ConAgra is spinning off Lamb Weston Holdings, its frozen potato business (think french fries). Joe Cornell did a nice job summarizing the pending spinoff in Forbes.

The ticker will be LW and when issued trading will begin imminently. Regular way trading will begin on November 9th.

ConAgra has been under pressure from Activist investors (Jana) to increase shareholder value. As such, it sold its private label business to Treehouse Brands and is in the process of spinning off Lamb Weston.

For background, here is the spinoff presentation and Form 10.

Lamb Weston can be viewed as a “good” business. Oftentimes, spinoffs are corporate misfits in secular decline (oftentimes this perception creates indiscriminate selling and an opportunity). This is not the case with Lamb Weston.

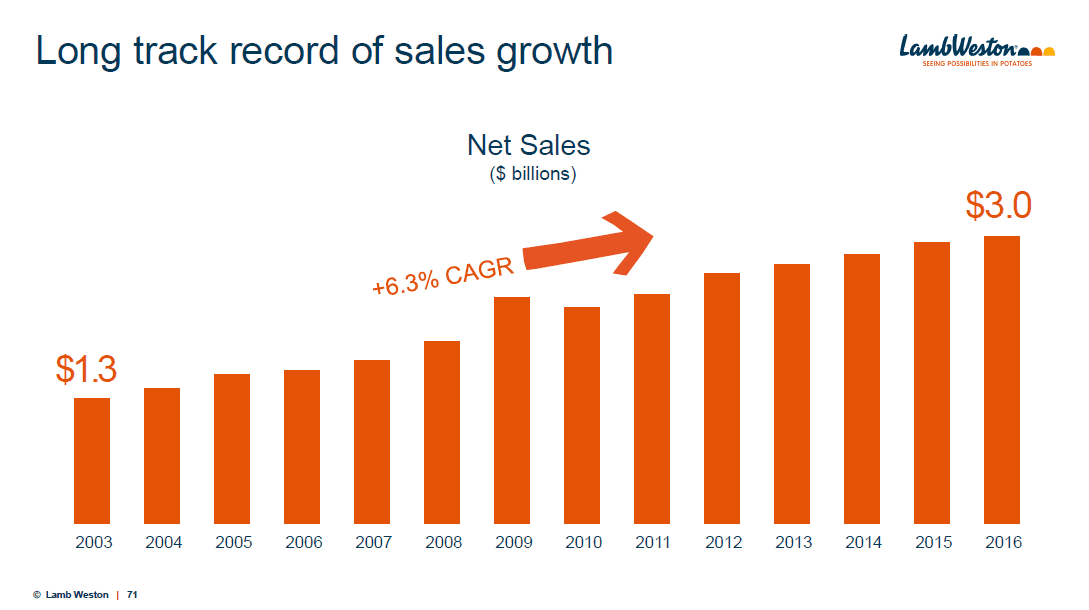

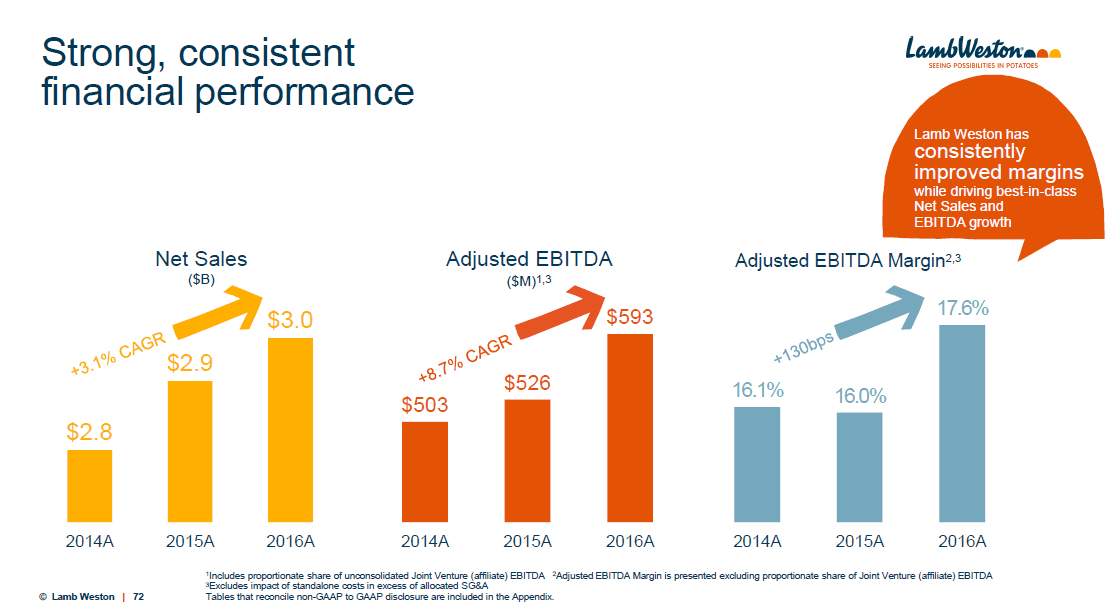

As seen in the chart below, LW has done a nice job of growing sales:

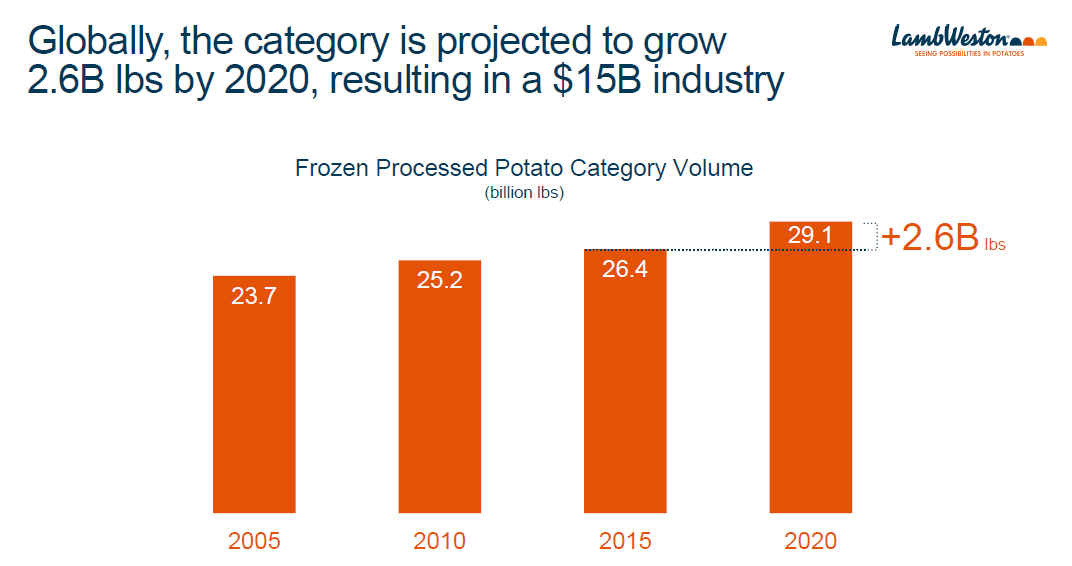

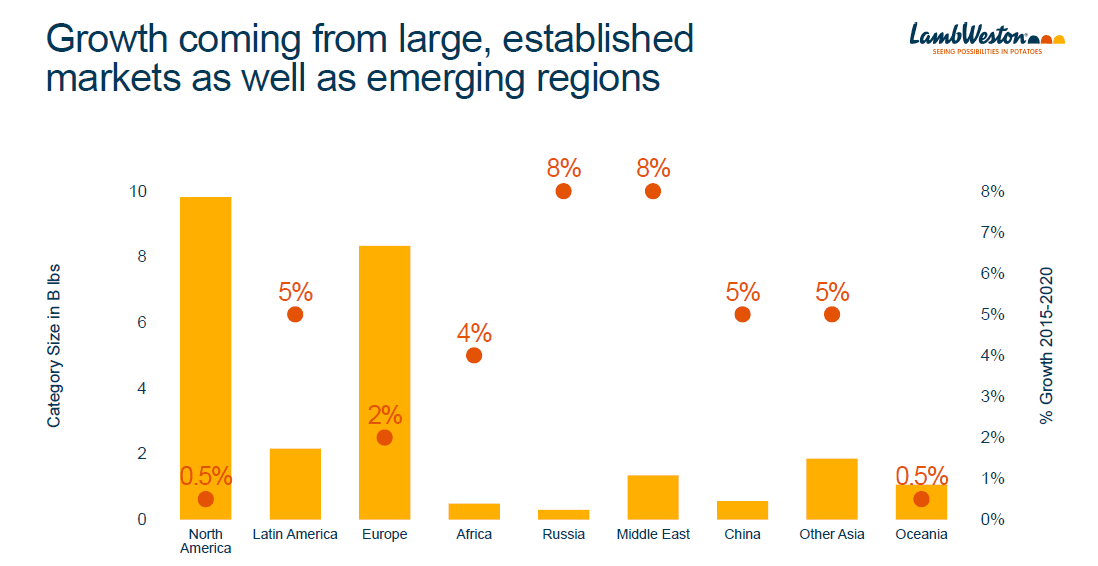

The frozen potato market is expected to continue to grow:

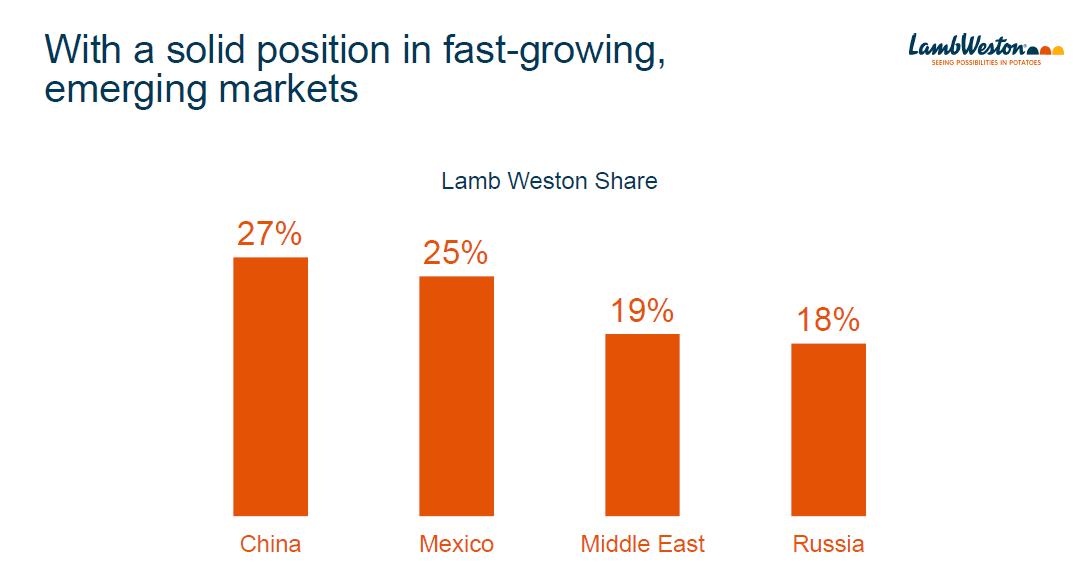

This is somewhat surprising to me. With everyone’s focus on health foods, I’m shocked that the potato market has experienced such growth. The growth is increasingly driven by the emerging markets where LW has strong market share.

Also, EBITDA and EBITDA margin have been growing:

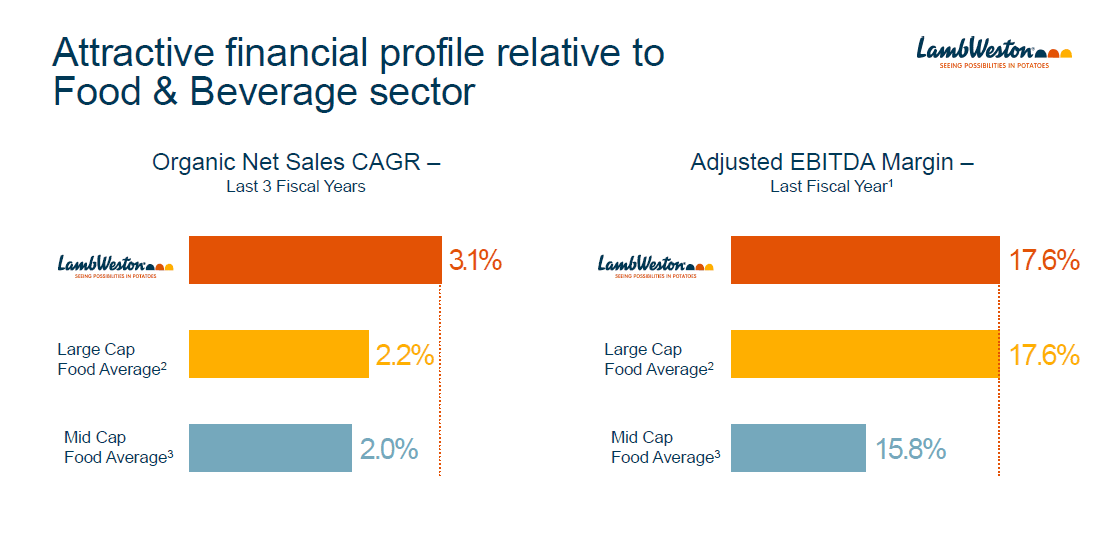

Finally, LW believes its organic growth and margins are ahead of peers:

So how much is LW worth?

It was widely reported in the press that ConAgra almost came to terms to merge the division with Post at a $6bn valuation. So this is a decent place to start. Check out the article for background.

According to LW’s spinoff presentation, in fiscal 2016, LW generated $593mm of EBITDA. For next year, management expects “mid to high single digit growth.” Assuming 6% growth, the $593mm of EBITDA grows to $628mm. LW also estimates that the annual cost of being a public company will be $15mm to $25mm (in Form 10). So I back out $20mm of costs and get an estimate of $609mm in 2017 EBITDA.

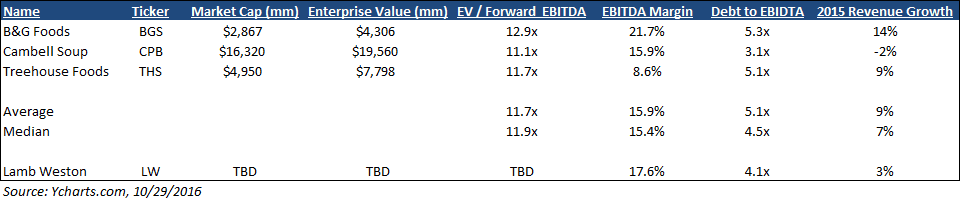

What do peers trade at?

Some good comps for LW are specialized food services companies such as B&G Foods (BGS), Cambell Soup (CPB) and Treehouse Foods (THS).

As seen in the chart below, they trade at a median EV to Forward EBITDA of 11.9x. LW’s margin, leverage and growth profile look to be in the same ballpark. In the chart, LW’s growth looks a little lower than its peer group. However, this isn’t a fair characterization as B&G Foods and Treehouse Foods have been very acquisitive. LW’s management believes its organic growth is ahead of peers so I think its fair to assume that the company’s growth prospects are at least in-line with peers.

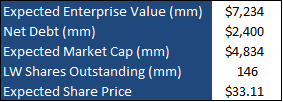

Thus, a 11.9x forward EBITDA multiple seems fair. Applying that multiple to my 2017 EBITDA estimate of $609mm yields an enterprise value of $7.2bn. This is a little below the $6bn valuation mentioned in press reports.

Backing out $2.4bn of debt yields an expected market cap of $4.8bn and a ~$33 share price. See the math below.

Will there be indiscriminate selling? It is tough to say for sure.

On the one hand, Lamb Weston’s market cap (most likely less than $5bn) will be significantly less than CAG’s current market cap of $21bn. Also, CAG is a member of several indices. Thus, we could see some selling pressure. On the other hand, Lamb Weston’s business is solid and defensive and thus, should be attractive to investors.

We will see!

Leave A Comment