Dividend As A Catalyst

One of my favorite spin-off strategies is the “dividend as a catalyst” trade. Here’s how it works: Identify a spin-off that will be indiscriminately sold, determine the expected dividend yield, wait to buy until 30% of shares out have traded and the stock is trading at attractive implied dividend yield, sell after dividend is initiated and the stock re-rates.

Now for case study #1 :

In 2019, VF Corp spun off denim manufacturer, KTB. After reading the form 10, I determined that this was a stock that I would own at the right price and that indiscriminate selling was likely (massive difference between the market cap of the parent and spin). But what about the dividend?

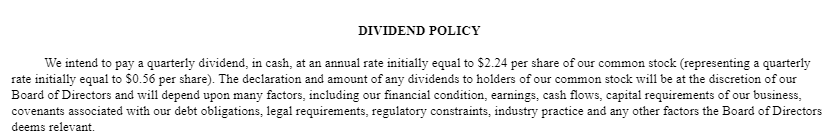

On Page 56 of the Form 10, I stumbled upon this gem: The company had committed to pay a $2.24 annual dividend.

Once regular way trading began for KTB, it sunk like a rock as expected. So I waited…

On June 6 after 86% of shares out had traded, KTB traded below $30, and I was able to recommend (and buy!) it at $29.41, an implied dividend yield of 7.7%. At the time, no other apparel co paid big dividends. HBI had the biggest yield at 3.8%. But 7.7% was JUICY. Once the dividend was declared, I knew the stock would rip. What happened? Well, I was a little early. The stock ended up bottoming at $26.50. But two months later, KTB declares its first dividend, and the stock took off. Within 6 months it was above $40 (+36%).

Now for case study #2 :

In September ’21, Prudential PLC spun off JXN. There would be some serious indiscriminate selling. Here’s how I knew:

1) Massive difference between the market cap of parent and spin

2) Extreme distribution ratio of 1:40

3) This was a UK company spinning off a US company

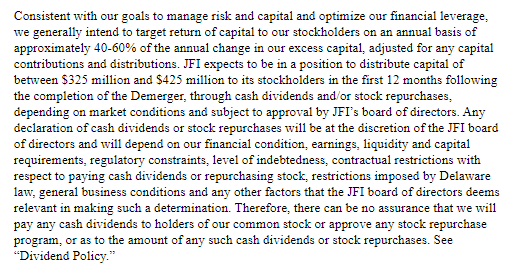

JXN‘s dividend policy was disclosed in its Form 10. Its goal was to distribute $375MM (at the midpoint) to shareholders through dividends and buybacks. Splitting that evenly implied an annual dividend of $187.5MM.

How do you determine the percentage of shares out that have traded after spinoff?