Stock Spin-off Case Study: Nuvectra – Microcap Spin-off Trading Below Net Cash

Overview

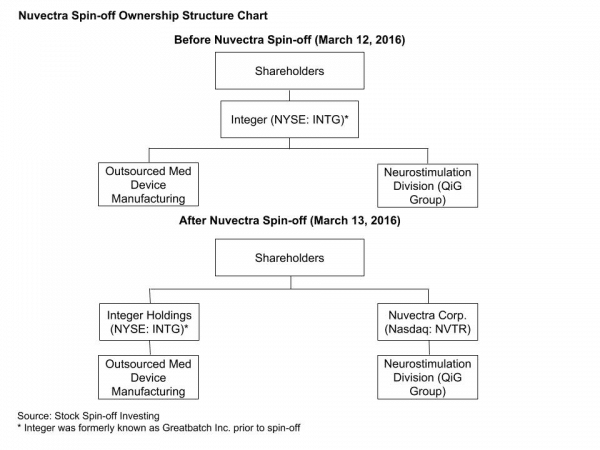

On March 13, 2016, Integer (NYSE: ITGR), formerly known as Greatbatch, Inc, spun off its neuromodulation business, Nuvectra Corporation (Nasdaq: NVTR).

Integer’s core business was outsourced medical device manufacturing. Nuvectra, which was known as QiG Group, was a small money losing division within Integer that was developing a new medical device platform to treat various disorders through neurostimulation (the electric stimulation of tissues associated with the nervous system).

These were very different businesses. While they were both focused on the medical device business, one (Integer after the spin-off) was focused solely on manufacturing medical devices for other medical device companies while the other (Nuvectra) was focused on creating and manufacturing its own medical devices.

Further, Integer has just announced it was making a major acquisition which would require it to take on $1.8BN of debt (significant for Integer, a ~$1.0BN market cap company). Shedding the money losing Nuvectra would improve Integer’s ability to service debt and increase margins.

Nuvectra’s Business Prospects

As discussed above, Nuvectra was focused on creating and manufacturing its own medical devices. At the time of the spin-off, Nuvectra had one product approved, Algovita, which was approved for the $1.6BN spinal cord stimulation market for chronic pain. Algovita generated ~$5MM revenue in 2015, but management expected to grow revenue exponentially as Nuvectra’s sales force was built out. Besides Algovita, Nuvectra had a number of additional products in development. At the time of the spin-off, one sell side analyst (Piper Jaffray) covered the stock and projected revenue of $78MM in 2018.

While Nuvectra appeared to be a high-risk start up, there were a couple factors that suggested Nuvectra had a promising future.

- Integer had invested ~$125MM over 7 years developing the Nuvectra platform (Nuvectra owned 107 patents).

- Nuvectra was well capitalized with $67.6MM of net cash ($6.58 per share).

- Nuvectra already had an approved product that was growing rapidly.

- The CEO of Nuvectra, Scott Drees, had an impressive medical device pedigree. He had 34 years of medical device experience. He recently had been President, Worldwide Sales and Marketing, at Advanced Neuromodulation Systems, a neuromodulation company that was acquired by St. Jude for $1.3BN. Drees would not have been interested in building Nuvectra as a public company unless he had high conviction in its prospects.

- The management team was highly incentivized. Nuvectra’s Form 10 disclosed that the company reserved 1,128,410 shares (11% of shares outstanding) for equity compensation. It further disclosed that the CEO and CFO of Nuvectra had elected to frontload their stock options that would have been granted in years 1, 2 and 3, all into year 1, suggesting that management believed the stock would trade at an attractive initial valuation.

Indiscriminate Selling

Soon after Integer completed its spin-off of Nuvectra, it became apparent that investors were selling the spin-off indiscriminately. This was unsurprising given Nuvectra’s initial $103MM market cap was prohibitively small for most institutional investors.

Nuvectra began trading on March 14, 2016 at $10 per share and sold off 26% to close the day at $7.38. Shares bottomed at $4.02 on March 18, 2016, 60% below where they had traded just four days earlier, and 38% below the company’s $6.58 of net cash per share.

Valuation

Replacement Value

As discussed above, Integer had invested ~$125MM into developing the Nuvectra platform. One could argue Nuvectra was worth at least what Integer had invested into it plus cash on hand. $125MM + $67.6MM = $192.6MM or $18.77 per share.

Price to Book Value

At the time of the spin-off, Nuvectra had a book value of $112.8MM. Medical device peers traded at a price to book value multiple range of 1.3x to 12.8x. Conservatively assuming NVTR deserved to trade at the low end of the range implied a market cap of $146.6MM or $14.29 per share.

Enterprise Value / 2018 Revenue

As discussed above, Piper Jaffray estimated that Nuvectra would generate revenue of $78MM in 2018. Medical device peers traded at an enterprise value to 2018 revenue multiple range of 1.3x to 4.4x. Conservatively assuming Nuvectra deserved to trade at the low end of the range implied a market cap of $169MM or $16.47 per share.

Sale of Minority Interest in Nuvectra

In early 2015, Integer owned 89% of Nuvectra, but purchased the remaining 11% in Q4 2015 for $16.7MM. This transaction value implied a $152MM valuation. Adding back net cash yielded a market cap of $219.4MM or $21.39 per share.

What Happened?

During the first six months of trading, Nuvectra’s average closing price was $7.27, giving investors ample opportunity to build a position.

Despite a slower than initially expected revenue ramp due to the delayed approval of Nuvectra’s second product, Nuvectra grew revenue significantly. Total revenue grew from $5.2MM in 2015 to $31.8MM in 2017. Sell side analysts expect revenue to hit $106MM by 2020.

As is often the case with spin-offs, additional investors discovered Nuvectra over time and the stock appreciated significantly. In the fall of 2018 (two and half years after the spin-off), Nuvectra traded for $22 per share, up over 200% from its initial trading range.

I recommended NVTR as a BUY back in April 2016. Want to know my favorite stock today? Become a member and get instant access to my top stock spin-off picks. It’s only $29/month and I offer a 30 day refund policy.

Leave A Comment