Spin-off Links – August 2021

Before we get into this month’s spin-off news I just wanted to highlight some research I did on Thungela Resources.

It is a spin-off from Anglo American, and at first blush, looks unappealing.

However, if you dig beneath the surface, it gets a lot more interesting.

In short, it’s crazy cheap (1.8x ‘21 current earnings), has no debt, and is going to return significant cash to shareholders (has pledged to pay out at least 30% as a dividend). And insiders are buying in the open market.

You can read my analysis here.

I highlighted this pick to my subscribers about a month ago (it’s +54.7% since then), but I think there is a ton more upside ahead.

Be sure to sign up for my premium service so you don’t miss my next pick.

Alright let’s get into this month’s spin-off news….

New Spin-off Announcements

Post Holdings (POST) announced that it will be distributing a significant holding in BellRing Brands (BRBR), an active nutrition business (think protein shakes, bars, etc.). I published some research on it when the initial spin-off happened (IPO of a portion of BRBR).

The current announcement looks really interesting. Post currently owns 97.5MM units/shares (71.2% of shares outstanding) of BRBR. It plans to distribute 78MM shares of BRBR to POST shareholders through a spin-off or share exchange (or some combination of the two). It plans to retain 19.5MM (currently valued at $585MM) units/shares which it plans to exchange to reduce its debt. Prior to the spin-off, Bellring will pay out a special dividend to all shareholders (including Post). How big could the dividend be? I think it would be reasonable to take net leverage to 3.0x to 5.0x EBITDA. Consensus expects 2023 EBITDA to be $284MM. Currently net debt $516MM. A 3.0x to 5.0x net debt / EBITDA multiple for Bellring implies a special dividend of $2.50 to $6.60 per share. The transaction will be finalized in the first half of 2022. And we just saw some meaningful insider buying from Bellring’s management team.

The other interesting angle is Post potentially looks very cheap pro-forma for its spin-off of Bellring. It has a market cap of $7.2BN and its stake in BRBR is worth $3.0NN. BRBR represents 42% of POST’s market cap but only 22% of EBITDA. Post’s remaining business is challenged (exposure to breakfast cereal) but it’s nonetheless an interesting situation. More work to do. Shout out to Low Tide Investments for highlighting this opportunity.

Recent Spin-offs

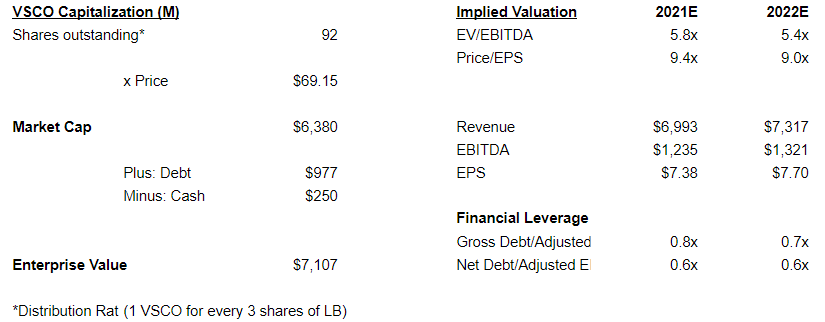

Victoria’s Secret (VSCO) has been an interesting spin-off. It looked really cheap in when-issued trading (at ~$45/share) and traded up massively on its first day of trading.

Most recently, it reported a good quarter, but issued disappointing guidance for Q3 and traded down modestly. Nonetheless, it looks attractive and I think it’s probably worth $80. I think Gap (GPS) is its best comp. Gap trades at 16.4x while VSCO is trading at 9.0x.

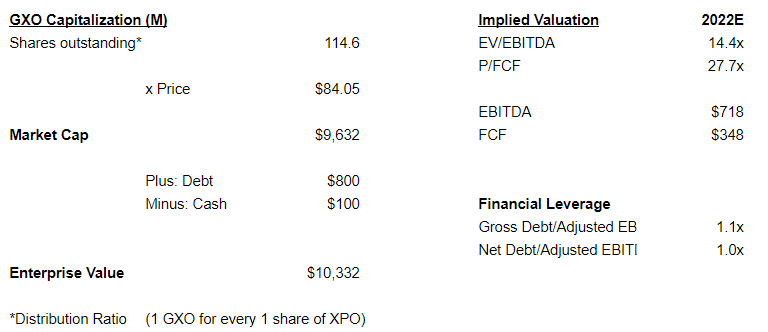

GXO Logistics (GXO), the spin-off from XPO Logistics (XPO), began regular way trading on August 2 and has performed well.

GXO is a supply chain management solutions company that offers tailored solutions to their customers’ businesses. They leverage a broad range of capabilities including ecommerce, reverse logistics and manufacturing support to tackle every logistical need. As an independent company, GXO will be the second-largest contract logistics company in the world, behind only DHL, which is privately held. Here is the company’s slide deck. The business is well positioned and looks reasonably valued, but not compelling, trading at 28x free cash flow.

Upcoming Spin-offs

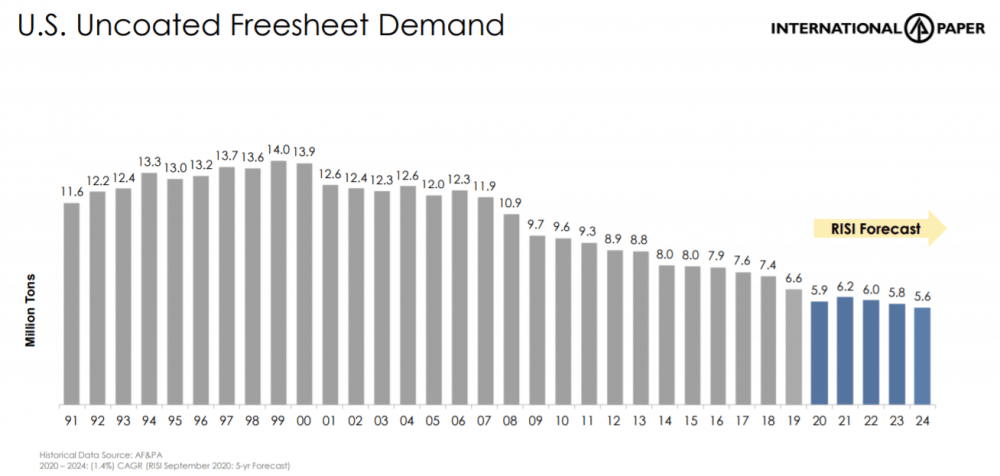

International Paper (IP) is set to complete it’s spin-off of their Printing Papers segment on October 1, 2021. The new publicly traded company will be known as Sylvamo Corporate.

I’m not at all interested in the spin-off probably at any price given their market is in secular decline:

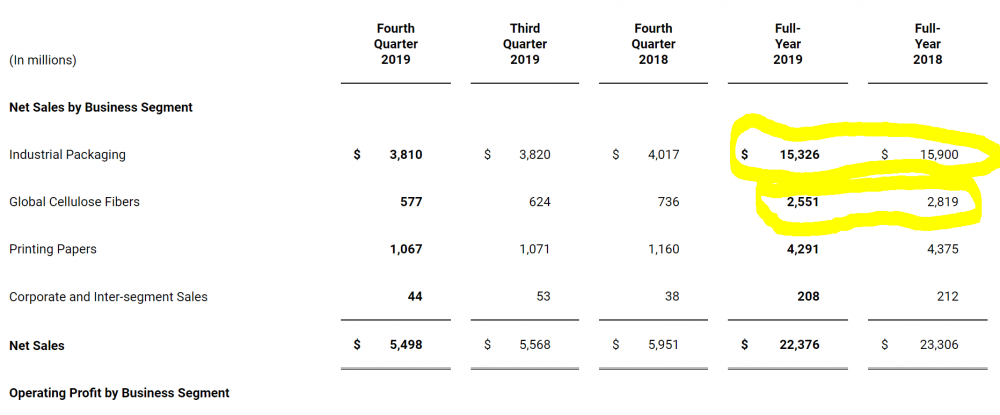

I need to do more work on the RemainCo. In theory, it should benefit from increased e-commerce, and the resulting demand for cardboard boxes. But pre-pandemic, sales were declining (see below).

More work to do, but this one doesn’t look too appetizing.

Spin-off Links

News Corporation: Valuation Disconnect Remains Despite Sensible And Opportunistic Dealmaking

ECN Capital (ECN) to Pay Large Special Dividend

Leave A Comment