How Peter Lynch Beat The Market

Peter Lynch is known as one of the best stock pickers of all time. At Fidelity’s Magellan Fund, he averaged an astonishing 27.9% return over the course of 13 years. He also was a notorious fan of spin-offs.

Here’s what Lynch looked for when picking stocks.

Look for Inefficient Markets

To find undervalued opportunities in the market, one has to look where the inefficiencies are. Areas without coverage and institutional investments are predestined to offer such opportunities.

Investors are obsessed with growth, but growth isn’t a necessity for a great investment. Spun-off companies often improve margins because there’s more focus on their business than before. Turning a 1% margin into 5% leads to a 5x increase in earnings. No revenue growth is needed.

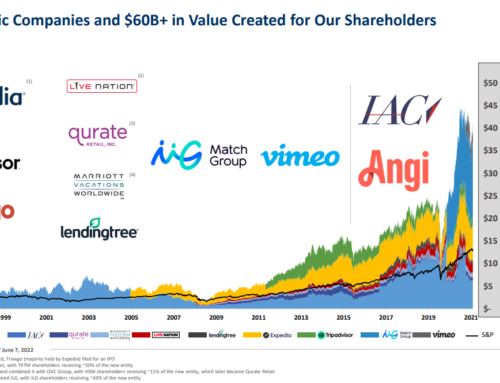

One-time events that result in a significant change for a company often create inefficiencies. The changes might be overlooked or misjudged by others. Examples of such events are Spin-offs, Mergers, Bankruptcies, or even stock buybacks.

Follow the Insiders

Insiders, by definition, have an edge on the average investor. That’s why it’s important to follow their actions. Lynch cares more about insider buys than sells. He famously wrote, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.” While I think this is right, it is usually a big turnoff for me if I see a stock with elevated insider selling.

Besides insider buys/sells, you can also glean other useful information from their actions. For instance, sometimes the CEO of the parent will go with the spin-off. This can be an important investment signal.

Unpopular Stocks

Nobody likes to own unpopular stocks. It’s a lot more fun to own high fliers like Apple (AAPL) and Tesla (TSLA). But “down and out” stocks can create attractive opportunities, especially, if the fundamentals have started to accelerate yet the stock price doesn’t reflect that improvement.

Being on the lookout for investment that fulfill one or more of the above-mentioned criteria will significantly improve your chances to generate attractive returns.

Leave A Comment