3 Biggest Takeaways From Joel Greenblatt‘s Special Situation Class

Joel Greenblatt‘s Special Situation Classes at Columbia University are a great source for practical investment advice. Today, we‘ll take a look at what he learned from different Spin-Off situations he discussed in his class.

1. Complicated, Messy, Obscure

Joel Greenblatt focuses on situations that seem to be complicated, messy, and obscure. “Opportunities are good when you understand why people are missing it.” You then have to ask: “What’s really going on here?” In one class, Greenblatt describes a situation concerning a firm called Liberty Media. In that situation, the question “What’s really going on here?” was answered with a lifelong lesson.

The CEO of the firm purposely made the situation look highly complex. Why would he do that? Because he was heavily incentivized to do it. The lower the stock price was in the first weeks of trading, the more stock he got out of his options. It was beneficial for him to make the spun-off company seem complicated and unattractive.

That’s an often-overlooked factor when assessing management and insider actions. We know to look whether they buy or sell stock but we pay too little attention to what else their actions might tell us.

Pay close attention to the incentives of the management. And, a rule of thumb, the more purposely complicated the situation, the higher the chance for an opportunity.

2. Simplicity

Considering Point 1, this might sound paradoxical at first, but I promise, it’s not. Above, we talked about how situations often seem complex when they hide great opportunities. Now, it’s not about how they seem to be but how they are. A good investment idea doesn’t need 40 pages of analysis to be made clear.

A good investment idea can be explained in 2 minutes. And those are the ones Greenblatt is looking for. And while this sounds obvious but rather unrealistic, these situations exist quite frequently. Remember, we look at situations that seem to be obscure, so other people don’t even look there.

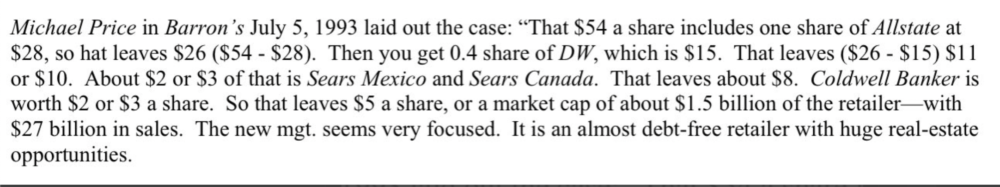

In his class, Greenblatt presented an interesting example of this. It’s about a company called Sears in the early 1990s. Sears decided to partially spin off some subsidiaries, Dean Witter and Allstate. Just before the spin-off, this was the situation: DW’s stock was valued at $37, Allstate’s stock at $29. Sears stock is trading at $54. For every Sears share, shareholders would receive 0.4 DW shares and 1 Allstate share. The math was pretty easy and was even shared by Michael Price in Barron’s (picture below). Still, this opportunity continued to exist. Because it seemed complex and messy at first sight.

Many situations seem more complex than they actually are, that’s why they keep existing. That’s also why you can stay picky and wait for great and simple opportunities. Partial spin-offs and other unpopular situations can offer such great opportunities.

3. Do your own Research

If you get drawn into the stories people and the media express on these obscure situations, you’ll never invest there. Because, obviously, they’ll be negative and incomplete, that’s why this works in the first place.

So you have to look at it for yourself, also using all the things we discussed today. Figure out if it makes sense for anyone to let this situation look worse than it is. Figure out if it actually is complex or if it’s quite easy behind the surface.

Make it a habit to look at it “from 40,000 feet apart”, as Greenblatt says. What this means, is to look at things from a different angle, to look at the bigger picture, to take a different perspective than other investors.

That’s it for today. I hope you learned something new and enjoyed reading this!

Thanks Ritchie, Your Dad told me about his book when we were fishing a couple of years ago. BL