Background

nVent Electric (NVT), a spin-off from Pentair (PNR) will begin trading tomorrow. NVT provides products and solutions that connect and protect electric equipment which improves the equipment’s utilization, lowers costs, and minimizes downtime. On a proforma basis, NVT generated $2.1BN in revenue and $440MM in EBITDA in 2017.

In the when-issued market, NVT has been trading in $22 to $26 range. It closed on April 30, 2018 at $22.04 and will begin regular-way trading tomorrow, May 1, 2018.

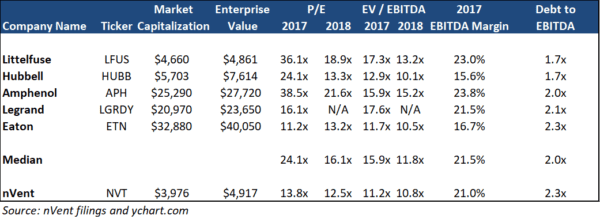

Valuation

NVT is trading at a price to 2018 earnings multiple of 12.5x and an EV / 2018 EBITDA multiple of 10.8x while comps (per management’s analyst day presentation) trade at 16.1x and 11.8x. Assuming NVT should trade more in-line with its comps, the stock would trade ~$26, implying modest upside from where it closed yesterday. Nonetheless, we are not overly excited about the stock in the ~$22 range, but the risk/reward would improve if there were a dramatic spin-off sell off.

Management Incentives

Per the Form 10, up to 6.5 million shares are reserved for the 2018 equity compensation. As such, management will be incentivized to hit their targets and to increase the stock price. Note nVent company guidelines include stock ownership requirements. CEO will have to own 6.0x base salary, CFO will have to own 3.0x base salary, etc.

Will there be any indiscriminate selling?

It’s tough to say for sure. On the one hand, NVT will be dropped from the S&P 500 index so index funds and ETFs will have to sell it. Further, it is viewed as the worse business (Pentair’s legacy water business is viewed more favorably). On the other hand, NVT is still a relatively large business with a ~$5BN enterprise value and so it is unlikely that actively managed funds will be forced sellers due to mandate constraints.

Other Information and Articles

nVent Analyst Day Presentation and Slide Deck

Bloomberg: Pentair Sets a Breakup Blueprint (May 2017)

Bloomberg: The Pentair Pouting is Excessive (January 2018)

Leave A Comment