As a follow up to my last post, I wanted to share my latest thoughts on APVO and AFI.

Aptevo Therapeutics (APVO)

APVO has been on quite a roller coaster. I originally recommended the stock in September 2016 at $2.79 after it had declined ~35% from its opening price. Check out my original write up here:

https://stockspinoffinvesting.com/aptevo-therapeutics-an-orphaned-spinoff/

But I clearly recommended the stock way too early. The stock continued to sell off and ultimately bottomed about a year later in August 2017 at $1.27 (!!) in August 2017. Since then, it has remained volatile but rallied based on a couple items.

First in August 2017, the company announced that it had sold 3 of its drugs for $65MM plus up to $7.5MM based on certain milestones. At the time of the announcement, the stock had a market cap of $28MM! The stock moved up after the announcement to a share price of $2.11 and a market cap of $45MM. But this looked ridiculously cheap given APVO would have $95MM of net cash (after the transaction), a revenue generating drug (XINITY) which I valued conservatively at $24MM, and a robust late stage pipeline. I highlighted this situation in an email sent on September 5, 2017. For those that were fortunate enough to not follow my original recommendation and buy at this point, the stock has been a home run (up 100%+).

Second, the CEO bought 100,000 shares in the open market in March 2018 at $2.93.

Third, Roth Capital initiated on APVO on April 12, 2018 with a price target of $12.

Finally, APVO on April 16, 2018 announced good data for one of its pipeline drugs (APVO436).

So what are my thoughts today? Well my original recommendation was based on relatively simplistic analysis. At the time of my recommendation, the stock had a market cap of ~$56MM and cash and cash equivalent of $65MM. So the market was saying that APVO’s 4 drugs generating $40MM of revenue and pipeline was worth -$9MM. This didn’t make sense to me. To me, this seemed like an obvious dislocation that was created by forced and/or disinterested sellers. It looked like an asymmetric opportunity (much more upside than downside).

Right now, one could argue that the stock is still undervalued. After all, APVO’s enterprise value is still only $18MM and its EV / 2017 revenue is 1.6x, an undemanding valuation given XINITY’s growth prospects and the company’s broader pipeline. However, I really don’t have a clue how APVO’s pipeline will play out. It will have to spend significant capital developing the pipeline and it may work, it may not. Right now, the outlook for the stock looks relatively balanced.

Accordingly, I’m closing out my recommendation at $4.28 (closing price as of April 20, 2018). Since my original recommendation, the stock has appreciated from $2.79 to $4.28 for a return of 53% over a nineteen-month period.

Armstrong Flooring (AFI)

AFI has been a disappointing stock. After I originally recommended the stock at $15.76 in May 2016, it rallied nicely and peaked at $21.37 in February 2017. Unfortunately, it has been very weak since then.

Interestingly my write-up on this stock was the most popular on my site. Just goes to show that the popularity of a write-up isn’t necessarily correlated (and could be inversely correlated) to performance.

Why did AFI perform poorly? My thesis was based on revenue growth, EBITDA growth and valuation expansion. Unfortunately, management overpromised and underdelivered on both its revenue and EBITDA guidance. And of course a stock won’t get valuation expansion if management doesn’t do what it says it will do. Management originally guided to annual revenue growth of 5% to 6%. It also guided that EBITDA margins would expand from 6.0% in 2015 to 10% in 3-5 years. What are the results? 2017 revenue of $1,134MM was 6% lower than 2015 revenue. So much for that 5% to 6% annual growth. Unfortunately, EBITDA margin also underperformed and declined from 6.0% in 2015 to 5.8% in 2017. AFI guidance for 2018 is low single-digit revenue growth and 70bps of EBITDA margin expansion, but management has completely lost its credibility, and I have no confidence in my original thesis.

From a valuation perspective, AFI remains cheap trading at 7.2x 2017 EBITDA and 6.2x 2018 EBITDA guidance, but AFI has a poor quality business (5.8% EBITDA margins) with a management team that has not executed. Further, AFI took LT debt to buy back stock and so the risk profile of the business has increased. If management begins to execute, there could be significant upside in the stock. But given management’s track record, I think this is unlikely.

As such, I’m closing this recommendation at a price of $13.33 (closing price as of April 20, 2018). Since my original recommendation, AFI has declined by 15%. My biggest regret with AFI is not abandoning the recommendation sooner when the first signs started to emerge that management guidance was unrealistic.

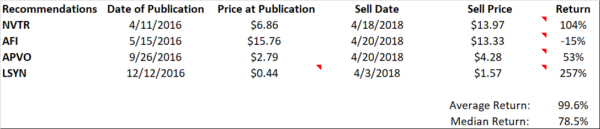

To summarize, I’ve closed out all four of my official recommendations that I made over the past two years. In total, these recommendations have generated an average return of 99.6% and median return of 78.5%. See the summary table below for additional details.

Disclaimer:

Note I still own positions in APVO but plan to gradually sell down as liquidity opportunities present themselves. All expressions of opinion are subject to change without notice, and I do not undertake to update or supplement this report or any of the information contained herein. I have no business relationship with any company whose stock is mentioned in this article. This article is provided for informational purposes only. Please do your own work before buying or selling any stock mentioned on www.stockspinoffinvesting.com.

Leave A Comment