The BEST Bull Spread Option Strategy to Use Part 2

Part 2 of 5 Part Series

Option Spreads Comparison

Part I – Full Explanation of Both Types of Bull Spreads

Part II – The Best Spread Option Trade?

- If you’re bullish on a stock, you can earn truly outsized profits with limited risk by using either a Bull Call or Bull Put Spread

- Key differences & major considerations between the two types of spreads

- Finally, how to decide between the two

If you’ve never traded an option spread before, part one of this series tells you all you need to do so with complete confidence and understanding of the risks and rewards.

It explained the key differences between using Calls and using Puts to form the spread, and what you stand to lose and gain using each one.

In this segment of the series, we will several key differences and focus on the most important elements for making a decision about which strategy to use.

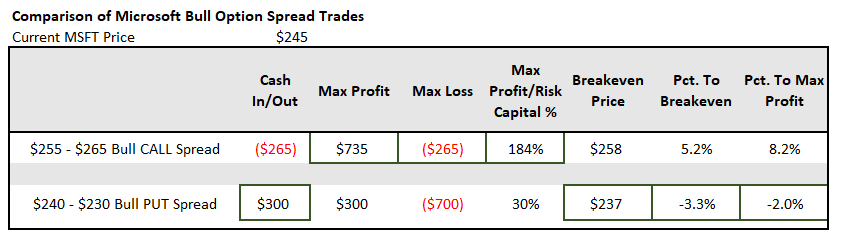

First, let’s go back to the chart that we put together in the first part of these series showing the differences between a Bull Put and a Bull Call spread on Microsoft stock. Despite the prices being somewhat changed due to volatility in the market, we have the necessary data for the period, which suffices for the discussion.

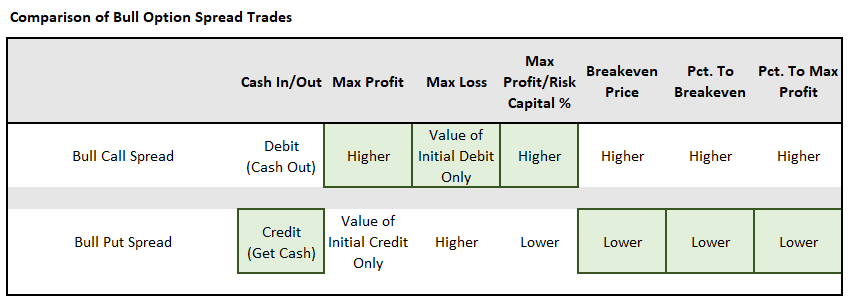

As you can easily see, there are important differences in the potential returns and risk profiles of these two strategies, which will be consistent, regardless of the underlying stock we are using to form the trades. Let’s summarize the most important ones with a slightly different version of the previous table, where the green shaded boxes indicates the superior option.

As with most decisions having to do with trading options, the choice of strategy depends on a set of tradeoffs.

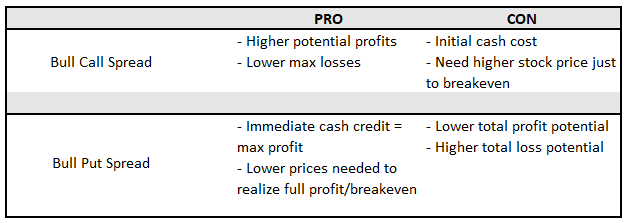

The CALL spread offers both substantially higher potential dollar and percentage returns, and significantly lower potential maximum losses. On the other hand, the PUT spread produces its maximum profit in the form of an immediate credit in your account and is a trade that will result in profits even at significantly lower price levels for the underlying, compared to the CALL trade.

The PUT spread has a very interesting trade-off – it’s a “bullish” trade that could potentially still be profitable even if the price of the underlying stock declines. However, the potential losses one must risk can be on the order of 2 or 3 times higher than the potential profits to be gained!

Those who have read the pieces on my trading strategy philosophy, consistent with the first tenet, “Whenever possible be the Casino, and NOT the Player”, will know that I am highly partial to option trades that a) generate immediate income, b) will result in a profitable outcome over a wider/lower range of ending prices, and c) have a higher probability of generating a profit.

At first glance, this might seem like a slam-dunk case for the PUT spread strategy, but to think that way would be making the colossal mistake of ignoring the implications of the huge disparity in the payoff to total loss ratio between the two strategies.

So, how do we balance out the higher payout/lower losses of the CALL strategy with the lower payout/higher losses of the PUT strategy?

The answer, it turns out, depends on a crucial missing piece of the puzzle that we haven’t taken into account yet up to this point:

PROBABILITY

In the next installment, I will show the (relatively) simple formula that I use to calculate a risk adjusted payoff value for spread trades, that helps me determine which strategy to use when trying to decide between the two.

Very soon, I’m going to be launching SSI Ultra: The Options Advisory.

The three primary reasons for launching the service are:

- To take advantage of mispriced options related to companies undergoing extraordinary change.

- To profit from more nuanced views of special situations.

- To create bearish recommendations on stocks in a risk mitigated manner.

Shoot us an email at rich@stockspinoffinvesting.com for earliest access.

Leave A Comment