Spin-off Links – January 2021

Recently Announced Spin-offs

Encompass Health (EHC) recently announced that it is exploring strategic alternatives for its home health and hospice business. While the plans aren’t set in stone, the company is considering an IPO, spin-off, merger, or sale. The home health and hospice business accounts for 24% of 2019 revenues. If this segment were to be spun-off, the remaining company plans to focus on its core business of inpatient rehabilitation. Best comps for EHC’s Home Health and Hospice business are AMED (28x 2021 EBITDA) and LHCG (trades at 23x 2021 EBITDA). Prior to the pandemic EHC’s Home Health and Hospice had organic growth inline with peers. In the pandemic, growth has lagged peers due to higher Medicare FFS mix (slower to recover from COVID), geographic mix (40% of rev from FL/TX), and a higher exposure to elective procedures (15% vs 8% for AMED). Nonetheless, growth should reaccelerate post COVID.

Assuming a 20x-25x multiple for the home health and hospice business and a 9.5x-10x multiple on the in-patient rehabilitation business, implies a fair value of $83-$97 ($90 at the midpoint).

Here are my notes which I will update with time.

Interactive Corp (IAC) recently announced that it plans to spin-off Vimeo, a video hosting service, into an independent company in a tax-free transaction. IAC is targeting a spin-off date in Q2 2021. Last year, Vimeo took a $150MM investment at a valuation of $2.75BN. In Q3 2020, Vimeo grew revenue 44% to $75.1MM or $300.4MM on an annualized basis. As such, Vimeo was valued at a 9.2x revenue multiple.

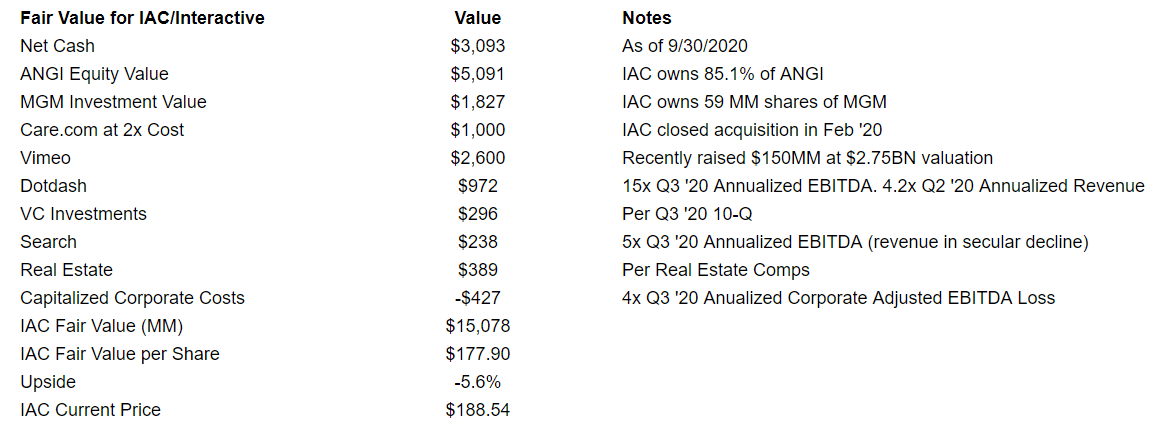

The video site has had an incredible year with revenues up 40%+ in every month from April to November y/y. While the company is still unprofitable, it is generating fewer operating losses every year. IAC believes that by spinning Vimeo off, it will offer several more avenues for Vimeo to raise capital and allow the pure-play business to focus on technology, product, and enterprise sales. IAC plans to hold a stockholder meeting in Q1 2021 to discuss and approve the spin-off. Shares responded overwhelmingly positively to the news, up as much as 14% the day of announcement. Currently, I believe IAC is worth ~$178 per share on a sum-of-the-parts basis. See details below.

Here are my notes which I will update with time.

Recent Spin-offs

Recently, Aimco (AIV) spun off its Apartment Income REIT (AIRC). The spin-off is a newly formed, self-managed real estate investment trust focused on multi-family apartments. It will own 93.5% of a portfolio of 98 properties in Boston, Philadelphia, and Washington D.C. with a NAV of $7.8bn or $50 per share. It currently trades at $37.78.

The remaining company looks more interesting on some levels. It has an NAV of $8 and trades at $5. There wasn’t as much indiscriminate selling as I had expected (the remaining company got kicked out of the S&P 500). Nonetheless, I’m not ready to buy it yet. The remaining company has all the assets that Apartment Income REIT did not want (mgmt explicitly stated this on the transaction conference call).

The remaining company is a real estate development company with a hodgepodge of assets. Further, management owns very little stock (of the spin-off or the remainco) yet collects very generous annual compensation (CEO gets ~$6MM per year). If I saw significant insider buying (we’ve seen a little) or a big share buyback, that might give me enough comfort to buy the AIV.

Here are my notes on the transaction.

Constellation Software (TSX: CSU) announced back in September that it would spin-off Topicus.com (recent acquisition merged with TSS division). The spin-off was delayed but ultimately occurred on January 4th per this press release although I haven’t seen any trading activity.

Constellation Software is a Canadian software company that grows by acquisition that has a great track record of returning value to shareholders. Constellation is primarily involved with vertical market software businesses that provide mission-critical software solutions.

Topicus.com was originally acquired in May 2020 by Constellation. As part of the acquisition, it was agreed that Topicus.com (€101M in annual revenue) would be merged with TSS (subsidiary of Constellation) and that a public listing would be explored.

The rationale for the public listing is that the founders of Topicus.com didn’t want “their legacy disappearing into the craw of an omnivorous conglomerate.” Under, the spin-off, provides software for banks, healthcare institutions, and education. It has 4,250 employees in Europe split among 85 software business units. The spin-off has $464MM of annualized revenue (9% of total Constellation revenue) and ~$56MM of annualized net income.

Constellation shareholders received ~1.86 shares for every 1 share of CSU. Constellation will retain voting control (via a single share with 50.1% of voting power). Here are my notes on the name.

This transaction opens up the possibility that Constellation could pursue similar types of acquisitions/spin-offs in the future.

Upcoming Spin-offs

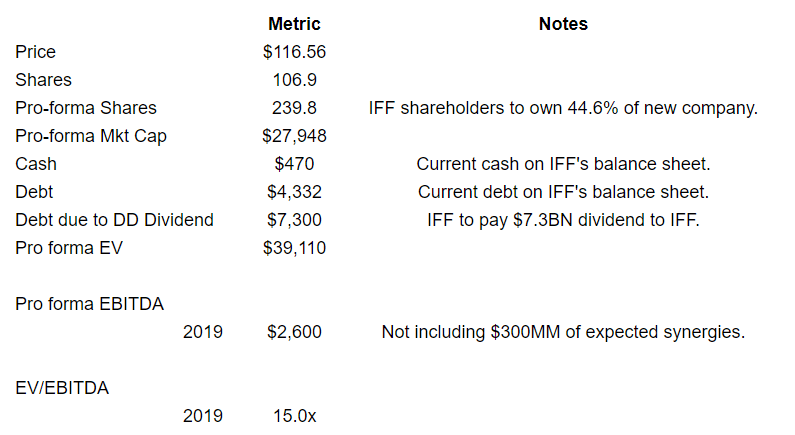

On December 31, 2020, DuPont (DD) announced that it will split off its Nutrition and Bioscience division and merge it with International Flavors & Fragrances (IFF) through a split off transaction. Dupont shareholders can tender their shares for International Flavors & Fragrances shares. To incentivize the exchange, tendering shareholders are expected to receive $107.53 of IFF for every $100 of DuPont common stock tendered (subject to an upper limit). This is an attractive opportunity and I expect it to be oversubscribed (although DuPont curiously does not). IFF, pro forma for the merger, is trading at 15.0x 2019 (which I view as “normalized” EBITDA). See details below.

Peers (Givaudan and Symrise) trade at 20.0x or higher. The offer will close on January 27, 2021. You can find more information at the exchange website.

More Spin-off Links

Libsyn Asks Court To Cancel Stock Held By Chinese Shareholders Over Alleged Fraud.

Dan Loeb Pushing Intel to Explore Strategic Options

Clark Street Value Year End Review

Verint Systems: Cognyte Spin-Off To Unlock Significant Value

Concentrix: An Interesting Spin-off

Hi Rich, thank you for sharing. Could you share your thoughts on why you expect the Dupont split-off offer will be oversubscribed? The management says they don’t expect it in the prospectus. I try to understand why management says that. The number of share Dupont offers to tender is rougnly 27% of total shares outstanding. Is this why? Does it worth it to bet that the offer won’t be oversubscribed? Any thoughts would be appreciated.

Hey Eric, thanks for the question! I think it is odd that mgmt doesn’t expect the tender offer to be oversubscribed. I don’t know why they would think that because every split off transaction that I’ve followed has been 4x to 5x over subscribed. I’m assuming this one will be heavily oversubscribed too. If you agree with management, than it makes sense to buy as much DD shares as you can and short the appropriate number of IFF shares to lock in your profit.

Perhaps, this one won’t be oversubscribed given (as you point out) that the number of shares that will have to be exchanged represents a high percentage of total shares outstanding. However, I’m not willing to make that bet. Luckily, there is an odd lot provision so if you own fewer than 100 shares, you won’t be prorated.