Superinvestors and Stock Spin-offs

Joel Greenblatt

“You can make a pile of money investing in spin-offs. The facts are overwhelming. Stocks of spin-off companies significantly and consistently outperform the market averages.”

– Joel Greenblatt, Founder of Gotham Capital, Generated 50% returns annually for a decade

Seth Klarman

“Spin-offs often present attractive opportunities for value investors.”

– Seth Klarman, Founder of Baupost Capital, Legendary Value Investor

Charlie Munger

“Carefully study spin-offs.”

– Charlie Munger, Billionaire investors and right hand man to Warren Buffett

Select Stock Spin-off Studies

Study #1

A J.P.Morgan study of 231 spin-offs and carve-outs between 1985 and 1998 found that during the first 18 months of trading, spin-offs outperformed the S&P 500 by 11.3% while carveouts outperformed by 10.1%

Study #2

In 2013, Credit Suisse took a fresh look at the performance of spin-offs. They analyzed spin-offs from 1995 to 2012. The study showed that spin-offs outperformed the S&P 500 by 13.4% in the first 12 months after the spin-off date.

Study #3

Deloitte and the Edge Consulting Group analyzed spin-offs that occurred between 2000 and 2014. They found that spin-offs generated a 22% return in their first 12 months of trading, outperforming the MSCI world index by 21%.

Study #4

In May 2018, we analyzed the returns of the Bloomberg U.S. Spin-off Index vs. the returns of the S&P 500. We found that the Bloomberg U.S. Spin-off Index generated a 511% return from December 2005 to May 2018, outpacing the S&P 500 by 314%.

Recent Members Only Research

ATMU – Atmus Filtration Spin-off Deep Dive – February 20, 2024

UNTC – Unit Corp to Pay $22.50 in Dividends – December 11, 2023

MURA -Mural Oncology Spin-off Quick Thoughts – November 17, 2023

NATL – NCR Atleos Spin-off Deep Dive – November 6, 2023

GMAA – Buy Gama Aviation – November 2, 2023

GTX – Garrett Motion Q3 ‘23 Results – October 25, 2023

IDT – Updated Investment Case – October 19, 2023

VSTS – Aramark Spin-off (Vestis) Deep Dive – October 11, 2023

VLTO – Danaher Spin-off (Veralto) Deep Dive – September 29, 2023

GEHI – Buy Gravitas Education – September 27, 2023

KVUE – Updated Thoughts on Kenvue – August 29, 2023

JNJ – Buy JNJ – JNJ/KVUE Exchange Offer – Special Situation – July 25, 2023

PHIN – PHINIA Spin-off Deep Dive – June 30, 2023

TSVT – Buy 2seventy bio – June 14, 2023

NXDT – Sell NexPoint Diversified – June 1, 2023

APVO – Sell Aptevo – June 1, 2023

NLTX – Sell Neoleukin – April 21, 2023

MSG Entertainment Spin-off Deep Dive – April 12, 2023

Crane Spin-off Deep Dive – April 6, 2023

iStar / Safehold Merger & STAR Spin-off Deep Dive – March 25, 2023

FTAI Spin-off Deep Dive – August 2, 2022

Glaxo-Pfizer Haleon Spin-off Deep Dive – July 15, 2022

Constellation Software Spin-off (Topicus) Deep Dive – January 30, 2021

Verint Spin-off (Cognyte) Deep Dive – January 28, 2021

Maxeon Solar Spin-off Deep Dive – August 30, 2020

Smith & Wesson Spin-off (American Outdoor Brands) Deep Dive – August 14, 2020

Allgeier SA Spin-off Deep Dive

Carrier Corp Spin-off Deep Dive

Arconic Corp Spin-off Deep Dive

Ensign Group Spin-off (Pennant) Deep Dive

Nuance Spin-off (Cerence) Deep Dive

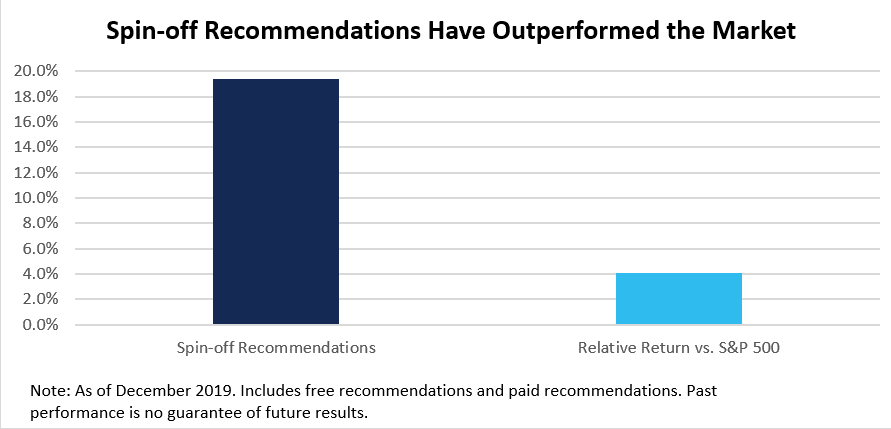

Performance of Recommendations

Additional Spin-off Analysis

Turo: The Next Airbnb?

Turo: The Next Airbnb? One of my favorite stocks is [...]

What will happen to Atmus Filtration (ATMU) after the exchange concludes?

What will happen to Atmus Filtration (ATMU) after the exchange [...]

How to Buy Your Favorite Stock at a Discount

How to Buy Your Favorite Stock at a Discount One [...]

Spin-off Mailbag: How do you get in touch with Investor Relations

Spin-off Mailbag: How do you get in touch with Investor [...]

A “SOTP” Horror Story

A “SOTP” Horror Story Sum-of-the-part or SOTP analysis is a [...]

Spin-off Mailbag: Why Don’t Investors Short All Spin-Offs?

Spin-off Mailbag: Why Don’t Investors Short All Spin-Offs? I got [...]