Joel Greenblatt Podcast

Joel Greenblatt is my favorite investor.

He specializes in special situations and generated 50% annual returns for a decade.

Whenever he’s interviewed, I drop everything and listen in.

Greenblatt was recently interviewed on the Investor’s Chronicles podcast.

The whole interview is interesting, but my favorite section was towards the end when the host asked Greenblatt whether he still likes spin-offs.

In my latest article, I share Greenblatt’s fascinating answer.

My first book I wrote is called, ‘You Can Be a Stock Market Genius’ and about 40% or 50% of it was about spin-offs.

The question is why.

I’m writing another book and the example I use to describe spin-offs is the following.

Suppose there was a law that said that every time you bought a house in New York you also had to buy one in Cleveland.

And every time you bought a house in Cleveland, you also had to buy one in New York.

The combined value of those two houses would be one price.

Now assume that the law was suddenly repealed

Now, the highest and best buyer for the house in New York could just buy the house in New York.

And the highest and best buyer in Cleveland could buy the house in Cleveland, the combined value of those two houses would go up.

Because you aren’t forced to buy something that you don’t want.

And that’s really one of the great things that happens during a spin-off.

The highest and best buyer for each one of those businesses can come in and buy it.

The other thing is that management usually doesn’t like to cut its empire in half or a third or get rid of assets that it controls.

They are usually conglomerating and adding to their kingdom

When you are separating, you are doing something usually selfless for yourself and to help shareholders.

Why would you do it other than you think shareholders will come off better off.

Or the businesses will operate better. Or to incent management better.

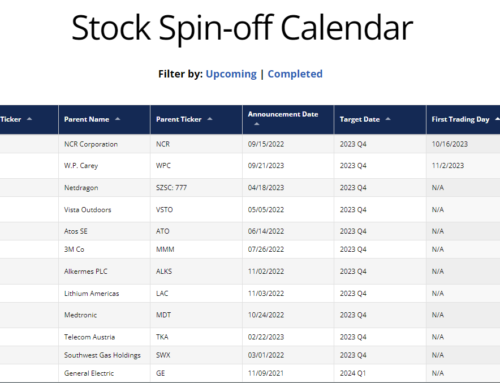

There’s a million reasons why spin-offs make sense. And why value is created usually in a spin-off transaction. Also, the opportunity obviously for spin-offs is always there because these are two companies that have never traded by themselves.

But the shareholders of the combined companies are getting one of the companies that they didn’t want, probably. And they are generally now selling. So there’s an opportunity there too.

Typically when a company goes public there is a big roadshow. The company is saying how great it is. Companies don’t usually go public when things are going badly. That doesn’t happen in spin-offs.

You are getting a new company that isn’t hyped.

Maybe it’s undervalued or misvalued or not even followed.

I could write at least half a book about that and I did. It’s a fertile area to look for opportunities.

They could be overpriced too because they aren’t followed well.

They could be underpriced or overpriced.

I would just say it is a fertile ground to look for opportunity.

My favorite investing book is You Can Be a Stock Market Genius.

Here’s a link to the full podcast episode:

https://shows.acast.com/investorschronicle/episodes/ic-interviews-joel-greenblatt

Leave A Comment