The Strategy John Malone Uses to Generate Income

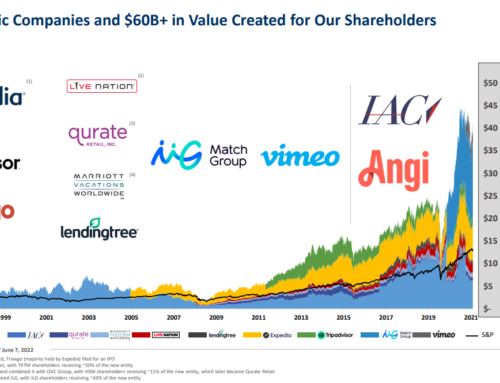

John Malone is one of the best operators and investors in the world.

He is profiled in value investing cult favorite The Outsiders.

Malone is best known today for running the Liberty Media complex, but he started his career in the cable industry at TCI.

Here’s a quote from The Outsiders:

“From his debut in 1973 until 1998 when the company was sold to AT&T, the compound return to TCI’s shareholders was a phenomenal 30.3 percent, compared with 20.4 percent for other publicly traded cable companies and 14.3 percent for the S&P 500 over the same period.”

My favorite investor, Joel Greenblatt, wrote about him in You Can be a Stock Market Genius.

I’m writing about John Malone for two reasons.

Reason #1: He recently employed one of my favorite options strategies.

Reason #2: He employed the above strategy to gain exposure to one of my favorite stocks.

First let’s talk about the strategy.

Naked Put Selling

Before I get into Naked Put Selling, I just want to emphasize that you should never sell naked puts on thocks that you don’t want to potentially own.

Selling a Naked Put just means that you sell a put option with a strike price below the underlying current stock price.

This has two benefits:

Benefit #1: You generate current income.

Benefit #2: If your put option gets exercised, you establish a cost basis in the stock below the current share price.

Warner Brothers Media (WBD) and John Malone

Warner Brothers Media (WBD) is one of my favorite current spin-offs.

It was established when AT&T (T) spun off Warner Bros and merged it with John Malone’s Discovery.

The basic investment pitch is as follows:

- The Warner Bros. combination with Discovery created an attractive media asset that is well positioned in the near, medium and long term.

- $3.5BN synergy target by 2024 is achievable and likely conservative.

- Management team is highly incentivized to increase WBD’s share price.

- At 12x current FCF, WBD’s stock looks cheap on an absolute and relative basis.

Mario Gabelli agrees. Here’s Mario from a recent Barron’s article:

Now let’s turn back to John Malone…

Back in November, John Malone sold 20,000 naked put contracts with a strike price of $10 and expiration May 15, 2023 for $1.18.

What does this mean?

It means:

- Malone received $2,360,000 of cold hard cash in November.

- If WBD closes below $10 on May 15, 2023, Malone will have the obligation to buy 2,000,000 shares at a price of $10 per share.

But because he has already collected $1.18 per contract of income, his effective cost basis would be $8.82 ($10 – $1.18).

I love Malone’s approach because it’s a win win.

Either he gets to keep $2.35MM of cash

Or he gets to buy a stock that he loves at a ridiculously cheap price (implied valuation of 7.1x free cash flow).

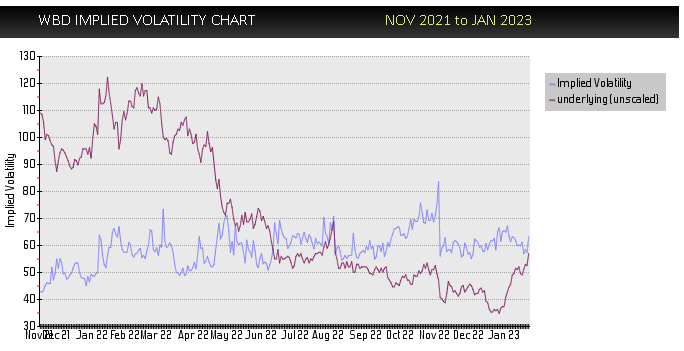

Finally, Malone sold the put contracts when WBD implied volatility was peaking.

Options are more expensive when volatility is high so in hindsight, this trade looks even more brilliant.

Interested in options trades like this?

Next time we open enrollment, you will be the first to know.

Leave A Comment