What will happen to Atmus Filtration (ATMU) after the exchange concludes?

One situation that I’m closely following is Cummin’s (CMI) spin off of Atmus Filtration (ATMU).

The situation is/was a fun one to watch because there was an “odd lot” arbitrage.

In a nutshell, there was an opportunity to make a low risk $2k.

The gist of the exchange offer was as follows…

Cummins decided to spin off its filtration business, Atmus Filtration (ATMU), through a share exchange.

CMI shareholders could swap their CMI shares for shares of the spin-off, ATMU.

Why would CMI shareholders agree to such a swap?

Like many things in life, it came down to cold hard cash.

CMI investors are in the process of receiving $107.53 of value in ATMU shares for every $100 of value in CMI shares, per the terms of the offer.

Given the attractive arbitrage, this offer is expected to be oversubscribed for CMI shareholder UNLESS you are an “odd lot” shareholder, one who owns fewer than 100 shares.

There was an opportunity to buy 99 shares of CMI, exchange them for shares of ATMU and pocket ~7.5% / ~$2K in the process.

The key question today for those of us who decided to participate in the exchange is the following….

“Should I sell my ATMU shares or hang on to them?”

Based on historical data, ATMU shares are likely to be weak in the aftermath of share exchange.

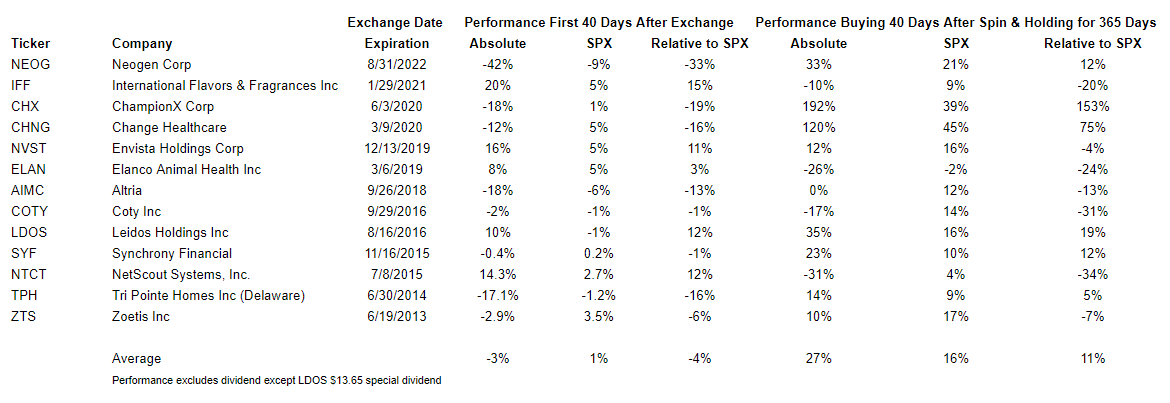

I’ve gone back and looked at “split off exchanges” going back to 2013 and found that on average, shares of the spin-off declined by 3% over the first 40 trading days.

Obviously there are exceptions (IFF and NVST) which showed initial strength.

But then again, there are others (NEOG, CHX) which dropped precipitously.

Is there a silver lining?

Perhaps.

According to my research, if you bought the above “split off exchange” spin-offs 40 days after the conclusion of the exchange, you would have generated an average return of 27%, beating the S&P 500 by 11% over the subsequent 12 months.

So if we do see weakness in ATMU, it could be an attractive opportunity.

I recently published a deep dive on ATMU and think the stock looks quite interesting.

Nonetheless, I think it would be prudent to wait to establish a long term position until selling pressure from the share exchange has moderated.

1x5bcx

2bvid2