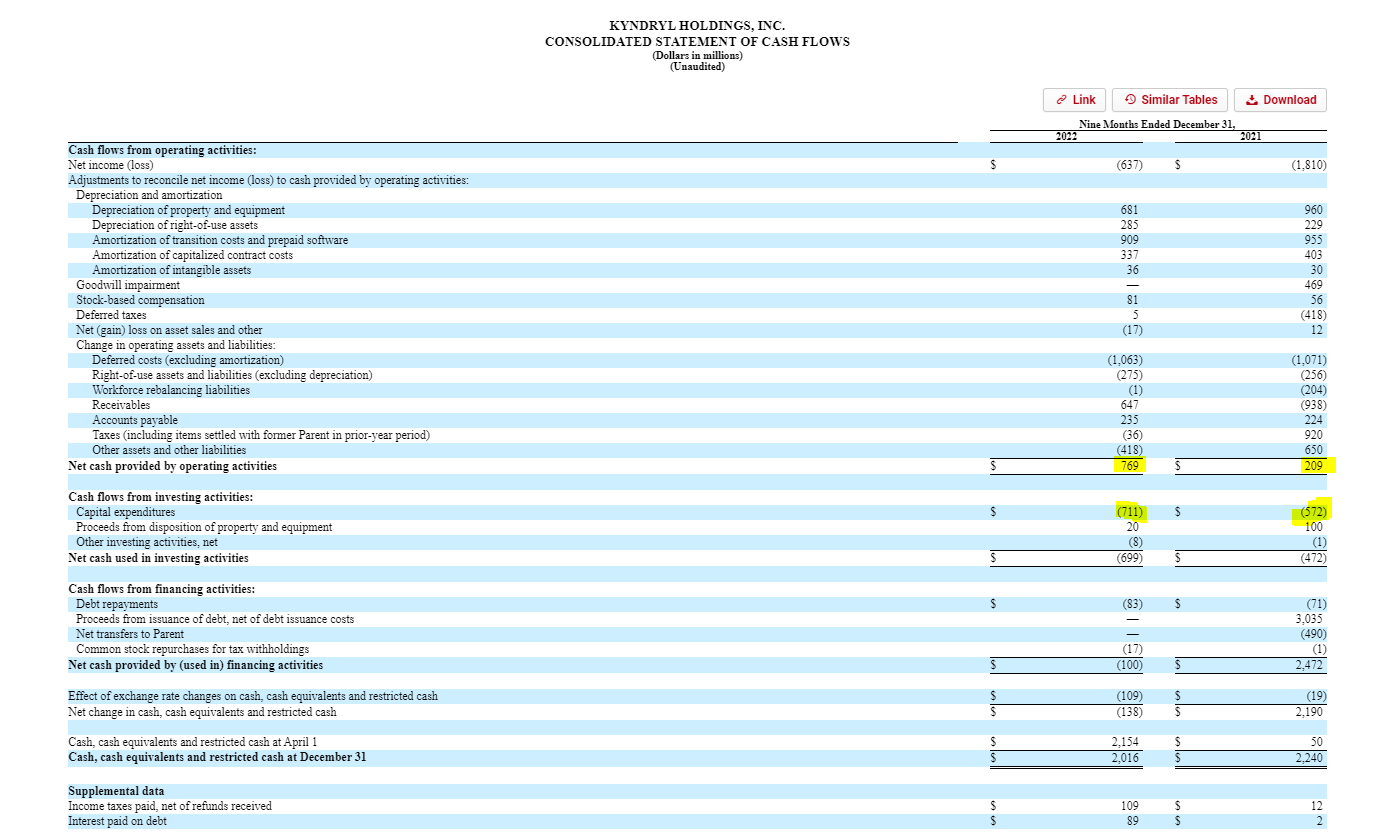

Meanwhile free cash flow is barely positive (albeit much improved from last year).

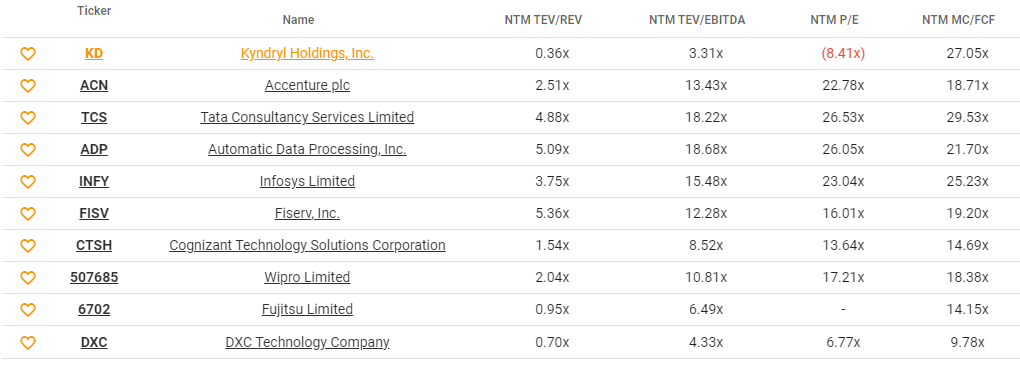

From a valuation perspective, KD continues to look cheap…

But I’m not quite there yet.

To get over the hump, I would need to see sustained positive revenue growth. Management’s plan is to increase margins sharply and that gets increasingly hard unless you are growing the top line.

One other thing to note….

Last summer, a judge ordered IBM to pay $1.6BN to BMC related to a lawsuit.

Barron’s writes “The problem is that the work in question appears to have been conducted by the slice of IBM that was spun off as Kyndryl.”

IBM is appealing the decision and who knows what the final decision will be.

I’m far from a legal expert, but I have a feeling KD will take a dive any time news of this lawsuit resurfaces.

Lensar (LNSR)

Lensar is a name that I would have forgotten about if it was not on my spin-off insider buying watch list.

As shown below, some pretty good insider buying from two different insiders in November and December.

Lensar is a spin-off of PDL BioPharma.

Lensar is a micro-cap med device company that sells systems for the treatment of cataracts.

Here is an excellent write up from 2020 that gives the background on the company.

Total revenue grew slightly in 2022 to $35.4MM.

The valuation looks attractive.

Lensar trades at just 0.5x (EV/Revenue).

The problem is the company is burning cash ($13MM per year) and will probably have to burn more cash if it wants to accelerate growth.

It currently has cash on its balance sheet of $19MM, but eventually it will have to raise cash.

The bull case would be an acquisition by Alcon or Medtronic which trade 4x revenue, but that’s hard to handicap.

I think this one would be more interesting if revenue growth accelerated.

OmniAb (OABI)

OmniAb is a 2022 spin-off from Ligand Pharma (LGND).

At the time of the transaction, I thought it was an absolute disaster.

The OmniAb business was merged with a SPAC at a 22x revenue valuation.

Predictably, the spin-off/SPAC was sold indiscriminately and insiders have stepped up to buy shares

So what does OmniAb do?

It has a technology platform that helps other biotech and pharma companies screen and discover therapeutic human antibodies.

OmniAb primarily derives revenue from license fees for technology access, milestones from partnered programs and service revenue from research programs.

>68 companies currently have access to OmniAb antibodies and to the extent any of those antibodies are commercially successful, OmniAb will receive a 3% to 5% royalty (depending on what has been negotiated).

I thought the business was ridiculously over valued at 22x revenue.

But today it’s trading at 6x current revenue.

Further, it has over $100MM of net cash on its balance sheet and has minimal cash burn.

So it won’t have to raise cash.

And revenue will continue to grow as some of its pipeline products progress to commercialization (again, OABI has over 68 partners at this point).

Consensus calls for $131MM in sales by 2025.

Assuming a 9x revenue multiple (same as Ligand Pharma, its parent), OmniAb would be worth $1.3BN or $11 per share by 2026, up over 200% from its current valuation.

9x might sound aggressive but OmniAb is going to be incredibly profitable just like Ligand.

I’m not ready to buy OABI, but I can understand the bull case.

Trinity Place Holdings (TPHS)

TPHS owns a bunch of New York City real estate that is probably worth a lot more than its current market cap and enterprise value.

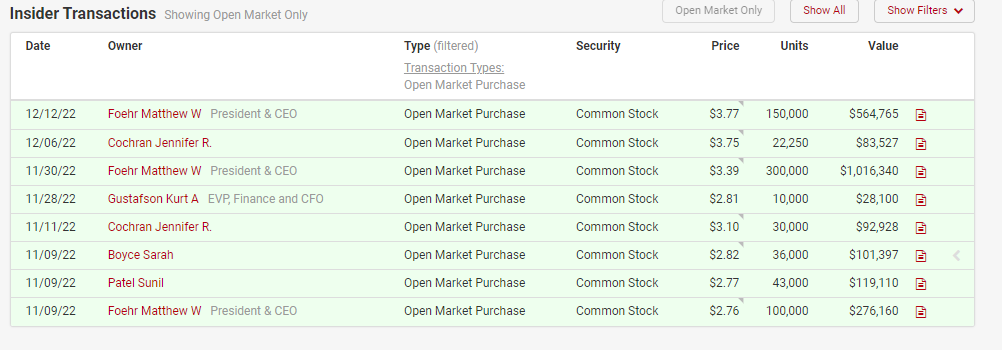

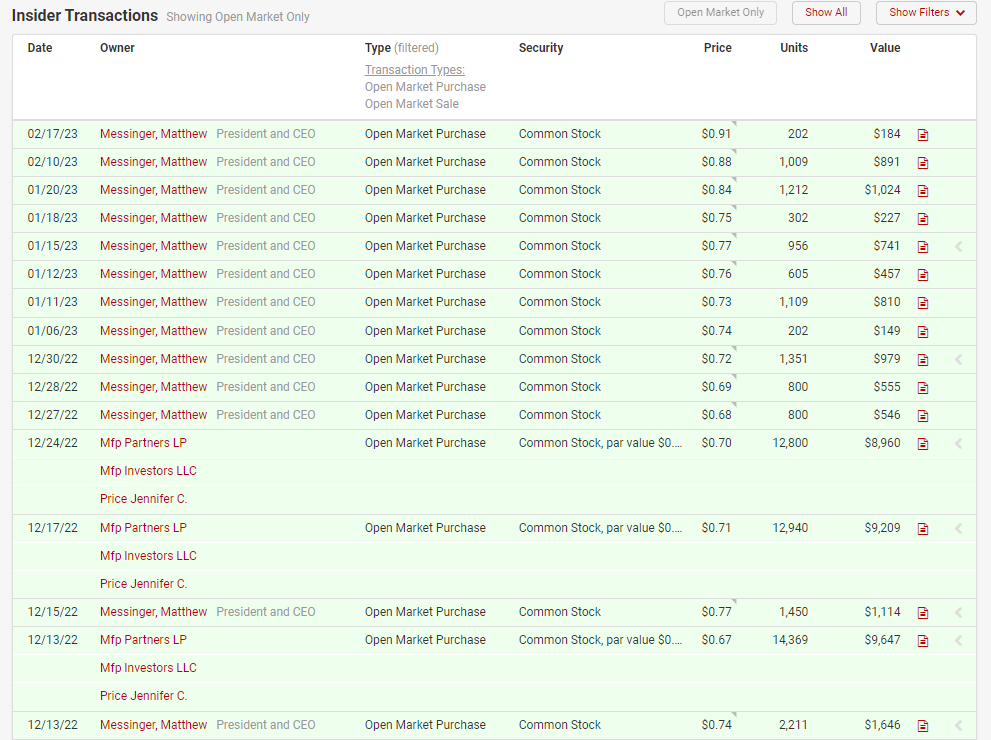

And insiders have been buying like crazy….

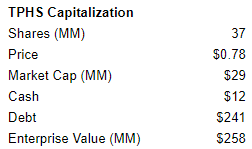

TPHS has a current market of $29MM and an EV of $258MM.

What are its assets worth?

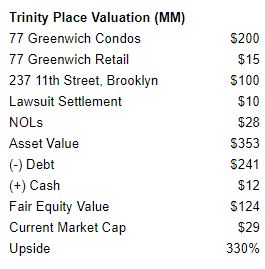

TPHS’ most valuable asset is 77 Greenwich in lower Manhattan.

It is nearing completion of development as a mixed-use project consisting of a 90-unit residential condominium tower, retail space and a New York City elementary school.

The company has sold 25 residential condos and 65 remain available to be sold.

Assuming each condo is eventually sold for $3M, implies $195MM of proceeds from condo sales.

A $3MM average sale price is grossly simplistic. I need to dig deeper to do a more granular analysis (for example find out how many 1BR, 2BR, 3BRs, and 4BRs are and use the prices listed here).

But let’s round up and assume the building is worth $200MM.

There is also 75,000 square feet of retail space at the bottom of the building. Management told me it’s probably worth $15MM at a 5% cap rate. I need to confirm, but let’s take management’s word for it in our rough valuation.

Next, we have a multi-family property located at 237 11th Street in Brooklyn. 237 11th Street has 105 units (100% occupancy) and 5,000 of retail square footage.

TPHS paid $81MM for the property, and management believes its worth “significantly” more today. Without digging too deep into the details, let’s assume it’s worth $100MM.

Another potential asset is a lawsuit that TPHS filed against the seller of 237 11th Street due to water damage and other building defects that were concealed. The lawsuit seeks total damages of $30MM. The lawsuit will be decided in 2024 and it may be appealable.

Let’s assume TPHS will receive $10MM in the settlement.

Another valuable asset is TPHS’ net operating losses.

As of 9/30/2022, TPHS has $268MM of NOLs.

Assuming a 21% federal tax rate, those NOLs are worth $56MM. We can cut that value in half to be conservative (who knows if TPHS will be able to utilize them).

TPHS also owns through a JV a 10% interest in a recently built 234 unit multi-family property at 250 North 10th Street in Brooklyn, NY. My sense is this 10% interest isn’t worth much so I’m going to ignore it.

Add it all up and you get a $124MM fair equity value vs the current market cap of $29MM

Over 300% upside to fair value….

What’s the catch?

TPHS is burning cash and will need to raise equity or debt financing soon.

Yes, TPHS is generating cash from the sale of 77 Greenwich condos but all that cash goes to pay off the mortgage.

Historically, the company has done ATM offerings or rights offerings in $1.90 per share range.

More work to do on this one but it looks super interesting!

William Penn Bancorp (WMPN)

The investment case for this one is short and sweet.

William Penn is a thrift that is 12 months away from the 3 year anniversary of its second step conversion.

At this point, WMPN will be eligible to be acquired.

Since 1982, ~70% of thrifts that have gone public have been acquired at an average price to TBV multiple of 1.4x (h/t Jim Royal!).

WMPN’s tangible book value is $12.67 so it’s probably worth $18 in a take out scenario.

If the takeout doesn’t materialize, downside is probably limited given WMPN is overcapitalized.

And of course, insiders have been buying….

Leave A Comment