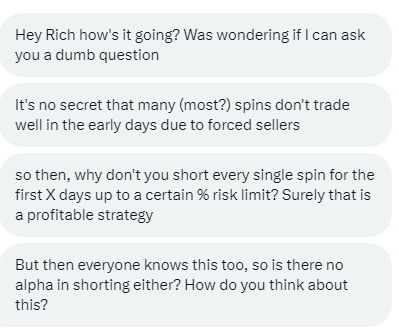

Spin-off Mailbag: Why Don’t Investors Short All Spin-Offs?

I got a great question in my Twitter DMs related to shorting spin-offs….

Here’s my answer:

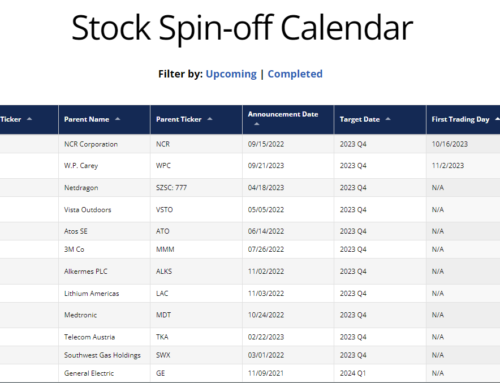

First, it’s hard to short spin-offs right when they come out.

Typically, no shares are available to borrow from my broker (Schwab) so shorting is challenging (maybe some brokers are better?).

But there’s a work around:

You simply:

- Short the parent company

- Simultaneously buy RemainCo in the when issued market.

This will leave you short the spin-off before regular way trading begins.

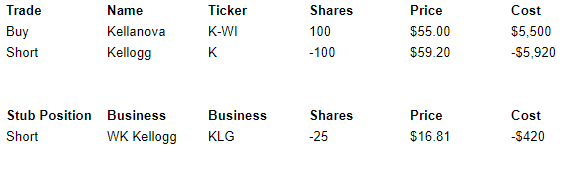

Let’s take the recent Kellogg spin-off to establish how an investor could have shorted the stock ahead of regular way trading…

On September 28 (the day before the KLG spin-off), K was trading at $59.20. At the same time, K-WI (RemainCo) was trading at 55.00.

If you shorted 100 shares of K and simultaneously bought 100 shares of K-WI, your resulting position would have been short 25 shares of WK Kellogg at a cost basis of $16.81 (spin-off ratio was 1:4).

KLG is currently trading at $10 so it would have been a great trade.

What’s the catch?

There are a few:

- It’ s capital intensive. You had to deploy over $5000 of capital to create a short position worth $420.

- Sometimes when issued trading is spotty for the RemainCo. In the example of K-WI, only 400 shares traded per day, thus, it would have been impossible to short KLG in size.

Despite the limitations, it’s worth paying attention to when-issued trading because sometimes there are egregious mispricings.

Do you have any other questions related to spin-offs or special situation investing? Let me know in the comments below, and I will answer them in future articles!

Hi Rich, I don’t seem to understand why you need to simultaneously buy shares of Remain Co, could you explain that in more detail?

Also, how did you calculate the $16.81 cost basis for the resulting KLG short position?

5jmjqu