Spin-offs with Insider Buying (September 2021)

In One Up on Wall Street, Peter Lynch wrote:

[Spin-offs] are a fertile area for amateur investors…….A month or two after the spinoff is completed, you can check to see if there is heavy insider buying among the new officers and directors. This will confirm that they, too, believe in the company’s prospects.

With that as a backdrop let’s see which spin-offs have recent insider buying.

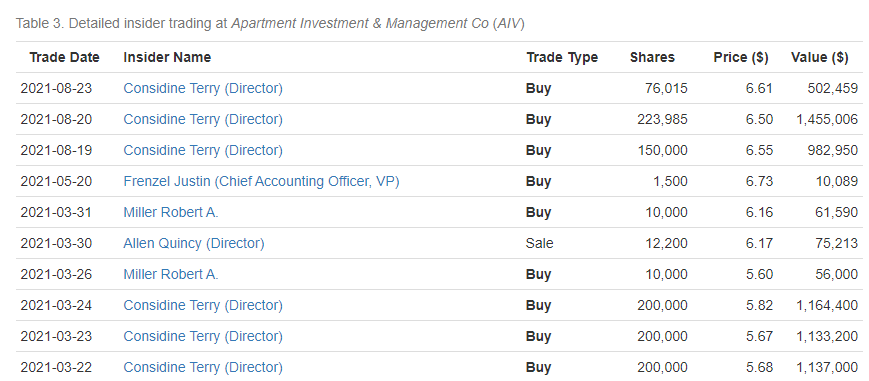

Apartment Investment & Management (AIV)

Apartment Investment & Management (AIV), known as Aimco, spun off Apartment Income REIT (AIRC), in December 2020.

At the time, the RemainCo, AIV, looked more interesting given it was the smaller of the companies and experienced some indiscriminate selling (it got kicked out of the S&P 500).

AIV is a real estate development company with a hodgepodge of assets.

This VIC article lays out the bull case nicely (must create a free account to read). In summary, NAV is likely above $10 and could be as high as $16. Meanwhile, incentives are aligned for a good outcome.

We have seen pretty consistent insider buys since the spin-off, especially from CEO, Terry Considine.

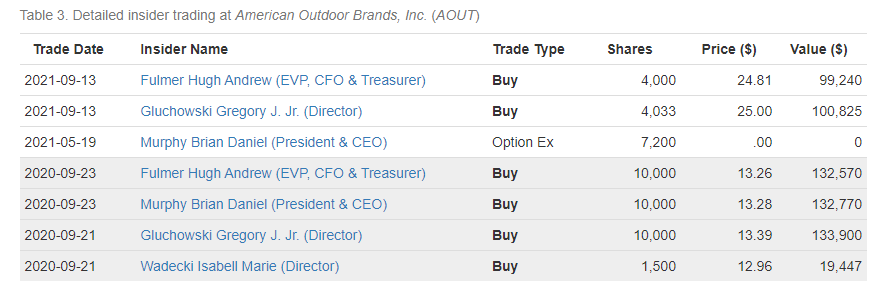

American Outdoor Brands (AOUT)

American Outdoor Brands (AOUT) has performed well since its spin-off from Smith & Wesson (SWBI) in August of 2020.

The company benefited from increased interest in outdoor sports (hunting, hiking, camping, etc.) due to the pandemic and revenue has soared.

The company revenue reported a strong quarter with ~20% revenue growth, but guidance for the remaining year implies ~2% y/y revenue growth given difficult pandemic comps. This looks conservative.

The company is benefiting from increased e-commerce penetration, international growth, and new product launches.

Valuation is not demanding at 12x forward earnings. I don’t own this name, but it’s high on my watch list.

Arconic Corporation (ARNC)

Arconic is a name we’ve covered in the past. It was spun out of Howmet Aerospace (HWM) at the beginning of the pandemic.

It is focused on global rolled products, aluminum extrusions, and building and construction systems. Think large customized sheets of aluminum for automobiles and airplanes.

Arconic also has an ESG angle as aluminum is viewed as more environmentally friendly (and stronger!) than steel.

The stock has performed well (it was spun off at the start of the pandemic) and should benefit from a recovering economy in 2021.

It’s not expensive trading at 5.9x forward EBITDA. It’s closest peer Kaiser Aluminium (KALU) trades at 10.0x forward EBITDA. On a forward PE basis, Arconic.trades at 15x versus KALU at 24x.

And insiders stepped in aggressively in August to buy in the open market.

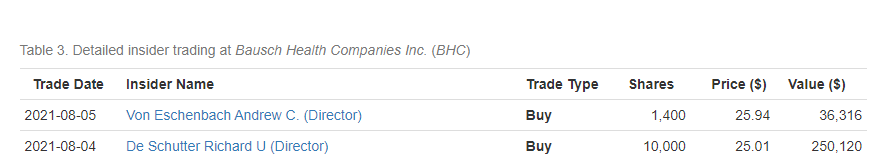

Bausch & Lomb (BHC)

Bausch & Lomb is going to spin off its contacts brands (Bausch & Lomb) within the next 6 months and this could be a nice catalyst for shares to re-rate.

The combined company trades at 9.6x forward EBITDA, but Alcon (the spin-offs best comp) trades at 23x forward EBITDA. This transaction should unlock value.

Insiders recently bought shares in the open market in August.

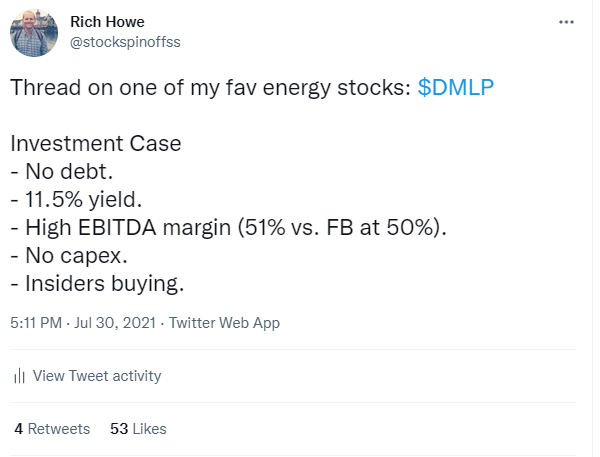

Dorchester Minerals (DMLP)

Dorchester Minerals is a name that I own and like a lot.

I laid out the investment case in this twitter thread.

Insiders have been consistently buying the stock in the open market.

Elanco Animal Health (ELAN)

I made money when Elanco was initially spun off from Eli Lilly in a share exchange a couple years ago.

Luckily I sold because shares have done nothing since the spin-off.

The story is potentially a good one as Elanco has margins that are way lower than Zoetis, its biggest competitor.

But management at Elanco has been distracted by acquisitions and hasn’t executed on the margin expansion potential.

Nonetheless, it’s good to see insiders step up and buy the stock in the open market.

Leave A Comment