Since our initial recommendation of Liberated Syndication (LSYN) in December 2016, the stock has increased from $0.44 to $1.57 (as of April 3, 2018) for a 257% return. We are closing out our BUY recommendation as we believe the stock is fairly valued and better risk-reward opportunity can be found elsewhere. This isn’t an urgent sell recommendation, but we would recommend gradually selling down LSYN positions.

What is the state of LSYN right now?

There are positives and negatives. First the positives:

(1) Liberated Syndication’s business continues to do incredibly well.

In 2017, revenue grew 20.4% to $10.6MM and adjusted EBITDA grew 46.4% to $4.1MM as adjusted EBITDA margins expanded from 32.0% to 38.9%.

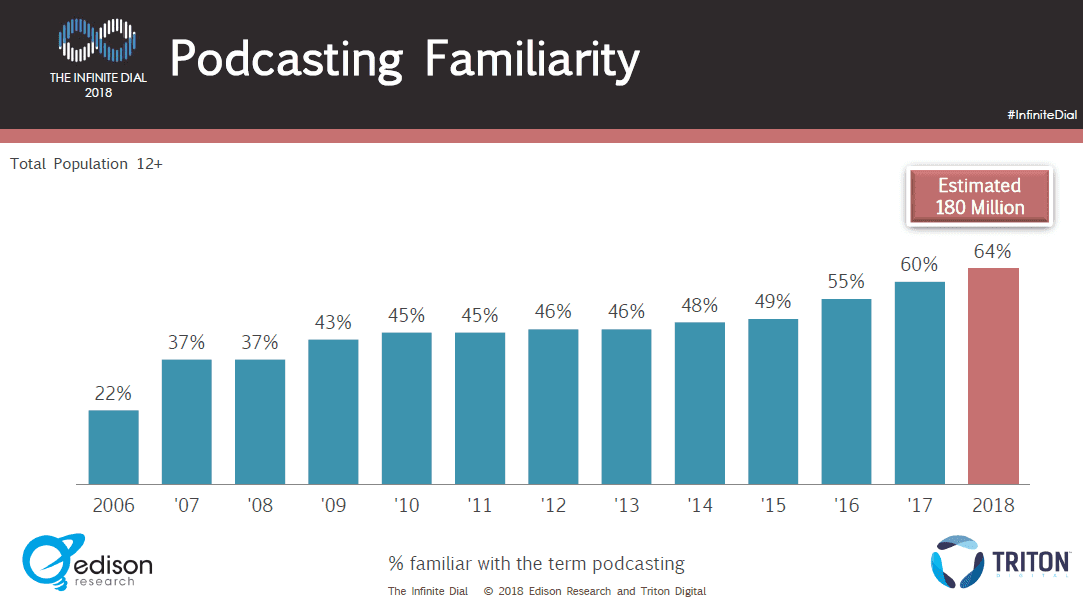

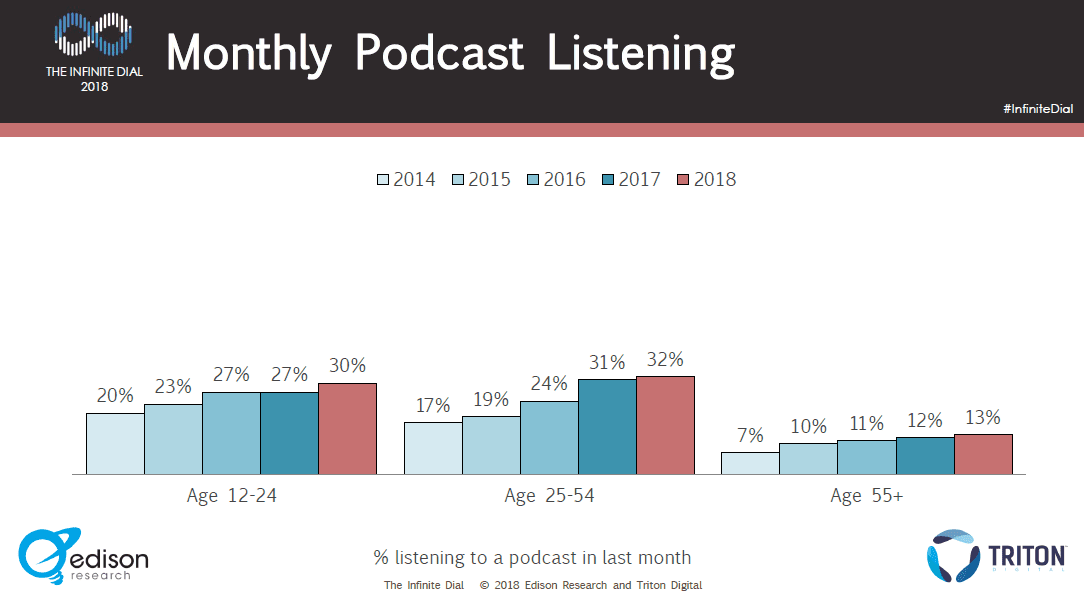

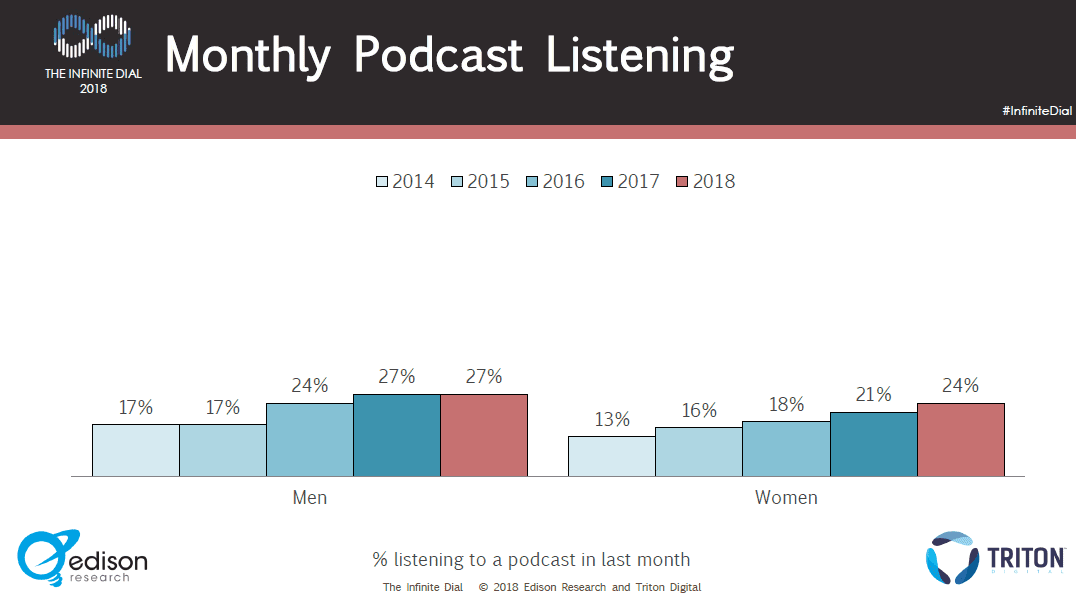

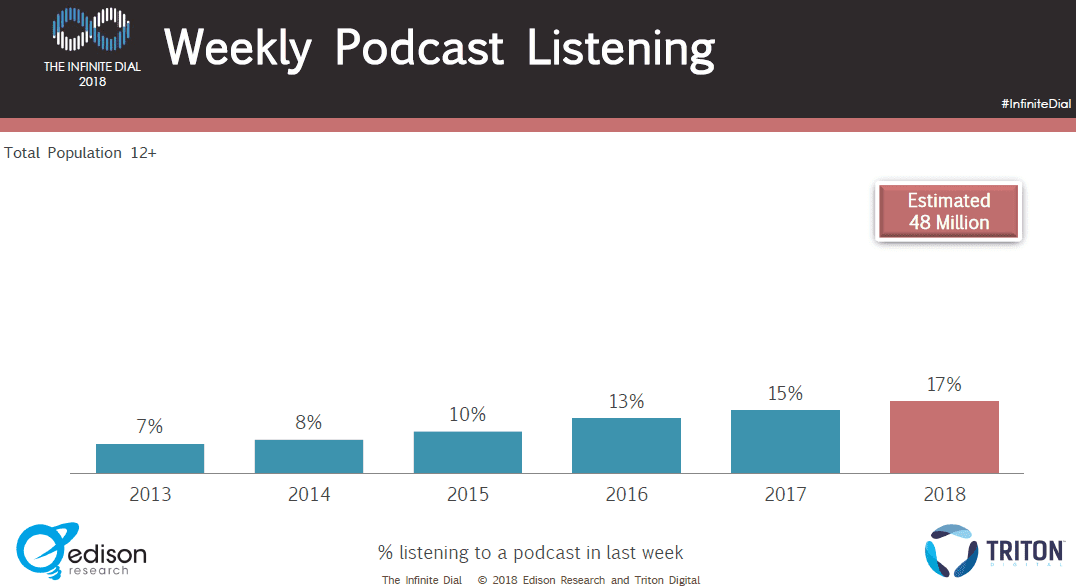

(2) The podcasting market continues its secular growth and LSYN is a direct beneficiary.

Check out key trends below taken from the 2018 Infinite Dial’s annual report. The key take-away for me is that podcast consumption is experiencing secular growth but remains relatively under penetrated (only 17% of the population listens to podcasts on a weekly basis).

(3) Nasdaq up-listing

LSYN has noted in quarterly filings and a recent press release that up-listing its stock from the OTC markets to the NASDAQ remains a priority for the company. This would be a significant positive catalyst for the stock. Further, significant management stock awards will expire if the NASDAQ up-list hasn’t occurred by January 18, 2019 (for example, the CEO would lose 375,000 options currently in the money by $1.07).

Now the negatives:

(1) Management compensation

Management and the board of directors issued themselves 6.25 million shares of restricted stock in 2017, diluting equity holders by 30%! Some of the awards were tied to an eventual NASDAQ up-listing and some were tied to split adjusted share price targets but 2.7 million shares issued earlier in the year were tied to market cap goals which looked good at first blush but can be easily achieved by issuing additional restricted stock for equity compensation (which management did later in the year) and by issuing shares to make an acquisition (more on that below).

(2) Pair Networks Acquisition

At the end of the year, LSYN announced that it had acquired a company called Pair Networks (Pair). Pair is a small privately-owned, Pittsburgh, PA based, internet hosting company that saw revenue declines of 5% in 2016 and 2% in 2017. LSYN paid 5.5x 2017 EBITDA (according to management) and 8.6x 2017 FCF (from the financials) and financed the acquisition with debt, cash on hand, and 1.5 million of newly issued shares.

So where does this leave us?

If LSYN hadn’t made the acquisition, LSYN would have ended the year with a $44.3 million market cap (based on a $1.58 share price on December 29, 2016). We project LSYN would have ended the year with $8.6MM of net cash implying an enterprise value of $35.7 million. In 2017, LSYN earned EBITDA of $4.1MM and so at year-end, LSYN was trading at 8.7x 2017 EBITDA. We project that LSYN on a standalone basis would earn $5.3MM of 2018 EBITDA and was trading at 6.7x 2018 EBITDA. Very cheap for a pure play podcasting company expected to up-list to the NASDAQ growing revenue 20% per year.

What does the company look like now on a pro-forma basis?

The press release announcing the acquisition noted that the combined company accounts for $23MM of revenue and $7MM of EBIDTA. What about 2018? Well a week ago, LSYN released another press release guiding the company to generate $23MM of revenue and $7MM of EBITDA in 2018. So flat revenue and flat EBITDA in 2018. Perhaps management is being incredibly conservative, but this guidance is very disappointing. If we assume LSYN’s podcast business would have maintained its 20% revenue growth in 2018, management’s guidance implies that the Pair revenue will decline by 14% to $10.3MM. If we assume LSYN’s podcast business would have grown EBIDTA to $5.3MM (our projection) in 2018, management’s guidance implies that Pair EBITDA will decline by 41% to $1.7MM.

After the acquisition related shares and debt that were issued, LSYN’s enterprise value is currently $48MM. So the company is trading at 6.9x 2018 EBITDA. This seems like a fair valuation for a lower middle market business with no expected revenue and EBITDA growth in 2018. Perhaps it is slightly cheap given the margin profile of the business, its exposure to continued growth of podcasting, and the expected NASDAQ up-listing. But it is definitely not a screaming buy at these levels.

Just to sum up, LSYN pre-acquisition was growing revenue 20% per year and trading at 6.7x 2018 EBITDA. LSYN post-acquisition is not growing revenue and trading at 6.9x 2018 EBITDA. It seems obvious that the Pair acquisition was a poor decision and that LSYN would have been much better off buying back shares (it could have bought back ~36% of the company!).

Conclusion

When we originally recommended the stock, it was trading at 3.1x earnings. At that time, LSYN was a pure play, market-leading podcast hosting company growing revenue 20%+ with 32% EBITDA margins.

After a strong 17 month run for LSYN’s stock, we are closing out our BUY recommendation with a 257% gain. To be clear, this isn’t an urgent sell recommendation (we still own shares) as the expected NASDAQ up-listing remains a significant catalyst, the current valuation (6.9x 2018 EBITDA) is reasonable, and (perhaps) management is being incredibly cautious with its guidance.

But we think the easy money has been made and would recommend gradually selling down LSYN positions as there are better risk reward opportunities elsewhere in the market.

Disclosure: We still own LSYN shares but plan to use share price strength to gradually wind down our position.

Leave A Comment