The BEST Bull Spread Option Strategy to Use

Option Spreads Explained – Four Part Series

Part I – Explanation of Both Types of Bull Spreads

Part II – The Best Bull Spread Option Strategy?

Part III – A Real World Example – How We Invested Using Both Strategies

Part IV – Real World Results and Lessons Learned

- If you’re bullish on a stock, you can earn truly outsized profits with limited risk by using either a Bull Call or Bull Put Spread

- The Key Differences & Major Considerations

If you’ve never traded an option spread before, the first part of this series will tell you all you need to do so with complete confidence and understanding of the risks and rewards.

It will explain the key differences between using Calls and using Puts to form the spread, and what you need to consider in choosing between the two.

Bull Spread Concept Explained

In general, a bull option spread is one that makes money if the price of the underlying stock increases and, by extension, a bear option spread is one that produces profits if the stock price decreases. For simplicity sake, I will limit the discussion to only bull option spreads, but the principles are just the exact mirror image of each other when dealing with bear option spreads.

While it’s true that both bull put and call spreads make money when the price of the underlying stock increases, there are important differences in how each is constructed, and when and how much you can expect to profit from each of them.

When I Use Bull Option Spreads

If I am particularly bullish on a particular stock (or market index) within a defined time period and have a high conviction that it is significantly undervalued and there are good reasons to believe that it will soon trade at a price that more fairly represents its core underlying value

For example, if I follow the stock closely and I am convinced that certain catalysts or good news is coming but has not been factored into the stock price by the market yet. That’s a major reason that I subscribe to Rich Howe’s Stock Spinoff Investing newsletter: the deep fundamental and quantitative analysis he performs on each stock gives me a high degree of confidence (even know that nothing is 100% certain) that there are solid reasons why the stock can and should trade higher in the foreseeable future.

When faced with a situation like this, bull option spreads, whether using calls or puts, can be extremely powerful trading strategies, producing tremendous returns over both short and longer periods of time with minimal use of capital and strictly limited risk profiles. Once you know about them, your main problem will be sifting through the almost limitless possibilities for using them to find only the best ideas, so use this information wisely!

Bull Option Spreads Mechanics – The Basics

So, what are they exactly and how does one start trading them?

To make it simple to understand, let’s use Microsoft (MSFT) as our example and say that, for arguments sake, that you are strongly convinced that the stock price will move UP anywhere from +3 to +7% over the next month for whatever reason. I want to emphasize that your level of conviction in your outlook for the stock is extremely important; having a strong sense that the stock price has a reason to move up is no guarantee that it will but, without that, you are simply playing craps with your investment portfolio.

For this example, let’s suppose that Microsoft is currently trading at $245, and you are expecting the stock price to increase to $265, a roughly 8% increase, in one month because you are expecting them to report gangbuster earnings (or some other catalyst).

Let’s first construct each type of bull option spread, and then compare them against each other among several important dimensions.

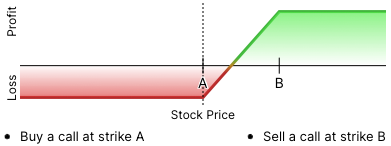

1. The Bull Call Spread

Construction of the bull call is pretty straightforward. We simultaneously buy an out-of-the-money (OTM) call and sell an even more OTM call. The sale of the second call reduces our out of pocket cost, but does limit our profit in the event that the stock price exceeds even our most bullish expectations. Going back to the Microsoft example,

Current MSFT stock price: $245

Buy 1 Month Call $255 Strike Price: -$4.65

Sell 1 Month Call $265 Strike Price: +$2.00

Net Difference -$2.65

Our cost per contract is the difference between the two calls, $2.65, times 100 or $265.

The good news is that this is the most we can lose on this trade. Our maximum profit in any bull call spread is simply the difference between the 2 spreads times 100, minus our cost.

Since there’s a $10 difference between $290 and $300, the math is very simply,

($10 x 100) – $265

$1000 – $265 = $735 per contract

That’s a whopping 185% return on our original investment, assuming that the stock price in one month is $265 or higher, requiring an increase of +8% in the underlying price. A very nice 30 day return indeed!

Now, keep in mind that we will lose our entire $265 if the stock price is at $255 or below at expiration, and for us to just breakeven, we need the stock price to be at $257.65, which is 5% above today’s price level.

Now let’s look at the other kind of bull spread option trade…

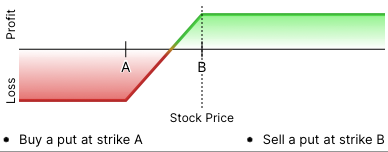

2. The Bull Put Spread

As always with options, the puts are just a mirror image of the call trade. We basically sell an ATM or slightly OTM Put and buy an even more OTM Put. Because the higher put will be worth more, this transaction creates an immediate credit, or premium that we will put in our pocket immediately.

Going back to our current example,

Sell 1 Month Put $240 Strike Price: +$6.90

Buy 1 Month Put $230 Strike Price: -$3.90

Net Difference +3.00

Doing this transaction will put $300 into our accounts today.

Yes, you’re reading that right. That’s immediate capital that we can spend today or, more likely, that we will want to keep in reserve. Because this represents the MAXIMUM profit that we will earn from this trade, which we will get to keep in our accounts so long as the price of MSFT is above $240 one month from now.

But… we are much more exposed if MSFT’s stock price goes down, with us incurring the maximum loss if the price declines to $230. Below that level, our losses are capped by the put that we purchased at $230.

The formula for profits with the bull put spread are easy: the stock merely needs to finish above $240 at expiration for us to keep 100% of the $300 we made in premiums on Day One. If it finishes below that, however, we will incur a loss of $10 for every $.10 below $240, up to a maximum loss of -$700 at $230 (or lower).

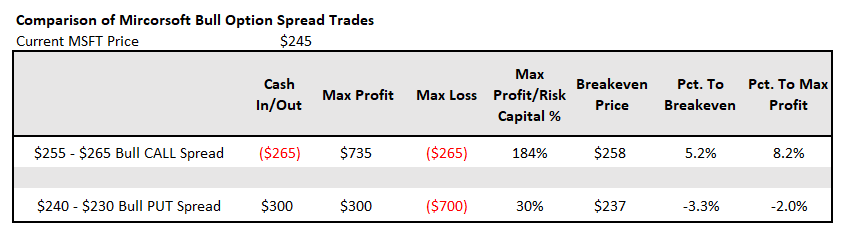

Let me summarize the key statistics of each trade in a table to more clearly illustrate the differences between the two strategies.

As you can easily see, there are some important differences in the potential returns and risk profiles of these two strategies. Take a while to study these and, in the next installment in this series, I will evaluate both strategies and make the case for which version of the bull call options spread represents the superior strategy – most of the time.

All about risk. Bull call sounds best to me